A brutal liquidation massacre has wiped billions off the cryptocurrency market, forcing traders to rethink their strategies. However, liquidation events can often present good opportunities within the market. Large liquidations have previously marked the end of speculative periods, which are usually followed by consolidation before the return of the bull run, as excess speculation is cleared. The market becomes increasingly focused on projects with good fundamentals and growing ecosystems during these periods. Ripple (XRP) and Little Pepe (LILPEPE) are two of the top tokens expected to make a comeback as the market reveals signs of recovery from the downturn.

Ripple’s Push for Utility and Adoption

The XRP price held steady in the past few weeks, moving from a low of $1.7775 in October to $2.53 today. One potential catalyst for the ongoing rally is that Ripple Labs completed the Hidden Road buyout. Hidden Road, which offers prime brokerage services, will now be called Ripple Prime. This is a major platform that handles over $10 billion in transactions a day. Following the acquisition, Ripple hopes to incorporate its XRP Ledger into the network. It also hopes to introduce the RLUSD stablecoin on the platform, which may help boost its assets.

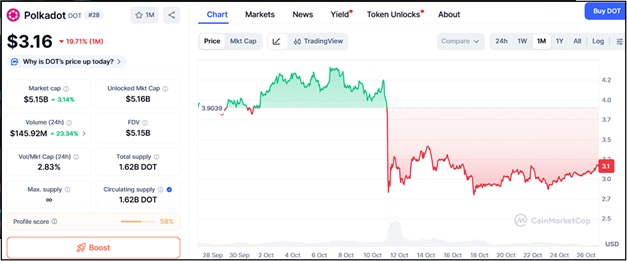

Source: Tradingview

Ripple price is about to avoid the risky death cross pattern, which happens when the 50-day and 200-day moving averages cross each other. Avoiding this pattern will be bullish for the token, and may see it jump to the key psychological level at $3. A drop below the head section at $2.2 will invalidate the bullish XRP price forecast.

Little Pepe (LILPEPE): The Meme Coin That’s Redefining the Narrative

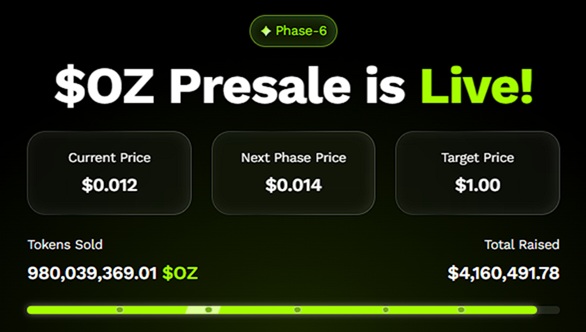

While XRP builds on institutional trust, Little Pepe (LILPEPE) is capturing the imagination of retail investors. Once viewed simply as a playful meme token, LILPEPE has steadily grown into one of the most ambitious community driven projects in the market. Already listed on CoinMarketCap and fully audited by CertiK, the project has demonstrated credibility and transparency, two traits that most meme coins lack. Its concept goes beyond humor and hype. LILPEPE is building a dedicated Layer 2 chain explicitly designed for meme coins, with a focus on fast transactions, resistance to sniper bots, and affordable gas fees. This positions it as the launchpad for new meme projects, effectively creating an entire ecosystem for creativity and collaboration in the meme economy. The project is currently in stage 13 of its presale, priced at $0.0022, and it has already raised over $27.2 million while selling more than 16.5 billion tokens. Those numbers aren’t just impressive, they signal an enormous wave of community backing and investor confidence that’s rarely seen at this stage. Add to that the team’s $777,000 giveaway, designed to reward early supporters, and it’s no wonder that the community surrounding LILPEPE is growing faster than most established meme projects did at this stage.

Why Investors Are Turning Back to These Two Tokens

Both XRP and LILPEPE represent distinct ends of the crypto spectrum, one focused on institutional adoption and the other on cultural virality. Yet, they share resilience. Ripple has endured years of regulatory uncertainty and remains strong, while Little Pepe has managed to maintain hype and momentum, even as other meme coins have faded. In a recovering market, investors are increasingly looking for assets that combine innovation with real potential for exponential returns. XRP offers steady growth potential through adoption and partnerships, while LILPEPE provides the allure of high-risk, high-reward upside. Some analysts predict LILPEPE could deliver returns exceeding 10,000% if it captures even a fraction of the attention and trading volume that fueled PEPE, DOGE, or SHIB during previous meme coin surges.

Conclusion

As the dust settles from the liquidation phase, the crypto market appears poised for its next leg upward. Bitcoin’s dominance may ease, giving altcoins more room to shine, and that’s where projects like Ripple and Little Pepe could lead the charge. Ripple’s continued push into global finance could solidify its position as the digital bridge for cross-border payments, potentially sending XRP closer to its previous peak levels. Meanwhile, Little Pepe’s growing ecosystem, community strength, and technical innovation suggest it could be the next breakout meme coin to dominate headlines as sentiment flips bullish once again. In a market that often rewards patience and conviction, both XRP and LILPEPE appear poised to capitalize on a major turnaround, each poised to capture a different wave of the upcoming crypto recovery.

For more information about Little Pepe (LILPEPE) visit the links below:

Website: https://littlepepe.com

Whitepaper: https://littlepepe.com/whitepaper.pdf

Telegram: https://t.me/littlepepetoken

Twitter/X: https://x.com/littlepepetoken

$777k Giveaway: https://littlepepe.com/777k-giveaway/