Introduction

In the exciting world of cryptocurrency trading, tax responsibilities might not be the first thing on your mind. However, as the popularity and value of digital assets like Bitcoin has surged, tax authorities are increasingly vigilant about ensuring proper reporting. Immediate Smarter, a renowned online trading platform, understands what a trader needs with respect to tools, resources and education to make informed decisions and get better at crypto trading.

Understanding Your Tax Obligations

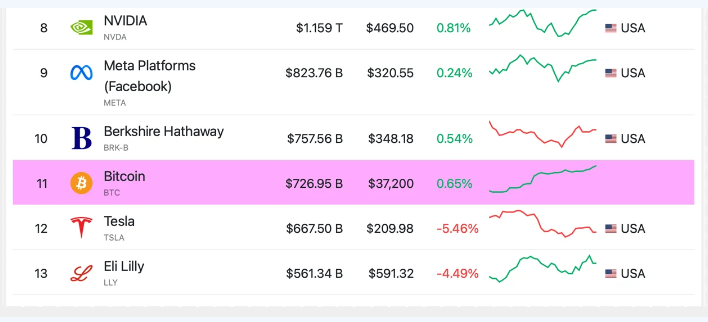

Before diving into the nitty-gritty of filing crypto taxes, it’s crucial to grasp the basic principles of how cryptocurrency is taxed. Cryptocurrencies are treated as property by most tax authorities, which means that any gains or losses resulting from their trading are subject to capital gains tax. This applies whether you’re actively trading on platforms or simply holding onto your digital assets.

Step 1: Gather All Your Transaction Records

The first step in filing accurate crypto taxes is to gather all your transaction records. These include every buy, sell, trade, or transfer involving cryptocurrencies. This process might seem daunting, especially if you’ve been active on multiple platforms, but it’s essential for accurate reporting. Make sure to compile records of dates, amounts, transaction fees, and the parties involved.

Step 2: Calculate Your Gains and Losses

With your transaction records in hand, it’s time to calculate your gains and losses. This involves determining the difference between the value of your cryptocurrencies at the time of acquisition and their value at the time of disposition. Whether you’ve made profits or incurred losses, accurate calculations are vital for proper tax reporting.

Step 3: Categorize Your Transactions

Different types of crypto transactions have varying tax implications. For instance, transactions classified as short-term (held for less than a year) are typically taxed at higher rates than long-term transactions. It’s crucial to categorize your transactions correctly to ensure you pay the right amount of taxes. Tools provided by platforms can assist in this process.

Step 4: Report Your Gains and Losses

Once you’ve calculated and categorized your gains and losses, it’s time to report them to the relevant tax authorities. This is usually done by filling out specific forms designed for reporting capital gains and losses. Ensure accuracy and double-check your entries to avoid potential audits or penalties. If you’re unsure about any aspect, consider seeking professional advice or using tax software tailored to crypto reporting.

Step 5: Paying Your Taxes

With accurate reporting completed, the next step is to pay the taxes owed on your crypto gains. Depending on your jurisdiction, you might be required to pay estimated quarterly taxes or settle the full amount when you file your annual tax return. Be sure to understand the deadlines and payment methods specified by your local tax authority.

Step 6: Keep Detailed Records

Maintaining meticulous records of your crypto activities is a year-round endeavor. Regularly update your transaction records, keep track of any changes in regulations, and stay informed about updates from platforms. Comprehensive and organized records will not only make the next tax season smoother but also provide a solid defense in case of any discrepancies.

The Importance of Seeking Professional Help

While this guide provides a clear outline of the steps involved in filing crypto taxes, the complexity of the cryptocurrency landscape can still be overwhelming. If you’re new to trading or dealing with large volumes of transactions, it’s highly recommended to seek professional help. Tax experts with experience in cryptocurrency can provide tailored advice and ensure you’re not missing out on any potential deductions or credits.

Staying Compliant for a Secure Future

In the ever-evolving world of cryptocurrency, staying compliant with tax regulations is a crucial aspect of being a responsible trader. Platforms not only offer a seamless trading experience but also emphasize the importance of tax compliance among their users. By following this step-by-step guide and seeking professional advice when needed, you can navigate the complexities of crypto taxes with confidence. Remember, accurate reporting today ensures a secure and hassle-free financial future tomorrow.

Conclusion

Navigating the world of crypto taxes might seem like a daunting task, but with the right approach and guidance, it can be manageable and even enlightening. As cryptocurrencies continue to gain mainstream acceptance, tax authorities are placing greater emphasis on proper reporting. Following this step-by-step guide, you can ensure that you’re meeting your tax obligations accurately and responsibly. By gathering your transaction records, calculating gains and losses, categorizing transactions correctly, and reporting them accurately, you’re taking a proactive step toward financial transparency.