Read Dangote’s position here (PDF) and follow up with BUA’s response here (PDF)

For several years, Aliko Dangote and Abdulsamad Rabiu, the founders of Dangote Group and BUA Group, have been involved in a highly publicized feud. The conflict primarily centered around their cement and sugar businesses, where Dangote Group and BUA Group were vying for market dominance in Nigeria.

The dispute began in 2017 when Dangote Group accused BUA of operating an unauthorized cement plant in Edo State, while BUA countered that Dangote was attempting to eliminate competition. Tensions escalated in 2020 when both companies planned to expand their cement plants in Sokoto State, with allegations of trade secrets theft and patent infringement.

The feud was characterized by mutual accusations and counter-accusations as they competed for a larger market share. It is 2023, and not much has changed.

On Friday, BUA released a letter in response to “a recent 7-page editorial” by Dangote, which leveled “blackmail” against BUA.

Read the full letter below:

“It’s with a profound sense of responsibility and a heavy heart that we address the claims and very cheap attempts at blackmail leveled against BUA by Aliko Dangote in a recent 7-page editorial following months of sponsored campaigns of calumny against us using third-party platforms. To put things in perspective, it’s imperative to revisit history—a history not of rivalry but of resilience; not of enmity, but of endurance.”

“In August 1991, a young BUA was doing its commodities trading business just as Nigeria faced a scarcity of sugar. As sugar was scarce, BUA was lucky to be one of the few with any stock for sale, and we stood prepared to supply the nation’s needs as best as our stock could. It was during this period Aliko Dangote approached us to purchase sugar. If only we knew he was setting the first of many traps in our business history. He gave us a Societe Generale Bank of Nigeria Cheque, which bounced upon presentation to the bank. Unbeknown to us, this was a ruse that would lead to a court-sanctioned freeze of our assets orchestrated by Dangote.”

“For three agonizing months, our accounts were garnisheed, warehouses shuttered, and our spirit tested. Yet, from the ashes of deceit, BUA survived. (see attached court order)”

“Fast forward a few years later, we decided that since we were making good progress in our various businesses, we should open a sugar refinery. We approached one Usman Dantata (now late), Aliko Dangote’s uncle, and leased his NPA waterfront land (4.5 hectares) at the Tincan Island port, ‘Polo House’. We took the land, signed an agreement with the consent of NPA, and paid all applicable dues. Dangote waited until our contractors and equipment had been mobilized to the site, then he went to former President Obasanjo. President Obasanjo had the land revoked entirely and gave the lease to Dangote. As a result, even his uncle lost the land. BUA was only given 24 hours to vacate the land.”

“It took us over a year to get another land. How?”

“Our survival as a business especially our Lagos sugar refinery is a legacy handed to us by a loving father who, seeing his son’s distress, did what only the noblest and kindest of hearts could do. With unwavering faith, our Chairman’s late father—may his soul rest in eternal peace—handed him the land on which our Lagos Sugar Refinery stands today. This land was the location of one of his thriving businesses with a warehouse, which he shut down and handed to us without asking for compensation. He just saw the pain of our chairman, Abdul Samad Rabiu, called him one day and handed him the papers to the land. His gesture was a beacon of hope in one of our darkest hours. And so, BUA survived again another Dangote trap. Today, we are now the largest Sugar refining concern in West Africa.”

“Our businesses continued to surge forward amid several other attempts, too many to mention now. In 2007, under President Yar’Adua’s visionary mandate to broaden Nigeria’s cement industry and break the monopoly in the sector, BUA was among the six companies selected and granted licenses. Our approach was unconventional but effective: we introduced a floating terminal – ‘BUA CEMENT I’, which is a cement factory built into a large ship, as a stopgap while we were working on securing our land-based cement plant.”

“What followed, however, was another act intended to drive us out of business. Our application to dock the floating terminal in Lagos met with resistance. We then decided to berth the ship at the terminal we owned in Port Harcourt. Despite this, we faced considerable pushback and it took the decisive intervention of late President Yar Adua, who directed that the Minister of Transport and the Chairman of NPA honor our right to contribute to the nation’s growth.”

“But the hurdles didn’t end there. The drama intensified when Orwell Brown, a Deputy Comptroller General who was also an older brother to a Dangote Staff, launched a sudden strike, attempting to deport our vessel’s entire expatriate crew. It was a Friday that is forever seared into our memory—the shock of our expatriates rounded up, their confusion as they were shepherded onto a Dangote-funded one-way local flight from Port Harcourt to Lagos en-route Asia via Emirates.”

“Upon hearing of what had happened, we reached out to Tanimu Yakubu, the then Chief Economic Adviser, who acted with the urgency that the situation demanded. His call to the CG of Immigration was a lifeline, and our expatriate team was brought back from the Emirates aircraft and not deported. The aftermath was swift action by the President, who ensured that such a misuse of power would not go unchecked. DCG Brown, caught in a tangle of undue influence, admitted what he did to the Minister, and he was later dismissed.”

“Through all these tribulations, BUA’s resolve has only strengthened. These events narrate not just the trials of a company but the resolve of its people, bound together by a shared vision and an unwavering belief in justice and fairness.”

“We also know what transpired whilst we were building our Edo Cement Plant. Everyone knows the issues we faced. The plant we are operating in Edo would not have been operating and contributing immensely to the economy, if not for the former President Buhari who had to intervene by calling Governor Obaseki that no staff must lose their jobs and the plant must not be shut down, no matter what happens.”

