For years, onchain transparency has been one of crypto’s defining promises. With a known address, anyone can verify a treasury’s holdings or validate outgoing payments. But that onchain transparency has traditionally been paired with offchain occlusion.

Without a viable onshore compliance regime, crypto treasuries and DAOs have too often disappeared into offshore black boxes—with little visibility into how funds were actually managed or reported.

The DUNA changes that. It brings both onchain and offchain operations into the light—aligning onchain transparency with institutional-grade financial reporting and U.S. legal compliance.

For the first time, token-holder–governed organizations can present a holistic, verifiable view of their finances—both onchain and offchain. This is a key step in the professionalization of the industry, and one that’s long overdue.

Public disclosures, paired with onchain transparency, can finally create a full and open picture of the Syndicate Network Collective—and a model for other DUNAs to follow.

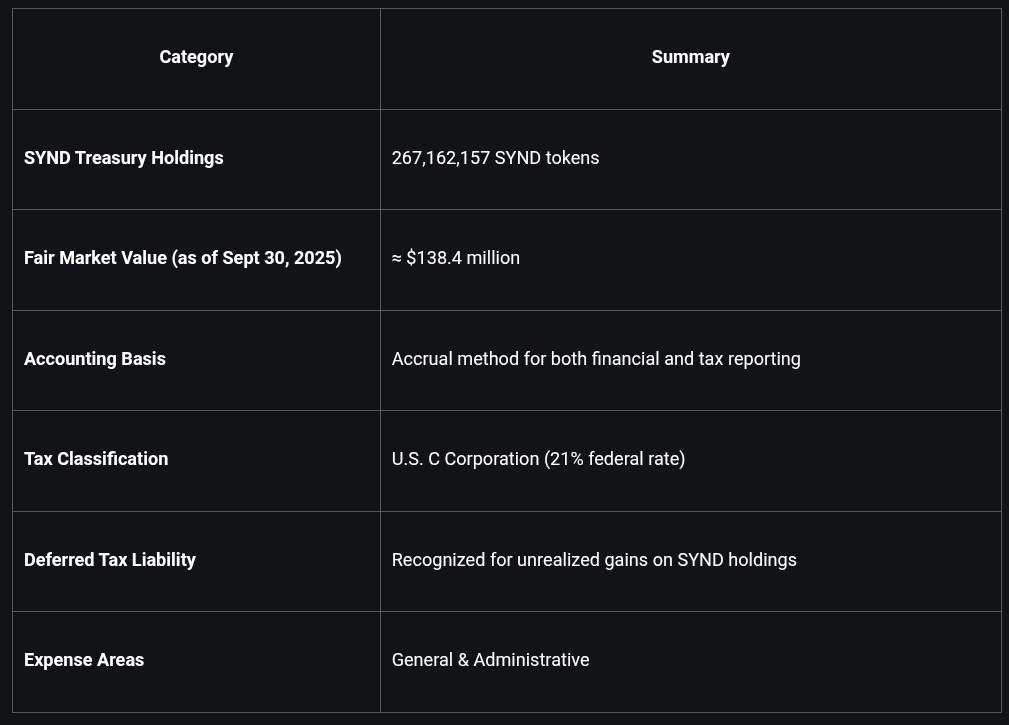

As of September 30, 2025, the DUNA held 267,162,157 SYND tokens and $285,000 cash on hand.

The DUNA’s financials capture its full economic activity, including unrealized gains or losses on token holdings. The treasury funds ecosystem development, governance operations, research, and long-term network security.

All disbursements are approved through governance and accounted for under U.S. tax rules—ensuring transparency and traceability across onchain and offchain records.

Building Trust Through Transparency

Building a community-owned internet requires more than open infrastructure—it requires systems that earn trust through accountability.

The Syndicate Network Collective’s financial framework turns that principle into practice. By applying established accounting standards to onchain activity and publishing those results openly, it sets a precedent for how decentralized networks can operate transparently and responsibly.

Transparency isn’t an afterthought to decentralization—it’s what gives it substance. The Syndicate Network Collective shows how communities can own not just their infrastructure within the Syndicate Network, but the integrity of the systems behind it—laying the groundwork for a more open, accountable, and community-owned internet.

The Framework: How the DUNA Operates

Syndicate Network Collective operates as a Wyoming Decentralized Unincorporated Nonprofit Association (DUNA)—a first-of-its-kind structure that enables collective governance while maintaining compliance with U.S. law.

Members are SYND holders who actively participate in governance—oversee the use of the network’s treasury through open proposals and onchain votes—not mere token ownership.

Upon formation, the DUNA elected to be treated as a U.S. C Corporation for federal tax purposes. This provides clear reporting obligations and accountability while allowing the DUNA to operate transparently within existing law.

Gives token holders real control over the network and its treasury. In the early stages, token holders participate in crucial votes, while a committee manages grants. Over time, we expect governance to shift fully onchain—where smart contracts control the network, keeping power where it belongs: with the community.

Provides a legal entity for contributors and participants to interact with—including limited liability protections to token holders. The DUNA framework defines clear, legally recognized roles for all ecosystem participants, creating a transparent structure for collaboration and accountability.

Manages the network treasury, signs contracts, and engages with traditional service providers with token holder votes and committees. The network can act in the real world—legally and operationally—while remaining governed by its tokenholders.

Operates transparently under U.S. law and regulation by default. This is a structure designed to bring greater transparency, reporting, and accountability to the crypto industry, without compromising its core values of decentralization, privacy, and openness.

Aligns with the future of U.S. policy. With the passage of the GENIUS Act, SEC’s Project Crypto, White House’s establishment of the Strategic Bitcoin Reserve and Digital Asset Stockpile, and the proposed market structure bills that explicitly support decentralized network governance structures like DUNAs, the U.S. is building a clear legal and regulatory foundation for the crypto industry to operate openly at home, not offshore.

Importantly, the DUNA is nonprofit by default—it’s designed for networks and protocols to serve its communities of users, not shareholders. DUNAs reflect a deep commitment to build networks where decentralization isn’t just technical but core to the purpose of the network itself.

Syndicate Network will now operate under a DUNA structure with the Syndicate Network Collective, helping set a new standard for the crypto industry—where community ownership is real, governance is transparent, and compliance doesn’t come at the cost of openness or permissionlessness.

Financial and tax reporting use accrual and fair-value accounting, meaning: Income is recognized when earned, not received. SYND holdings are valued at current market prices each period. Unrealized gains are recorded as income, with a deferred tax liability for future realization.