Tekedia Capital congratulates our portfolio company, TradeGrid, for a massive Q3 2025 in its energy trading company in Africa. Growing more than 1000% from 2024 numbers is a validation of superior operational execution. Continue to discover more markets.

Top 10 Best Crypto Coins to Buy for Massive 2025 Growth — Blazpay’s AI ICO Leads the New Wave of Smart DeFi Projects

The 2025 market cycle is quickly turning into an ICO revival era, where projects with strong fundamentals and early-stage entry points are drawing massive attention. Investors who remember the breakout phases of Ethereum, Solana, and Binance Coin know how life-changing early entries can be.

But in this new cycle, one name has started to overshadow the rest: Blazpay ($BLAZ) — a project redefining how crypto presales deliver technology and returns. With Phase 1 nearly 70% sold and a price increase less than 24 hours away, urgency is sky-high for early participants.

Below are the 10 best crypto coins to buy in 2025’s ICO and presale environment — ranked by innovation, momentum, and growth potential.

1. Blazpay ($BLAZ) — AI-Driven ICO with Real Utility and Massive ROI Upside

ICO / Presale Price: $0.006 (Phase 1)

Next Price: $0.0075 (+25% increase in < 24 hrs)

Blazpay is the flagship AI DeFi presale everyone is talking about. Built for automation and cross-chain integration, its core engine — BlazAI — automates swaps, staking, and liquidity routing across Ethereum, BNB Chain, Solana, Polygon, and Tron.

Developers can integrate these same tools through the BlazSDK, turning any dApp into an AI-smart system for execution, analytics, and routing.

ROI Projection:

A $1,000 investment at the current presale price of $0.006 would yield 166,666 BLAZ tokens. If the presale closes around $0.16, the investment could be worth approximately $26,666. Should the token list at $0.50, the same investment could grow to $83,333, representing an estimated 8,233% gain.

With automation, gamified rewards, and cross-chain AI routing already functional, Blazpay is widely called the best presale crypto of 2025 — and its early-entry window is closing fast.

2. Bitcoin (BTC) — The Foundation Layer for Every New ICO Cycle

Bitcoin remains the benchmark for every crypto presale and ICO that follows. Even as new projects emerge, BTC’s dominance defines liquidity, confidence, and capital flow across the market.

Currently hovering around $115,000, Bitcoin continues to attract institutional inflows through ETFs, providing the liquidity backbone that sustains the broader ecosystem.

Analysts forecast potential growth toward $130,000–$150,000 in Q4 2025, reflecting renewed optimism after the recent $19 billion market correction.

While Bitcoin isn’t a presale project, it’s still the anchor for stability and trust, forming the financial foundation that allows early-stage coins like Blazpay and WLFI to flourish.

3. Ethereum (ETH) — The Original ICO Success Story

Ethereum’s ICO started near $0.30, and it has since evolved into the definitive infrastructure for decentralized applications and smart contracts. Now trading near $4,000, ETH remains the core layer powering most DeFi and presale ecosystems.

With its Layer-2 scaling upgrades and EVM compatibility, Ethereum has become the bedrock for almost every best crypto presale, including AI-driven projects like Blazpay and Ethena.

Analysts predict Ethereum could push past $5,000 as tokenization, AI applications, and DeFi integrations expand throughout 2025.

For investors, ETH represents long-term utility and stability — a must-have balance alongside higher-risk presales.

4. Solana (SOL) — High-Speed Ecosystem Supporting New AI Presales

Launched at just $0.22, Solana’s rise to over $200 underscores its reputation as one of the most successful ICOs in history. Its blazing-fast throughput and low-latency design have made it a hub for high-performance DeFi and AI applications.

Solana solves the persistent issue of blockchain congestion, enabling microtransactions and real-time execution that are essential for AI-powered projects like Blazpay.

With expanding developer activity and institutional partnerships, analysts expect SOL to retest $250–$300 during the next major market rotation.

5. XRP (XRP) — Institutional Payments and Liquidity Base

XRP offers a powerful alternative to traditional payment systems, solving the age-old problem of slow and expensive cross-border transactions.

Following its regulatory clarity and renewed banking partnerships, XRP has become a trusted liquidity bridge between traditional finance and crypto.

As adoption grows through partners like Santander and Bank of America, forecasts point toward a $5–$8 range by 2026.

Its integration potential with AI-based payment and DeFi systems further strengthens its relevance among the best crypto coins to buy for long-term institutional use cases.

6. BNB (BNB) — The ICO That Built an Exchange Empire

BNB’s journey began with a modest $0.10 ICO in 2017, evolving into a multi-billion-dollar ecosystem token tied to Binance’s exchange, staking, and governance network.

Now trading near $550, BNB remains a model of how utility and scalability can transform an early-stage ICO into a top global asset.

It offers built-in value through transaction fee discounts, smart-chain integration, and community-driven governance — all of which mirror the user-focused design approach that Blazpay is now applying to its AI DeFi platform.

BNB continues to stand as a blueprint for successful presale growth, balancing usability and adoption.

7. Chainlink (LINK) — The Data Oracle That Every Presale Needs

Chainlink launched its ICO near $0.11, and its steady rise to around $18–$20 highlights its foundational role in blockchain reliability.

Its decentralized oracle network enables secure external data connections for smart contracts — essential for AI, DeFi, and automation protocols.

As new presales integrate AI and external analytics, Chainlink’s Cross-Chain Interoperability Protocol (CCIP) provides the data bridge that makes those interactions possible.

Analysts expect 2–5× growth potential as AI and machine learning systems increasingly rely on real-world on-chain data feeds.

8. Notcoin (NOT) — New Entrant Riding Community Momentum

Notcoin has quickly become one of the most engaging new crypto coins thanks to its unique gamified mechanics.

By rewarding users for tasks, activity, and social engagement, Notcoin proves that community-first models can still capture millions of active participants.

Its early-stage success has reignited the idea that interactive ICOs can compete with traditional finance projects by combining fun, accessibility, and real token value.

While its volatility remains high, Notcoin is an example of how community-powered presales can evolve into major ecosystems when executed creatively.

9. WLFI (WLFI) — AI Meets Liquidity Farming

WLFI is one of the most promising AI-driven presale tokens, combining automated yield farming, smart liquidity routing, and cross-chain asset optimization.

Its model allows investors to access yield strategies typically available only to institutions — powered by algorithmic rebalancing and intelligent data feeds.

WLFI’s early presale success mirrors Blazpay’s — both projects targeting real-world automation through artificial intelligence.

Analysts see WLFI as a strong complement to Blazpay’s ecosystem, focusing on yield generation while Blazpay dominates DeFi execution and routing.

10. Hedera (HBAR) — The Enterprise ICO Model Evolving

Hedera takes the ICO model to the enterprise level. Its Hashgraph consensus allows 10,000+ transactions per second, carbon neutrality, and near-zero fees.

Backed by major companies such as Google, IBM, and SWIFT, Hedera serves as the corporate-grade layer for tokenized assets, AI data pipelines, and supply chain solutions.

Its enterprise adoption strategy and stable tokenomics make HBAR one of the best crypto coins to buy for risk-adjusted long-term exposure.

As 2025’s market matures, Hedera’s balance of speed, scalability, and partnerships could turn it into a quiet leader in the next wave of enterprise blockchain adoption.

How to Join the Blazpay Presale Before Phase 2 Starts

Go to www.blazpay.com ? Click Join Presale

Connect your wallet (MetaMask, WalletConnect, or Coinbase Wallet)

Select your payment crypto (ETH, BNB, SOL, USDT, or MATIC)

Confirm your purchase ? Tokens appear instantly in your dashboard

Phase 1 is ending within 24 hours — once it closes, the price jumps 25%.

Early buyers secure the lowest entry and maximum ROI potential before public listing.

Conclusion: ICO Cycles Are Back — But Blazpay Is Leading Them

From Bitcoin’s dominance to Ethereum’s infrastructure and Solana’s speed, each coin on this list holds historical value.

But the new wave of AI-driven ICO projects — led by Blazpay’s crypto presale — is shaping what the next bull cycle will look like.

Early-stage entries are rare and time-sensitive. With the best presale crypto nearing Phase 2, now is the moment to position yourself before the next 100× story unfolds.

Join the Blazpay Community

Website: https://blazpay.com

Twitter: https://x.com/blazpaylabs

Telegram: https://t.me/blazpay

Managing Insecurity-Driven Crises on Ride-Sharing Platforms: The InDrive–Onipanu Incident

In October 2025, a ride booked through InDrive from Surulere to Mafoluku Oshodi in Lagos became the center of a heated online controversy that reflected the deep link between insecurity and trust in Nigeria’s mobility ecosystem. The passenger, a young woman named Itohan, alleged that her driver, James Oluwatosin, deliberately faked a car breakdown around Onipanu to enable robbers to attack them. She claimed that the driver sat idly in his vehicle while thugs extorted money from her and her friend. Her public narration on social media quickly went viral, fueling outrage and calls for the driver’s suspension.

According to the driver’s account, however, the event unfolded very differently. He explained that his car developed an electrical fault, causing it to shut down suddenly. Using the vehicle’s remaining motion, he steered to a lighted area to inspect the problem and advised the passengers to stay locked inside for safety. The women refused, stepped out of the car, and were soon approached by local street thugs, popularly known in Lagos as area boys, who demanded payment to allow the car to remain parked.

The driver engaged them, but they insisted on ?20,000. Itohan then intervened, negotiating the amount down to ?8,000, which she transferred to the thugs herself. With assistance from the same group, the driver fixed the car and completed the trip, receiving ?4,000 from Itohan instead of the agreed ?4,800. He later discovered that his InDrive account had been suspended due to her report accusing him of complicity in the robbery.

Understanding the Nature of the Crisis

What began as a mechanical fault quickly evolved into a full-blown crisis driven by insecurity and amplified by social media outrage. The real danger originated from Lagos’s structural insecurity: the presence of extortionist street gangs who prey on stranded motorists. Yet, in the absence of context, online audiences interpreted the event through moral and emotional frames—trust, gender, and safety.

This shift from a security incident to a reputational conflict exposed a major challenge in digital mobility systems: how platform algorithms and users interpret events stripped of on-ground realities. In Lagos, where urban breakdowns often attract harassment, both drivers and passengers are vulnerable. However, because most platforms prioritize customer protection, drivers are often the first to be penalized when complaints arise, regardless of context. The Onipanu incident thus combined physical insecurity, procedural imbalance, and the volatility of online judgment into one cascading crisis.

Public Reaction and Platform Response

The story divided public opinion sharply. Many Lagos residents, drawing from lived experience, empathized with the driver and argued that area boys harassment is a common feature of the city’s transport life. Others criticized the ride-hailing company for suspending him without investigation, framing it as another case of platform bias against workers. Meanwhile, online debates expanded into questions about feminism, accountability, and the credibility of digital accusations.

In response to the growing uproar, InDrive issued an official statement clarifying that it had contacted the driver, reviewed his trip records, and found no inconsistencies in his account. The company stated that James Oluwatosin had been a driver-partner for over three years, maintained a high rating, and that safety and fairness remained its top priorities. This direct communication reversed the narrative almost instantly. The driver was publicly vindicated, and the platform regained credibility for demonstrating fairness after due process. Importantly, the tone of the statement was calm, factual, and neutral, which suggests avoiding defensive or accusatory language and instead reaffirming institutional values of safety and fairness.

From Insecurity to Corporate Crisis Management

The InDrive–Onipanu case indicates that insecurity on Nigerian roads is not merely a safety issue but a reputational risk factor for digital platforms. A car breakdown in a high-risk area after dark can easily turn into a viral crisis if interpreted as negligence or conspiracy. Platforms that rely on user feedback and automated discipline systems must therefore recognize the socio-urban realities of their operating environment.

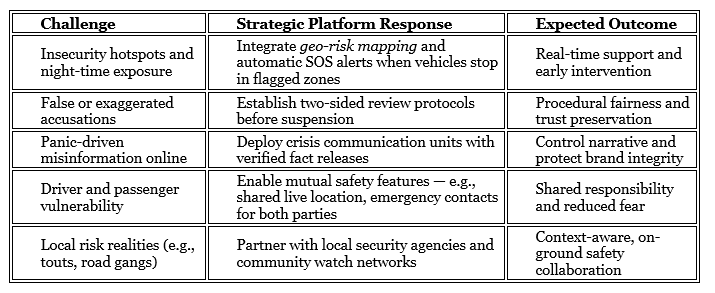

Exhibit 1: Lessons for managing insecurity-driven crises

InDrive’s eventual response demonstrated effective crisis management in four key ways: it verified the facts before taking a final decision, communicated its findings publicly, balanced empathy with neutrality, and highlighted the driver’s proven track record. These steps transformed a reactive suspension into a case of responsible corporate learning. Centering evidence over outrage reaffirmed InDrive’s legitimacy while subtly educating its audience about the real nature of Lagos insecurity.

