In a world rapidly advancing through innovation and technological prowess, Nigeria stands at a crucial crossroads. The nation’s innovation landscape, as revealed through rigorous analysis, reflects a concerning decline in recent years. As we delve into the intricacies of this trend, we unearth both challenges and opportunities that demand the immediate attention and collaborative efforts of policymakers, new political appointees, and innovators alike.

Understanding the Innovation Ecosystem

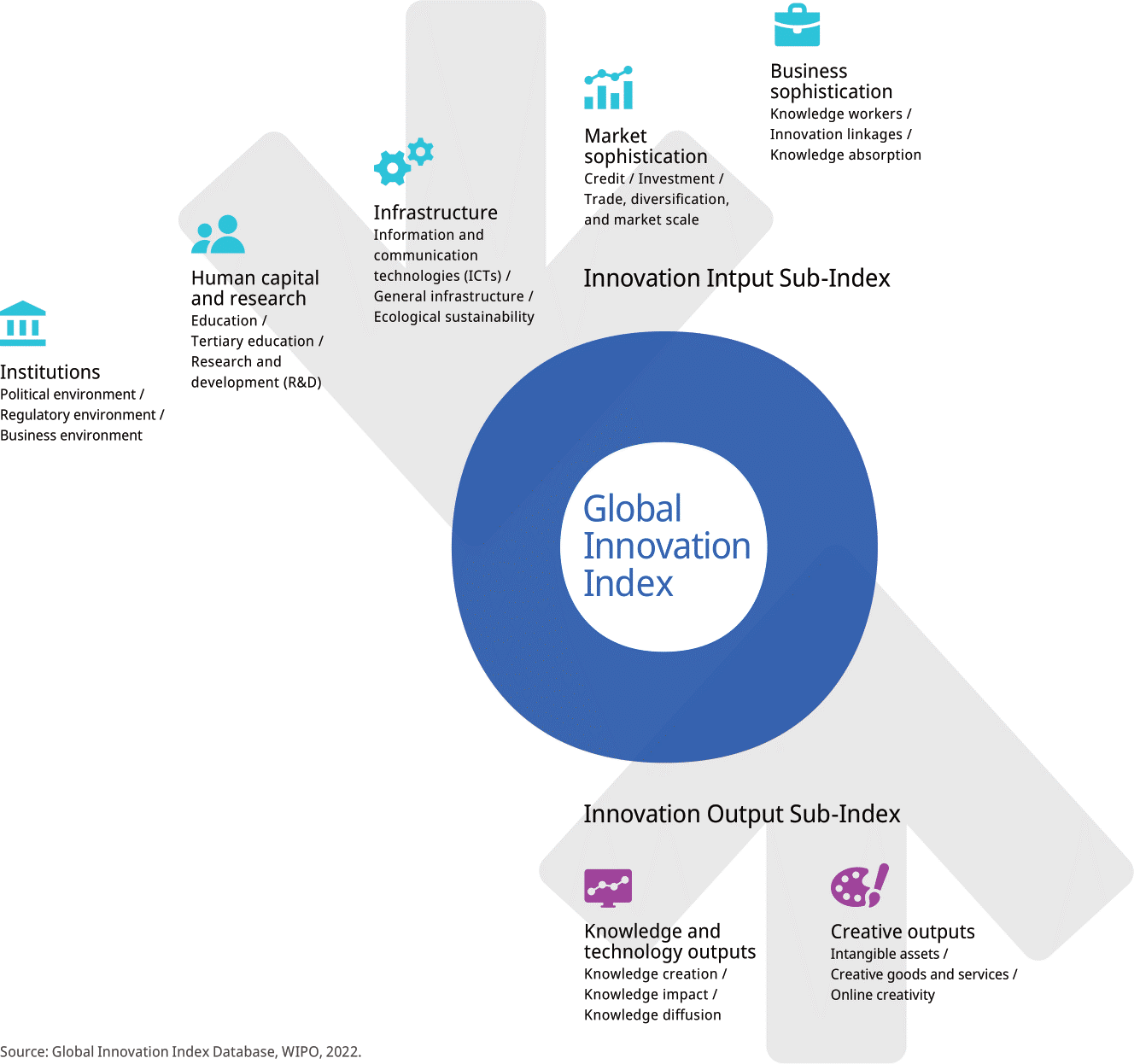

At the heart of this analysis lies the correlation between innovation inputs and outputs. The components of innovation inputs include institutions, human capital and research, infrastructure, market sophistication, and business sophistication. These factors are the foundational pillars upon which a thriving innovation ecosystem is built. However, from 2013 to 2022, a disconcerting trend emerged – innovation inputs demonstrated a negative impact on innovation outputs.

This correlation, while perplexing, serves as a wake-up call for Nigeria’s decision-makers. As we dissect the data further, a startling revelation surfaces: each unit increase in innovation inputs led to a staggering 62.4% reduction in innovation outputs during these years. It’s an alarm bell that demands immediate attention and recalibration of our nation’s approach to innovation.

The Struggle for Innovation Outputs

Despite the discouraging connection between inputs and outputs, Nigeria’s concerted efforts in innovation inputs, as assessed by prestigious institutions like the World Intellectual Property Organization, only yielded a mere 39% realization of the indicators considered for innovation outputs. This disparity underscores a critical discrepancy – the need for a more harmonized, holistic approach to innovation that bridges the gap between aspiration and execution.

The Ripple Effect on Economic Growth

Innovation isn’t just a buzzword; it’s a cornerstone of sustainable economic growth. The analysis reveals a significant ripple effect that innovation outputs – which encompass knowledge, technology, and creativity – exert on Nigeria’s GDP per capita. Shockingly, a single unit increase in innovation outputs corresponds to a reduction of over 74% in GDP per capita growth in constant terms, and over 20% in current terms, when measured in US dollars. This tangible impact highlights the inextricable link between innovation and the prosperity of our nation’s citizens.

Breaking Down the Components

To resuscitate Nigeria’s ailing innovation outcomes, a comprehensive understanding of the components involved is essential. The institutions that shape our political, regulatory, and business environment, along with the development of human capital through primary and tertiary education, hold the key to nurturing a fertile ground for innovation. Infrastructure, ranging from information and communication technologies to general infrastructure and ecological sustainability, must be optimized to foster innovation.

Market sophistication, encompassing aspects like credit, investment, trade, competition, and market scale, must evolve to provide innovators with the conducive environment they need. Business sophistication, the realm of knowledge workers, innovation linkages, impact, and absorption, has the power to transform ideas into reality.

Charting a New Path

To revive Nigeria’s stifled innovation outcomes, policymakers, new political appointees, and innovators must join hands in a united effort. The first step lies in dismantling the negative correlation between innovation inputs and outputs. This can be achieved through strategic investment in institutions, robust education systems, futuristic infrastructure, and dynamic market mechanisms.

Moreover, the innovation ecosystem requires a holistic overhaul. Aligning policies to incentivize businesses to invest in research and development, fostering collaboration between academia and industries, and cultivating an atmosphere of creativity are pivotal steps toward unleashing Nigeria’s latent innovative potential.

In the face of challenges, great opportunities await. The analysis provides a clarion call to policymakers, new political appointees, and innovators to take the reins of Nigeria’s innovation journey. By reimagining the nexus between inputs and outputs, and by fostering an ecosystem that nurtures creativity and technology, we can embark on a trajectory of innovation-led growth. The road ahead is challenging, but the potential for Nigeria to emerge as a global innovation powerhouse is boundless. Now is the time for decisive action, collaboration, and an unwavering commitment to reviving Nigeria’s stifled innovation outcomes.