Stellantis’ new $13 billion investment plan in the United States signals a major shift in the global auto industry’s response to President Donald Trump’s sweeping tariffs — a recalibration that analysts say could permanently reshape how and where automakers build their cars.

The plan, announced late Tuesday, marks one of the most aggressive moves yet by the French-Italian-American carmaker to fortify its position in its most important market and shield itself from the escalating costs of tariffs imposed under Trump’s “America First” trade agenda. The company had estimated in July that the tariff burden alone would cost it around $1.7 billion this year — a hit that now appears to have pushed Stellantis toward decisive action.

“This move is relevant and part of a wider path started by Stellantis to be more and more aligned to the new business environment drawn by Trump with tariffs. It’s paying off,” Fabio Caldato, portfolio manager at AcomeA SGR, who recently increased his exposure to Stellantis, told Reuters.

However, the $13 billion investment underscores both the risks and opportunities facing global automakers as Washington’s trade strategy forces a reordering of supply chains. Analysts say it represents a turning point not only for Stellantis but for the broader auto industry, as companies reconsider the long-term viability of their North American production strategies.

‘Manufacture Where You Sell’ Becomes the New Rule

Stellantis, which owns brands including Jeep, Ram, Chrysler, Fiat, and Peugeot, sold about 1.2 million vehicles in the U.S. last year. More than 40 percent of those were imports — primarily from plants in Mexico and Canada — that are now subject to 25 percent tariffs under Trump’s trade framework.

The new investment plan is expected to increase local U.S. production, reducing reliance on imports and aligning Stellantis more closely with Washington’s industrial priorities.

