Crypto market momentum continues heating up as Bitcoin, Solana, and XRP all display strong bullish setups heading into the next major expansion cycle. Yet even as these top-tier assets build powerful market structure, analysts consistently highlight one project with a far more aggressive long-term ROI curve—Ozak AI (OZ).

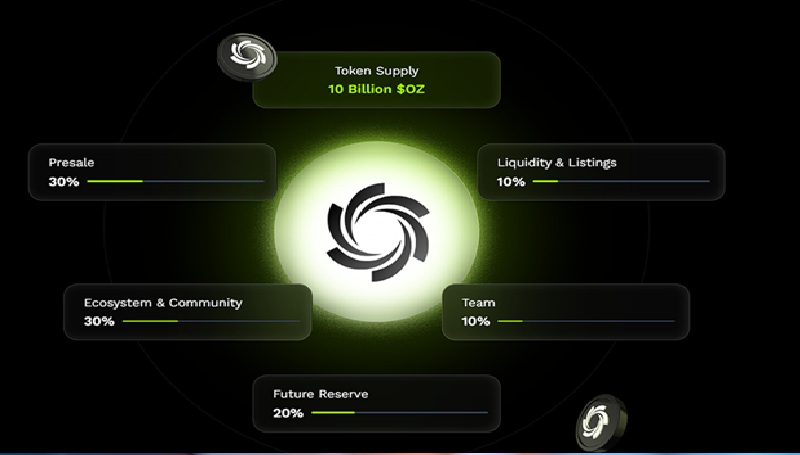

As an AI-native intelligence engine with working millisecond predictive technology, autonomous AI agents, and cross-chain real-time analytics, Ozak AI enters the market with functional utility rather than speculative promises. With the Ozak AI presale now surpassing $4.8 million, analysts argue that its upside potential could exceed Bitcoin, Solana, and XRP combined during the next two-year window.

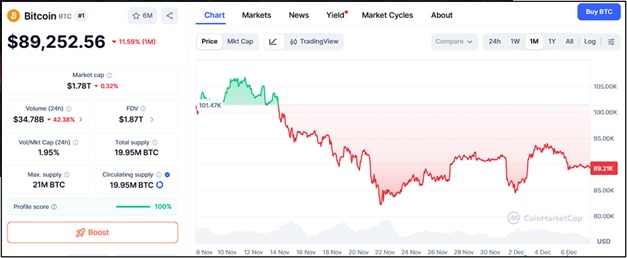

Bitcoin (BTC)

Bitcoin trades around $89,252 and maintains a structurally strong macro uptrend. Support at $87,200 keeps the bull structure intact, with deeper confirmation zones near $85,600 and $83,900 protecting long-term momentum.

BTC begins shifting into breakout mode once price retests resistance at $91,400, with higher extension zones near $93,200 and $95,600 often driving major continuation moves during peak liquidity cycles. Analysts expect Bitcoin to reach new all-time highs in the next phase, supported by ETF inflows, institutional demand, and supply-side constraints following the most recent halving.

But even with Bitcoin’s solid trajectory, its ability to deliver exponential ROI is limited due to market maturity. Ozak AI, by contrast, is at the beginning of its curve and introduces real-time intelligence that compounds continuously—leading smart-money models to assign it much higher long-term upside than BTC.

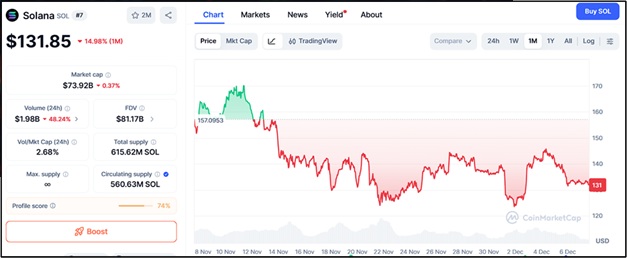

Solana (SOL)

Solana trades near $131.85 and continues to lead high-performance Layer-1s in both user growth and throughput efficiency. Support at $128 reinforces the trend, while deeper zones at $124 and $118 form a durable multi-layered demand structure. Solana’s next acceleration phase begins once the price approaches resistance at $136, followed by higher extension levels near $141 and $148. With rising developer adoption, expanding DeFi activity, and increasing institutional interest, Solana remains one of the strongest large-cap contenders for the coming cycle.

Yet analysts point out that Solana’s growth—while impressive—follows a more predictable linear path. Ozak AI’s compounding intelligence architecture, millisecond-speed predictive system, and autonomous multi-chain agent network create an exponential curve that few major altcoins can match.

XRP

XRP continues its steady recovery as long-term confidence returns. While not part of the title’s data mix for technical levels, XRP still plays a key role in broader market direction, and analysts consistently compare its large-cap outlook to early-stage exponential opportunities like Ozak AI. XRP’s long-term path remains tied to regulatory clarity and institutional settlement adoption—a narrative with strong potential but far less compounding utility than Ozak AI’s AI-driven system.

opportunities like Ozak AI. XRP’s long-term path remains tied to regulatory clarity and institutional settlement adoption—a narrative with strong potential but far less compounding utility than Ozak AI’s AI-driven system.

Ozak AI’s intelligence layer, supported by HIVE’s 30 ms signals, SINT’s autonomous agent execution, and Perceptron Network’s 700K+ node footprint, creates a utility loop that expands in value every single day—regardless of market conditions. This is the core reason analysts expect Ozak AI to outperform XRP, Solana, and Bitcoin in ROI over the next 24–36 months.

Ozak AI Becomes the Top ROI Pick of the Cycle

Bitcoin controls market direction. Solana drives performance innovation. XRP strengthens utility adoption. But Ozak AI stands in a different category—an AI-powered intelligence engine that evolves automatically, learns continuously, and increases in value as Web3 becomes more data-dense. Analysts projecting 20x–60x upside for Solana and 3x–10x for Bitcoin now assign Ozak AI a much steeper curve, with forecasts ranging from 50x to more than 100x if adoption accelerates.

As the next expansion cycle approaches, Ozak AI is increasingly viewed as the highest-ROI opportunity in the market—outperforming even the strongest bullish setups across BTC, SOL, and XRP.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi