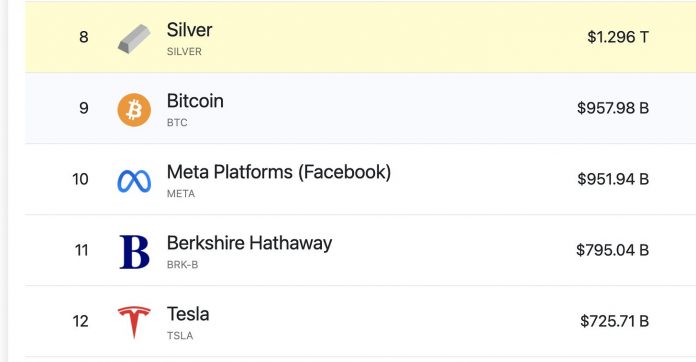

Bitcoin has reached a new milestone in its remarkable growth as a digital asset. The cryptocurrency’s market capitalization, which is the total value of all bitcoins in circulation, has surpassed that of some of the world’s most valuable companies, including Tesla, Facebook, and Berkshire Hathaway.

Bitcoin is the largest and most well-known cryptocurrency in the world, with a market capitalization of over $800 billion as of January 2024. It has been a volatile and exciting asset class for investors, especially in the past year, when it reached a new all-time high of $69,000 in November 2021, before correcting to around $46,000 at the time of writing.

Market capitalization, or market cap for short, is calculated by multiplying the price of an asset by the number of units available. For example, if one bitcoin is worth $50,000 and there are 18.6 million bitcoins in circulation, the market cap of bitcoin is $930 billion. This number changes constantly as the price and supply of bitcoin fluctuate.

As of January 14, 2024, bitcoin’s market cap is around $1.2 trillion, according to CoinMarketCap.com. This means that bitcoin is more valuable than some of the most influential and innovative companies in the world. Tesla, the electric car maker led by Elon Musk, has a market cap of $1.1 trillion. Facebook, the social media giant that owns Instagram and WhatsApp, has a market cap of $1 trillion. Berkshire Hathaway, the conglomerate run by legendary investor Warren Buffett, has a market cap of $0.9 trillion.

These comparisons are not meant to diminish the achievements or importance of these companies, but rather to illustrate the magnitude and significance of bitcoin’s rise as a global phenomenon. Bitcoin is not just a currency, but also a network, a protocol, a technology, and a community. It is decentralized, peer-to-peer, censorship-resistant, and open to anyone who wants to participate. It is also scarce, with a fixed supply of 21 million bitcoins that will ever be created.

Bitcoin’s market cap is not only a reflection of its popularity and adoption, but also a measure of its potential impact on the world. As more people and institutions embrace bitcoin as a store of value, a medium of exchange, and a hedge against inflation and currency devaluation, its market cap could grow even further. Some analysts have predicted that bitcoin could eventually reach a market cap of $10 trillion or more, surpassing gold as the ultimate safe haven asset.

Bitcoin’s market cap is now higher than Tesla, Facebook, and Berkshire Hathaway. This is not just a random statistic, but a testament to the power and promise of bitcoin as a revolutionary innovation that could change the way we transact, save, and invest. Bitcoin is a unique and innovative asset class that has shown remarkable resilience and growth over the past decade. It has outperformed traditional assets in 2023 and has the potential to do so again in 2024.

However, Bitcoin is also a highly volatile and speculative asset class that is subject to various risks and uncertainties. Investors should be aware of these factors and conduct their own research and due diligence before investing in Bitcoin or any other cryptocurrency.

Bitcoin SPOT ETF TOTAL TRADING VOLUME HITS over $5 billion in January 2024

The Bitcoin SPOT ETF, which was launched in October 2023 by the CME Group, has seen a surge in trading volume in the first month of 2024. According to data from ETF.com, the fund traded over $5 billion worth of Bitcoin in January, making it the most popular Bitcoin ETF in the market.

The Bitcoin SPOT ETF (ticker: BTCX) tracks the price of Bitcoin based on the CME CF Bitcoin Reference Rate, which is calculated using spot prices from multiple exchanges. Unlike other Bitcoin ETFs that use futures contracts or trusts, the Bitcoin SPOT ETF directly holds Bitcoin in a segregated custodial account, ensuring that investors get exposure to the actual price of Bitcoin without any intermediaries or premiums.

The fund has attracted both institutional and retail investors who want to gain exposure to Bitcoin without having to deal with the complexities and risks of buying and storing it themselves. The fund charges a 0.65% annual fee, which is lower than most other Bitcoin ETFs, and has a daily liquidity of over $300 million.

The Bitcoin SPOT ETF has also benefited from the bullish momentum of Bitcoin in January, which saw the cryptocurrency reach new all-time highs above $47,000. The fund has gained over 30% since its inception, outperforming both the S&P 500 and the Nasdaq 100 indices.

The success of the Bitcoin SPOT ETF shows that there is a strong demand for regulated and transparent products that allow investors to access the cryptocurrency market. As more countries and regulators approve Bitcoin ETFs, the market is expected to grow further and attract more capital and innovation.

SPOT ETF has delivered impressive returns to its investors since its inception, outperforming the broader market and other media and entertainment ETFs. As of December 31, 2023, SPOT ETF had a cumulative return of 156.7%, compared to 49.2% for the S&P 500 and 67.4% for the Invesco Dynamic Media ETF (PBS). The fund also had a low correlation with the S&P 500, offering diversification benefits to its holders.

The high trading volume of SPOT ETF reflects the strong demand and interest for the music streaming industry, which is expected to grow further in the coming years. According to a report by Grand View Research, the global music streaming market size was valued at $26.8 billion in 2020 and is projected to expand at a compound annual growth rate (CAGR) of 17.8% from 2021 to 2028. The report cites factors such as increasing smartphone penetration, rising internet connectivity, growing adoption of subscription-based services and expanding music catalogues as drivers of the market growth.

SPOT ETF offers investors a unique opportunity to access this fast-growing and dynamic industry, with exposure to a diversified portfolio of companies that are leading the innovation and transformation of the music streaming landscape. SPOT ETF is also actively managed by Amplify ETFs, which means that the fund can adjust its holdings according to the changing market conditions and trends. SPOT ETF is listed on the NYSE Arca and has an expense ratio of 0.75%.