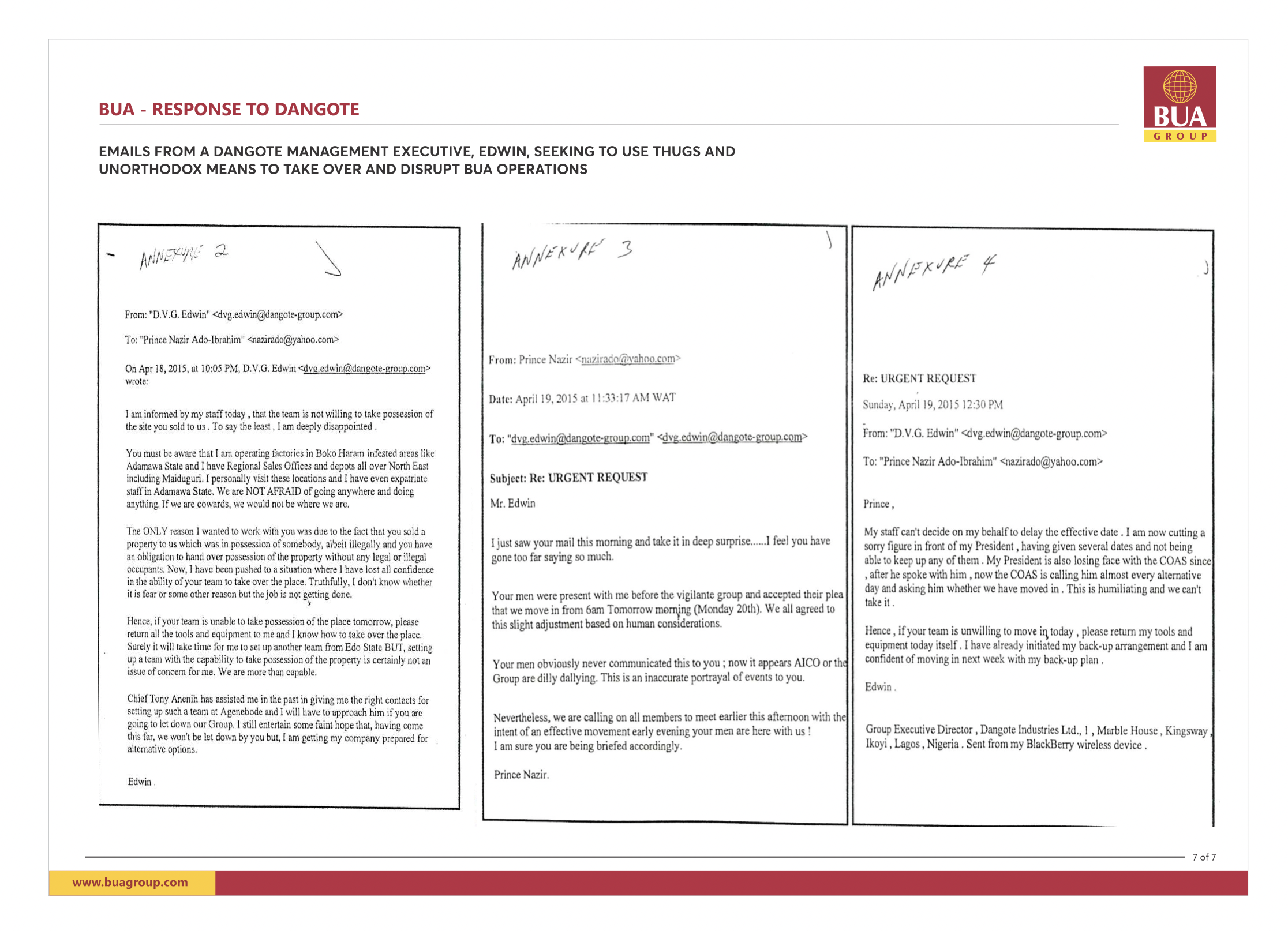

“We cannot say more as the matter is currently sub-judice – and is at the Supreme Court. During that time, Edwin Devakumar and Sunday Esan (two long-time and current staff of Dangote) were caught in leaked emails, whose content were not limited to sending thugs to foment trouble, close our factory as well as pushing bad press against us (See emails attached).”

“Same thing happened again with our Port Harcourt sugar refinery – the only sugar refinery in Nigeria that is outside Lagos. Dangote utilized every means possible to ensure the refinery did not take off and we raised the alarm. At some point, the terminal was taken away from us and was to have been given to someone else at the behest of Dangote. There had to be a presidential intervention again for NPA to do the right thing. Yet, we survived.”

“For over 32 years, we have been cast as the antagonists in a narrative woven with malice. We have not just survived; we have thrived, expanding our operations and contributing to Nigeria’s economy without resorting to subterfuge.”

“To Mr. Dangote and the Dangote Group, we say: Let us build, not belittle. Let us cultivate, not conquer. While we may share the marketplace, we need not share malice. We have nothing to do with your self-inflicted issues. Blame no one but yourself.”

“In closing, we at BUA remain committed to our ethos of innovation, integrity, and inclusiveness. Our history is not one of being handed anything on a silver platter. We will continue to serve our beloved country and its people with the diligence and honor they deserve. Our past, present, and future activities are rooted in the prosperity of Nigeria, undeterred by the winds of unfounded criticism. We remain focused on building and developing Nigeria.”

Like this:

Like Loading...