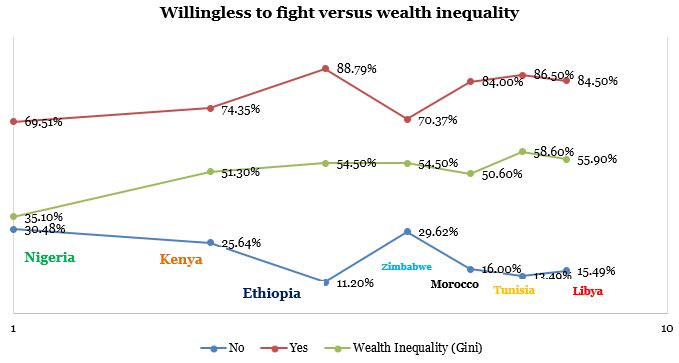

Across the African continent, a striking and resilient spirit is emerging—a spirit that refuses to be overshadowed by the growing chasm of wealth inequality. Recent studies, such as the World Values Survey conducted between 2017 and 2022, have revealed a fascinating trend: despite the economic disparities plaguing their nations, Africans are demonstrating a strong willingness to defend their countries when called upon. This growing interest in patriotism and unity in the face of adversity is not only a testament to Africa’s unwavering strength but also a beacon of hope for the continent’s future.

The Wealth Inequality Challenge

It is no secret that wealth inequality is a pressing issue in many African nations. Disparities in income and access to resources have persistently plagued the continent, often deepening divisions among its people. While the reasons behind this inequality are complex and multifaceted, one might expect such economic disparities to erode the social fabric and undermine national unity. However, the reality is quite the opposite.

A Willingness to Fight

In the midst of these economic challenges, Africans are displaying a remarkable readiness to defend their countries. The World Values Survey revealed that citizens from countries like Nigeria, Kenya, Ethiopia, Zimbabwe, Tunisia, and Libya are, on average, over 60% willing to take up arms for the sake of their homeland. This statistic is not a mere numerical figure; it embodies a profound commitment to preserving the sovereignty and unity of their nations.

The Nigerian Paradigm

Nigeria, one of Africa’s most populous and economically diverse nations, stands out as a prime example of this phenomenon. Despite significant wealth inequality within its borders, Nigeria consistently demonstrates a high level of willingness among its citizens to protect their homeland. This readiness to fight is a testament to the deep-rooted sense of national pride and unity that transcends economic disparities.

Unity in Diversity

The African continent is often celebrated for its rich cultural diversity, a tapestry woven together by myriad languages, traditions, and histories. In the face of wealth inequality, this diversity becomes a source of strength rather than division. Africans are showcasing that their commitment to their nations transcends ethnic, linguistic, and regional boundaries.

The North African Story

Even in the North African countries of Tunisia, Morocco, Libya, and Ethiopia, where wealth inequality was notably high according to 2019 measurements, the spirit of unity remains unwavering. The citizens of these nations are ready to stand shoulder to shoulder in defence of their countries, reflecting a shared determination to protect the sovereignty they hold dear.

Hope for the Future

Africa’s growing interest in patriotism and its readiness to fight for the nation in the face of wealth inequality offers a glimmer of hope. It underscores the continent’s resilience and determination to overcome obstacles that have persisted for generations. This trend is a reminder that economic challenges, while significant, cannot extinguish the flame of national pride and unity.

Harnessing the Spirit of Unity

As Africa moves forward, it must harness this spirit of unity and willingness to defend the nation. Governments, civil society organizations, and international partners can play a crucial role in addressing wealth inequality and creating economic opportunities for all citizens. By reducing disparities and ensuring that the benefits of growth are shared equitably, Africa can build a more prosperous and harmonious future.

In the face of growing wealth inequality, Africans’ willingness to fight for the nation is a compelling narrative of resilience and unity. It showcases a determination to protect the sovereignty and unity of countries across the continent. This growing interest in patriotism serves as a beacon of hope, reminding us that even in the face of economic challenges, the spirit of unity can prevail. As Africa moves forward, it must harness this spirit to build a brighter and more equitable future for all its citizens.