China’s Economic Growth Slows to One-Year Low as Trade Tensions Deepen, Raising Calls for Fresh Stimulus

China’s economy likely expanded at its weakest pace in a year in the third quarter of 2025, according to a Reuters poll, as renewed trade frictions with the United States and persistent domestic weakness threatened to derail Beijing’s 5% growth target.

The slowdown, which points to mounting structural strains, has intensified pressure on Chinese authorities to roll out new stimulus measures before the year’s end.

According to the poll of 45 economists, China’s gross domestic product (GDP) is forecast to have grown by 4.8% year-on-year between July and September — down from 5.2% recorded in the second quarter and the slowest pace since the third quarter of 2024. The reading would still surpass the 4.5% projection made in a July poll, but remains below the government’s target.

Larry Hu, Chief China Economist at Macquarie, said he expects third-quarter growth to dip to 4.5%, adding that Beijing will likely resort to “mini-stimulus measures in Q4, especially for housing,” as it tries to cushion the economy.

“In the long term, Beijing will use domestic stimulus to cushion external shocks, in order to maintain relatively steady growth,” Hu added.

The slowdown comes despite Beijing’s modest support measures earlier this year, which sought to preserve policy space for future shocks amid resilient exports and buoyant stock markets. However, the renewed U.S.-China trade tensions have dimmed sentiment.

Trade frictions escalated sharply after Beijing tightened export controls on rare earth elements — critical materials for high-tech and defense industries — prompting U.S. President Donald Trump to threaten a 100% increase in tariffs on Chinese goods from November 1. Still, U.S. officials have signaled a willingness to lower the temperature, suggesting both sides could open new channels of dialogue.

China’s reliance on manufacturing and overseas demand has made it highly vulnerable to such shocks. Many exporters are already struggling with steep tariff costs, forcing a pivot toward new markets.

Wang Pengjie, sales manager at a car floor mat exporter, told Reuters that his company has lost between 60% and 70% of its U.S. orders this year.

“We are trying to compensate by expanding into emerging markets, including Southeast Asia, Mexico, and the Middle East,” he said. “But these new markets can’t make up for it. The competition is very intense, and we have to compete more on price.”

To survive, Wang’s company is focusing on high-end products, a strategy increasingly common among Chinese exporters caught in the tariff crossfire.

Economic Indicators Show Softening Across Sectors

On a quarterly basis, GDP is projected to have expanded by just 0.8% in the third quarter, down from 1.1% in the second quarter. Official GDP data, along with September retail sales, industrial output, and fixed-asset investment figures, will be released on Monday.

Despite a slight rebound in export growth in September, much of the recent economic data points to waning momentum. The property sector remains mired in a prolonged slump, while weak consumer demand has continued to exert downward pressure on prices, heightening the risk of deflation. Analysts say these factors support the case for additional fiscal and monetary support.

The People’s Bank of China (PBOC) has so far refrained from aggressive easing, maintaining its key policy rates for four consecutive months. Analysts, however, expect more targeted stimulus steps in the coming weeks. Lynn Song, Chief Greater China Economist at ING, noted that “the recent escalation of tensions between China and the U.S. ahead of potential talks between Presidents Xi and Trump at the end of the month could keep the PBOC on hold for the rest of October.”

“That would leave ammunition to support markets if talks do not go well,” Song said. “November, consequently, remains an interesting window to watch for potential easing.”

More Stimulus on the Horizon

Beijing has announced a range of limited interventions, including interest subsidies on household and business loans to spur consumption. It also plans to deploy about 500 billion yuan in policy-based financial tools to accelerate investment projects and bolster growth.

According to the Reuters poll, analysts expect the PBOC to cut its seven-day reverse repo rate — a key policy benchmark — by 10 basis points in the fourth quarter, alongside a similar reduction in the benchmark loan prime rate (LPR). The central bank is also expected to trim the reserve requirement ratio (RRR) by 20 basis points to ease liquidity conditions.

Even with these measures, full-year growth is projected to fall short of Beijing’s “around 5%” target, with analysts forecasting 4.8% for 2025 and a further slowdown to 4.3% in 2026.

