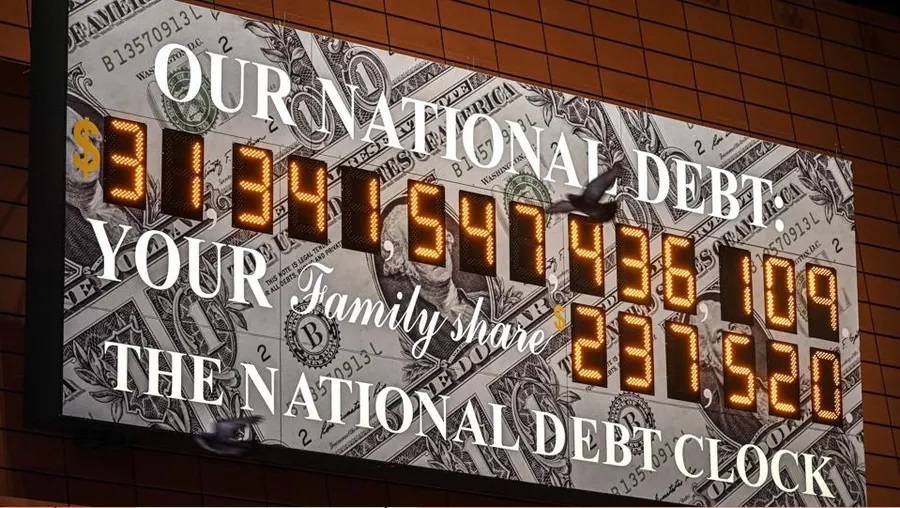

The United States of America is the world’s largest economy and a global superpower. However, it is also the world’s biggest debtor, owing more than $28 trillion to its creditors, both domestic and foreign. What are the implications of such a high level of debt on the USA economy and governance?

We will explore some of the possible effects of the US debt on various aspects of its economic and political system, such as growth, inflation, interest rates, trade, security, and democracy. We will also discuss some of the potential solutions and challenges that the US faces in managing its debt burden.

Growth: The US debt has been growing faster than its gross domestic product (GDP) for several years, reaching 127% of GDP in 2023. This means that the US is spending more than it is producing, and relying on borrowing to finance its deficit. While some level of debt can be beneficial for stimulating economic activity and investment, excessive debt can have negative consequences for long-term growth.

For example, high debt can crowd out private sector borrowing, reduce public investment in infrastructure and education, and limit fiscal space for responding to shocks and crises. Moreover, high debt can erode investor confidence and increase the risk of a debt crisis or default, which could trigger a severe recession.

The US debt is largely denominated in its own currency, the US dollar. This gives the US an advantage over other countries that borrow in foreign currencies, as it can print money to service its debt without facing exchange rate risk.

However, this also creates the possibility of inflation, which is the general rise in the prices of goods and services over time. Inflation reduces the purchasing power of money and erodes the real value of debt.

While inflation has been low and stable in the US for decades, some economists warn that the unprecedented fiscal and monetary stimulus in response to the COVID-19 pandemic could lead to higher inflation in the future.

Higher inflation could hurt consumers and businesses, especially those with fixed incomes or contracts. It could also force the Federal Reserve to raise interest rates to curb inflation, which could slow down economic growth and increase the cost of servicing debt.

The US debt is influenced by the level and direction of interest rates, which are determined by the supply and demand for money in the market. The US government borrows money by issuing bonds, which are promises to pay back a certain amount of money with interest over time.

The interest rate on these bonds reflects the risk and return that investors expect from lending to the US government. The higher the interest rate, the more expensive it is for the US government to borrow money and service its debt.

The lower the interest rate, the cheaper it is for the US government to borrow money and service its debt. Interest rates are affected by various factors, such as inflation expectations, economic growth prospects, monetary policy actions, global market conditions, and investor sentiment.

Generally speaking, higher inflation, lower growth, tighter monetary policy, weaker global demand, and lower confidence tend to push interest rates up. Lower inflation, higher growth, looser monetary policy, stronger global demand, and higher confidence tend to push interest rates down.

The US debt has implications for its trade balance with other countries, which is the difference between its exports and imports of goods and services. The US has been running a trade deficit for decades, meaning that it imports more than it exports.

implies that the US consumes more than it produces, and relies on foreign savings to finance its consumption. The trade deficit is partly financed by issuing debt to foreign investors, who buy US assets such as bonds, stocks, real estate, and businesses.

This increases the US net foreign debt position, which is the difference between its assets and liabilities abroad. The trade deficit also affects the value of the US dollar relative to other currencies, which influences the competitiveness of US goods and services in international markets.

A weaker dollar makes US exports cheaper and imports more expensive, which could reduce the trade deficit and boost domestic production. A stronger dollar makes US exports more expensive and imports cheaper, which could increase the trade deficit and reduce domestic production.

The US debt has implications for its national security and global leadership role, as it affects its ability to fund its military spending and foreign policy objectives.

The US debt has implications for its democratic system and institutions, as it affects its political stability and governance quality. The US debt is partly a reflection of the political polarization and gridlock that have characterized its policymaking process in recent years.

The US has faced difficulties in reaching consensus and compromise on key fiscal issues, such as the budget, the debt ceiling, taxes, spending, and entitlements. This has resulted in frequent fiscal cliffs, government shutdowns, and credit rating downgrades, which have eroded public trust and confidence in the government.

The high level of debt could also exacerbate social and economic inequalities, as different groups may compete for scarce public resources and benefits. Moreover, the high level of debt could increase the vulnerability of the US to external pressures and interference, as foreign creditors may have leverage over its policy decisions and actions.

Solutions and challenges: The US faces a complex and daunting task of managing its debt burden in a sustainable and responsible manner. There is no simple or easy solution to this problem, as it requires a comprehensive and balanced approach that involves both increasing revenues and reducing expenditures, while maintaining economic growth and social welfare. Some of the possible measures that the US could consider include:

Reforming its tax system to make it more efficient, fair, and progressive, by broadening the tax base, eliminating loopholes and deductions, raising taxes on the wealthy and corporations, and introducing new taxes on carbon emissions, financial transactions, or digital services.

Reforming its spending programs to make them more effective, targeted, and affordable, by prioritizing public investment in infrastructure, education, health, and research, streamlining bureaucracy and administration costs, reducing waste and fraud, and adjusting entitlements such as Social Security, Medicare, and Medicaid to reflect demographic changes and fiscal realities.

Reforming its monetary policy to ensure price stability and financial stability, by maintaining an independent and credible Federal Reserve that can adjust interest rates and money supply according to economic conditions and inflation expectations, while avoiding excessive or prolonged monetary stimulus that could create asset bubbles or inflationary pressures.

Reforming its trade policy to enhance its competitiveness and productivity, by promoting free and fair trade agreements that open up new markets and opportunities for US businesses and workers, while protecting its national interests and values from unfair trade practices or strategic rivals.

However, the US also has many strengths and advantages that could help it overcome these challenges, such as a resilient and dynamic economy, a diverse and innovative, a robust and flexible democratic system, a powerful and respected military force, and a network of allies and friends around the world.

The US debt is not an insurmountable problem, but it is a serious one that requires urgent attention and action. The US has the capacity and responsibility to manage its debt in a way that preserves its economic prosperity, political stability, national security, and global leadership role for generations to come.

Like this:

Like Loading...