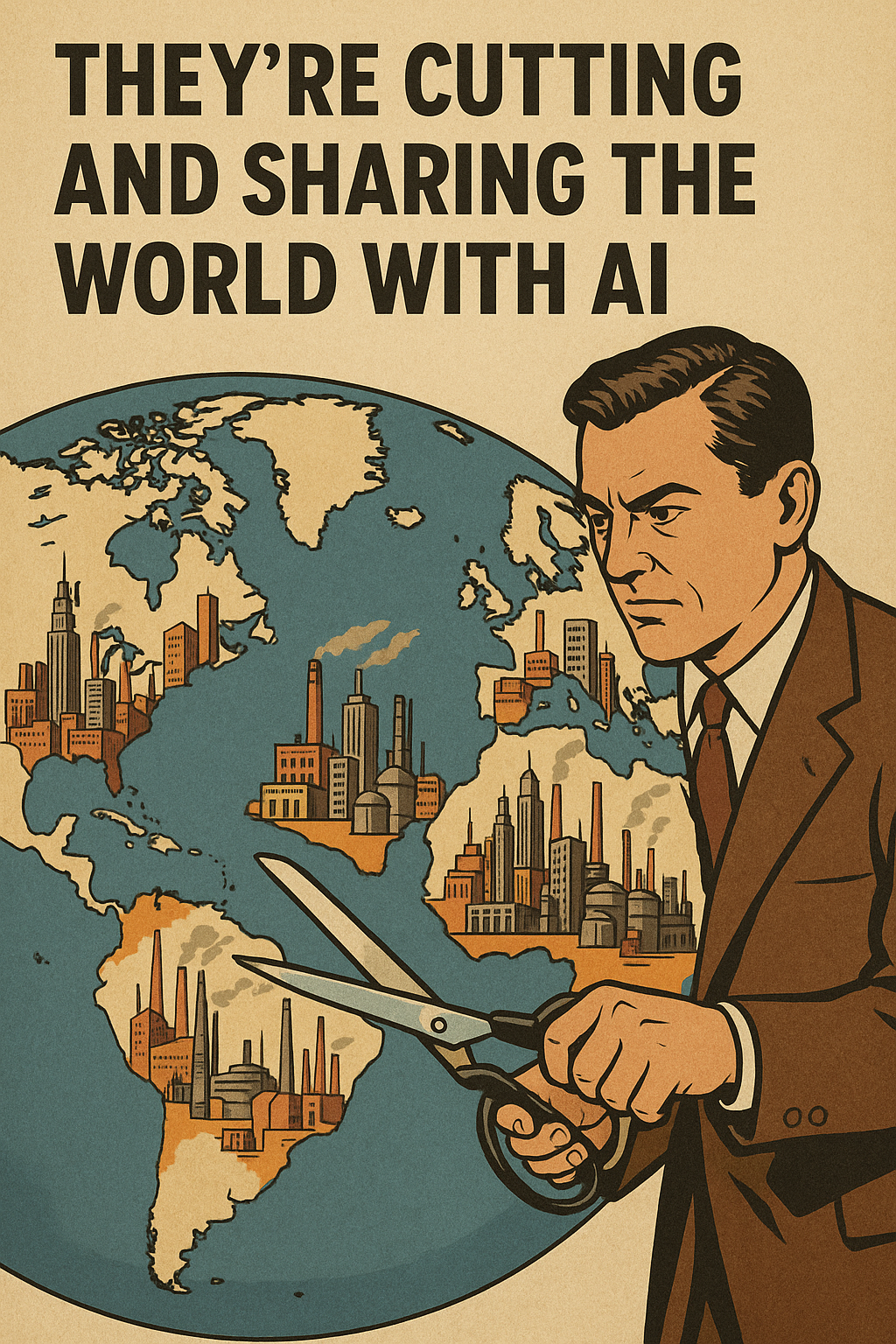

“I see it as an irreversible trend, to manufacture more where sales happen, a sort of forced de-globalisation process,” said Massimo Baggiani, founder of London-based Niche Asset Management. “More investments and sales in the U.S. might also attract more American investors in the long term.”

Baggiani, who previously sold his Stellantis shares, said he was not reinvesting in the stock yet, noting that while Stellantis shares remain attractively priced, “they do not offer a significant discount compared to Ford or GM.”

That cautious stance reflects a broader investor mood. Stellantis shares rose as much as 4.3 percent in early trading on Wednesday following the announcement, but they remain down 33.5 percent year-to-date. Analysts attribute part of that decline to persistent uncertainty over trade policies, production costs, and consumer sentiment in the face of higher car prices.

Tariffs Push Automakers to Reinvent Supply Chains

Trump’s tariff wave — targeting goods from Mexico, Canada, and China — has already triggered a strategic rethink across industries. Automakers, long accustomed to integrated North American supply chains, are now being forced to localize production more aggressively.

For Stellantis, the decision is as much about survival as opportunity. The company has seen its U.S. market share weaken in recent years, particularly in its sedan and compact segments, while brands like Jeep and Ram face intensified competition from Ford and General Motors in the truck and SUV categories.

“The investment plan was necessary to mitigate the impact of U.S. tariffs and relaunch brands that have lost significant volume in recent years,” said Equita analyst Martino De Ambroggi, who added that the spending reshuffle “should result in limited changes to total capital expenditure.”

Some believe that Stellantis’ investment strategy could include expanding or repurposing existing plants in states such as Michigan, Ohio, and Indiana — regions where auto production and employment carry deep political significance. Such moves would not only curb tariff costs but also signal alignment with Trump’s emphasis on domestic manufacturing.

A Sign of ‘Greater Tariff Comfort’

The timing of Stellantis’ announcement has also drawn attention. After months of industry-wide uncertainty, the move is seen as a sign that the company now has a clearer understanding of Washington’s trade trajectory.

“The timing of this announcement possibly signals greater tariff comfort and clarity on the part of Stellantis management,” analysts at TD Cowen — Itay Michaeli, Justin Barrell, and Selina Liu — wrote in a note to clients.

By locking in a U.S. investment of this magnitude, Stellantis appears to be hedging against further escalation while simultaneously positioning itself as a long-term domestic manufacturer. That shift could earn it goodwill from both policymakers and consumers, particularly as other global automakers scramble to adjust to the new tariff regime.

A Broader Shift Toward Industrial Reshoring

Stellantis’ move fits into a larger wave of reshoring announcements by multinationals seeking to minimize exposure to tariff risk and geopolitical disruption. From electronics to electric vehicle batteries, companies have been relocating supply chains closer to major consumer markets — a process some economists describe as the “re-nationalization” of global manufacturing.

Trump’s policy framework, which includes incentives for companies to expand domestic operations alongside punitive tariffs on imports, has accelerated this transformation. Analysts note that while it increases near-term costs for automakers, it could also bolster domestic production and employment in the long term — a political win for the White House.

For investors, Stellantis’ U.S. investment plan represents both a reassurance and a calculated gamble. On one hand, it signals the company’s willingness to adapt quickly to policy changes; on the other, it raises questions about profit margins, capital allocation, and execution risks in a high-cost environment.

“Stellantis shares remain cheap, but like the rest of the industry, they do not offer a significant discount compared to Ford or GM,” said Baggiani.

Caldato, the AcomeA SGR portfolio manager, sees the investment as a vote of confidence in the company’s ability to navigate a new trade reality.

“It’s paying off,” he said, suggesting that Stellantis’ proactive stance could help it win market share from slower-moving rivals.

Still, analysts caution that even with new plants, supply chain volatility, inflationary pressures, and continued tariff uncertainty could weigh on margins.