China’s consumer price inflation, meanwhile, remains near zero — well below the government’s 2% target — and is expected to edge up only modestly to 0.9% next year.

Policymakers Eye Long-Term Strategy

Against this backdrop, Chinese leaders are scheduled to meet from Monday to Thursday for a closed-door policy conference that will help shape the country’s 15th Five-Year Plan. The agenda is expected to prioritize high-tech manufacturing and innovation, particularly as China seeks to insulate its economy from the deepening rivalry with Washington.

The leadership meeting will likely emphasize self-reliance in technology and supply chains — a strategic pivot already reflected in recent state-led investment drives in semiconductors, electric vehicles, and green energy.

But analysts warn that these structural shifts will take time to translate into sustainable growth. Currently, China’s policymakers are caught between two imperatives: managing the short-term fallout from the U.S. trade war and addressing long-term vulnerabilities in property, debt, and domestic consumption.

Kraken Acquires Small Exchange for $100 Million

Cryptocurrency exchange Kraken announced the completion of its $100 million acquisition of Small Exchange, a U.S.-based, CFTC-regulated Designated Contract Market (DCM) for derivatives trading, from IG Group.

The deal, structured as $32.5 million in cash and $67.5 million in Kraken parent company Payward stock, positions Kraken to launch a fully onshore U.S. derivatives platform, integrating spot crypto, futures, and margin trading under unified CFTC oversight.

This move builds on Kraken’s earlier $1.5 billion purchase of futures platform NinjaTrader in March 2025, aiming to create a “high-performance trading environment” with reduced latency and enhanced risk management for institutional and retail users.

Kraken co-CEO Arjun Sethi described it as laying the groundwork for “a new generation of United States derivatives markets designed for scale, transparency, and efficiency.” IG Group, which acquired Small Exchange in 2023, called the sale a “significant return” while shifting focus to its own crypto expansions in the UK and Australia.

Kraken’s $100M acquisition of Small Exchange strengthens its U.S. presence by enabling a CFTC-regulated platform for crypto spot, margin, and futures trading.

It enhances retail and institutional access to derivatives, improves liquidity, and aligns with regulatory trends, potentially boosting adoption and market efficiency for assets like BTC and ETH.

Both Coinbase and Kraken have aggressively pursued derivatives expansion in 2025 amid surging institutional demand for regulated crypto tools.

Coinbase’s approach emphasizes massive scale through high-value acquisitions and global product diversification, positioning it as a “one-stop shop” for derivatives.

Coinbase International Exchange: 106 perpetual futures listings up from 15 in 2024; $185B+ monthly volumes, $60B open interest post-Deribit. Expanding to altcoins (e.g., SUI futures Oct 20) and hybrids like Mag7 + Crypto Equity Index Futures (Sept 22).

Kraken focuses on U.S.-centric integration, leveraging smaller, targeted buys to unify spot and futures under CFTC oversight for retail and institutional efficiency.

Coinbase leads in global dominance and options volume, ideal for institutions seeking breadth. Kraken excels in U.S.-regulated unification and cost-efficiency, appealing to retail/pro traders wanting seamless onshore access.

Both align with 2025 trends toward regulated hybrids, but Coinbase’s bolder M&A $3B+ spent gives it an edge in market share, while Kraken’s $1.6B investments prioritize practical U.S. integration.

Backpack and Superstate Partner to Launch Tokenized Equities

Backpack Exchange—a Solana-based crypto platform founded by former FTX executives—has partnered with blockchain finance firm Superstate to integrate native, SEC-registered tokenized U.S. equities into its trading venue.

Through Superstate’s Opening Bell platform, eligible non-U.S. users can now trade, buy, sell, and cross-margin real shares of public companies not synthetic wrappers onchain, alongside crypto and stablecoins, with full shareholder rights including dividends and voting.

Unlike custodial products like Kraken’s xStocks, these tokens use the same CUSIP identifiers as traditional NYSE or Nasdaq shares and are issued via Superstate’s SEC-registered transfer agent for direct onchain settlement.

Backpack CEO Armani Ferrante highlighted the partnership as advancing “the future of finance is the future of crypto,” positioning the exchange as the first centralized venue for issuer-backed, compliant tokenized stocks.

Initial supported stocks, including recent examples like Galaxy Digital’s GLXY shares, will roll out soon, amid Backpack’s broader push into regulated real-world assets following its acquisition of FTX’s EU arm earlier this year.