Crypto markets are heating up once again, and investors are flocking toward coins that show the potential to deliver strong gains in the upcoming bull run. Dogecoin (DOGE) and Solana (SOL) are leading the pack of established altcoins with exciting projections—DOGE’s long-awaited push toward $2 and Solana’s bullish path to $500 are fueling optimism across the market.

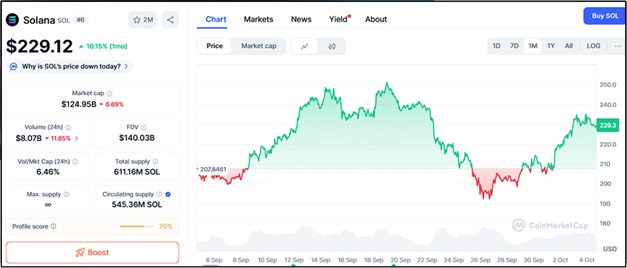

Yet, amid this excitement, one emerging project is drawing even greater attention: Ozak AI (OZ). Currently in Stage 5 of its presale at $0.01, having raised over $3.5 million and sold more than 930 million tokens, Ozak AI is predicted by analysts to hit $1 post-launch, implying a potential 100x surge that even Solana and Dogecoin can’t match.

Dogecoin’s $2 Dream Remains Alive

The original meme coin, Dogecoin, continues to surprise skeptics. Despite its humble beginnings as a joke, DOGE has built a massive global community and remains a cornerstone of the meme-coin market. Currently trading at $0.25, Dogecoin’s loyal holders are once again setting their sights on the long-held dream of reaching $2.

Resistance levels: $0.35, $0.75, $2.00

Support levels: $0.22, $0.20, $0.15

Elon Musk’s continued references to Dogecoin, along with the integration of DOGE payments in certain online platforms, have maintained the coin’s cultural momentum. Analysts suggest that if institutional attention returns to meme coins, DOGE could surge nearly 8x to $2 during the next bull phase. However, even this impressive projection doesn’t compare to Ozak AI’s presale potential, which offers exponential early-stage upside.

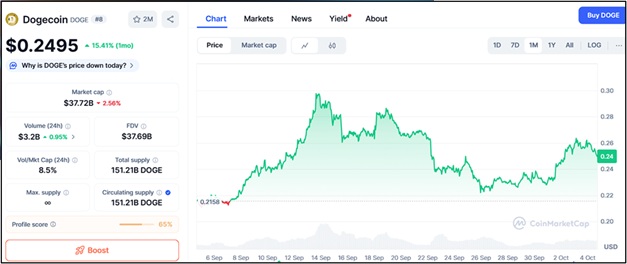

Solana’s $500 Path Strengthens Its Legacy

Solana (SOL) has been one of the biggest comeback stories in recent years. After its technical and network challenges in previous cycles, Solana has rebounded spectacularly and now ranks among the top-performing blockchains in terms of developer activity and on-chain volume. Currently priced around $230, Solana is enjoying renewed investor confidence as DeFi, NFTs, and AI-based dApps continue to migrate to its ecosystem.

Resistance levels: $250, $350, $500

Support levels: $210, $180, $160

With increasing institutional adoption and continued improvements to speed and efficiency, analysts expect SOL to climb as high as $500 by 2025. That would represent more than a 2x increase, making it a strong blue-chip play. Still, for those seeking high-risk, high-reward potential, Solana’s growth rate looks modest compared to what Ozak AI might achieve from its low presale valuation.

Ozak AI: The Next 100x Project

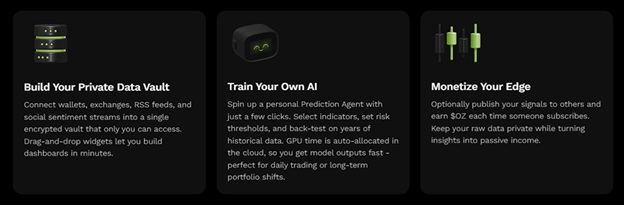

While DOGE and SOL represent maturity and stability within their respective niches, Ozak AI is emerging as the bold new disruptor in the fusion of artificial intelligence and blockchain. The project is building a predictive ecosystem that uses AI models to analyze market data, forecast trends, and enhance decision-making for traders and investors.

At the heart of Ozak AI lies an advanced architecture integrating Arbitrum Orbit for scalable smart contracts, EigenLayer AVS for decentralized validation, and the Ozak Stream Network (OSN) for real-time data ingestion and processing. These systems work together to deliver high-speed predictive analytics that could reshape how investors approach trading.

Stage 5 Presale Momentum Surpasses Expectations

Ozak AI’s Stage 5 presale has become one of the fastest-growing in 2025. With over $3.5 million raised and 930 million tokens sold, the project has established strong credibility in a market saturated with short-lived presales. At just $0.01 per token, Ozak AI offers investors the rare opportunity to enter before major exchange listings, with analysts forecasting potential launch prices as high as $1.

If achieved, this would deliver a 100x ROI, making Ozak AI one of the most profitable OZ presale investments in recent years. The project’s innovative approach, combined with its strategic partnerships and verified audits, has positioned it as a serious contender among AI and DeFi projects.

Verified, Audited, and Built for Growth

Unlike many speculative tokens, Ozak AI has already taken major steps toward establishing investor trust. The project has completed both a CertiK audit and an internal audit, ensuring smart contract safety and transparency.

It’s also listed on CoinMarketCap and CoinGecko, giving it public visibility even before its official token launch. Beyond this, Ozak AI’s partnerships with Dex3, Hive Intel, and SINT expand its ecosystem’s functionality — bringing together predictive trading, blockchain intelligence, and AI-driven automation.

Why Ozak AI’s 100x Outlook Dominates

Comparing the potential returns paints a clear picture: Dogecoin’s optimistic 8x move to $2 and Solana’s 2x jump to $500 look promising but limited when stacked against Ozak AI’s potential 100x run. The project’s combination of AI-driven utility, rapid presale traction, verified audits, and strategic partnerships gives it an edge few presale tokens achieve.

Moreover, Ozak AI’s alignment with the booming global AI market — projected to exceed $1 trillion by 2030 — gives it both relevance and scalability far beyond meme or Layer-1 narratives.

Dogecoin’s $2 target and Solana’s $500 projection highlight the bullish sentiment driving the 2025 crypto cycle. Yet, Ozak AI’s Stage 5 presale, priced at $0.01, with $3.5M raised and 930M tokens sold, stands in a league of its own. With a 100x forecast, cutting-edge AI infrastructure, and credible audits, Ozak AI is emerging as the next-generation crypto disruptor. For investors looking beyond established giants, Ozak AI offers not just the potential for massive returns—but a front-row seat to the evolution of AI-integrated finance.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi