IBM officially announced the launch of IBM Digital Asset Haven. This new platform is designed to provide secure, scalable infrastructure for managing digital assets like cryptocurrencies, stablecoins, and tokenized assets, specifically tailored for highly regulated entities such as banks, governments, and large enterprises.

It’s a timely move amid surging institutional interest in blockchain, with crypto market activity rebounding and tokenized assets gaining traction in traditional finance.

IBM Digital Asset Haven acts as a “full-stack” operational backbone, integrating custody, transactions, settlement, and compliance tools into a single platform.

Multi-Chain Support; Operates across 40+ public and private blockchains like Ethereum, Bitcoin, Solana. Enables seamless asset management without siloed systems, reducing fragmentation.

Secure Custody and Wallets; Combines IBM’s hardware-level security via IBM Z mainframes with programmable wallets, multi-party approvals, and cold storage options. Meets bank-grade standards for sovereignty, encryption, and access controls, minimizing risks like hacks.

Built-in AML/KYC, policy-driven workflows, and regulatory reporting aligned with global standards (e.g., ISO 20022). Helps institutions avoid penalties while scaling from pilots to production.

Lifecycle Management; Automates routing, monitoring, settlement, and integration with third-party services via DeFi yields, payments. Streamlines operations from asset storage to real-time transactions, supporting tokenized RWAs and stablecoins.

Deployment Flexibility; SaaS/Hybrid SaaS available now; on-premises in Q2 2026. Allows customization for cloud, on-prem, or hybrid setups to fit enterprise needs. The platform was developed in partnership with Dfns, a Coinbase-backed digital wallet provider, leveraging Dfns’ custody tech with IBM’s renowned reliability in mission-critical systems.

As Tom McPherson, GM of IBM Z and LinuxONE, stated: “With IBM Digital Asset Haven, our clients have the opportunity to enter and expand into the digital asset space backed by IBM’s level of security and reliability.”

This launch comes as institutions ramp up crypto involvement. Banks are eyeing tokenized assets and stablecoins for efficiency in payments and capital markets, with platforms like this addressing integration barriers.

It positions IBM against rivals like Oracle’s Blockchain Platform, Microsoft’s Azure Web3, and Amazon’s Managed Blockchain, especially after recent AWS outages highlighted reliability needs.

Broader trends aligns with moves like Citi-Coinbase partnerships for digital payments and France’s proposed 420K BTC strategic reserve.

Analysts noted it as IBM’s “most ambitious crypto infrastructure push for U.S. businesses and governments.” This could accelerate mainstream crypto use—thoughts on how it might impact tokenized real-world assets?

IBM-Dfns Partnership: This collaboration combines IBM’s enterprise-grade security and infrastructure expertise with Dfns’ specialized custody and wallet management capabilities to create a full-stack solution for regulated entities handling digital assets like cryptocurrencies, stablecoins, and tokenized real-world assets (RWAs).

The partnership aims to bridge traditional finance with blockchain, enabling seamless operations from pilot projects to production-scale deployment. The partnership builds on an existing relationship between IBM and Dfns, including a prior integration of Dfns’ wallet technology with IBM’s Hyper Protect Virtual Servers for hardware-backed security in institutional wallets.

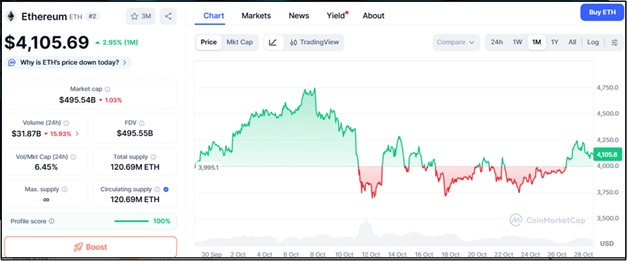

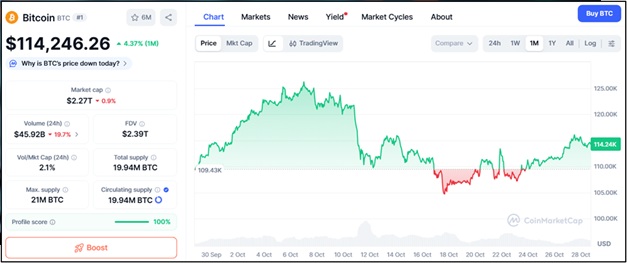

Announced alongside the platform launch, it was formalized to address the growing institutional demand for compliant, scalable digital asset tools amid surging crypto activity with Bitcoin surpassing $115,000 and stablecoin supply exceeding $300 billion.

Dfns specializes in wallet-as-a-service (WaaS) solutions and has created over 15 million wallets for more than 250 clients, including fintechs and enterprises. It raised $16 million in a Series A round in January 2025, led by Further Ventures, emphasizing compliance-heavy environments.

IBM, with over a decade in blockchain via Hyperledger, sought Dfns’ expertise to handle the “last mile” of digital asset operations—custody and programmable wallets—while layering on its mainframe reliability.

This integration was highlighted in Dfns’ recent announcement of OSO support, directly tying into the platform’s cold storage features. Lowers barriers to entry by providing a single, integration-ready platform that evolves tokenized assets from experiments to core services.

It supports scalability for high-throughput sectors like finance and healthcare while navigating global regulations. Positions IBM against competitors like AWS via Cronos partnership and aligns with trends like Ripple’s Absa Bank custody deal in Africa.

Clarisse Hagège, CEO of Dfns: “For digital assets to be integrated into core banking and capital markets systems, the underlying infrastructure must meet the same standards as traditional financial rails. Together with IBM, we’ve built a platform that goes beyond custody to orchestrate the full digital asset ecosystem, paving the way for digital assets to move from pilot programs to production at a global scale.”