Polytechnics are typically centers of higher education specialised in science and technology-based academic courses, making them qualify as specialised manpower production centers.

This article will be focused on how to set up a privately-owned polytechnic in Nigeria, with a focus on the topics of :-

– The regulatory framework governing polytechnics in Nigeria

– Who can own/set-up a private polytechnic in Nigeria

– The requirements for setting up a private polytechnic in Nigeria

– The procedures involved in setting up a private polytechnic in Nigeria

Who can own a polytechnic in Nigeria?

A polytechnic in Nigeria can be set up or/and owned by :-

– The federal government as well as a state or local government

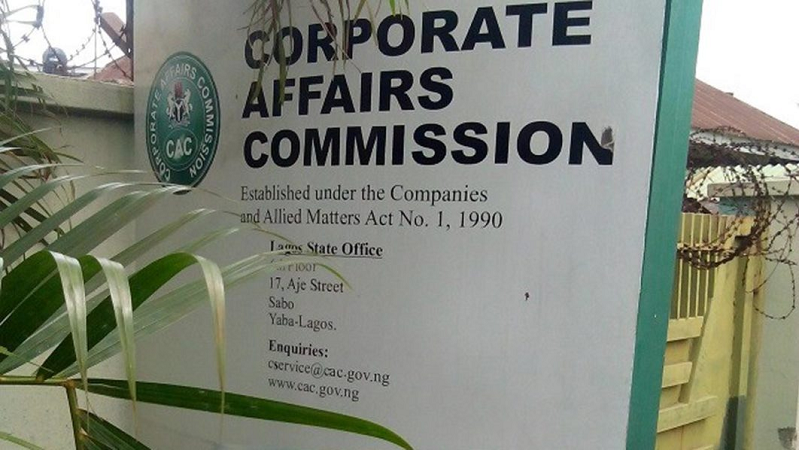

– A company registered in Nigeria

– An individual or association of individuals who are citizens of Nigeria and who satisfy the criteria set out by the relevant regulations.

Which regulatory agency is in charge of licensing private universities in Nigeria?

Polytechnics are Nigeria are licensed by the National Board For Technical Education (NBTE).

What are the requirements for setting up a licensed private university in Nigeria?

The requirements for setting up a private polytechnic in Nigeria are :-

– A completed application form and application letter (preferably through legal counsel)

– A master plan

– An academic plan

– A needs assessment/feasibility survey

– A bank guarantee of 100 Million Naira minimum

– A Certificate of Occupancy (C of O) in the name of the institution. The site of the proposed polytechnic should be at least 5 (Five) hectares

– A financial plan

What are the regulatory procedures involved in licensing a polytechnic?

The procedural steps involved in licensing a polytechnic are as follows:-

Submission of Licensing Application

– This should be done by the proprietor of the proposed institution through a lawyer and should be followed by submission of application forms and the obtaining of relevant guidelines from the polytechnic/monotechnic programmes departments of the NBTE.

Analysis of Licensing Application & Inspection Visit

– The completed forms and attached documents are analysed by the NBTE

– A team of NBTE specialists visit the site of the proposed institution to confirm the correctness of the submissions made by the proprietor. This team shall pay particular attention to :-

a).The proposed curriculum of the institution

b). The physical teaching and accommodation facilities – offices, classrooms, workshops, farms, laboratories, studios and libraries as appropriate for the proposed programmes to be offered by the institution, their adequacy for size of classes proposed, environment and the complement of equipment required.

c). The adequacy of financial resources to support capital and recurrent expenditure

d). Availability of human resources – administrative, teaching and support staff in quality, number and mix (?) for the programmes to be mounted in the first and second years of existence of the institution

e). The institution’s library – well-furnished and stocked with book and non-book items for the proposed programmes of a size adequate to accommodate its readership

f). Availability of regular water and power supplies and provisions for gas in the case of science, engineering and other technology-based programmes.

Post-Visit NBTE Recommendations

– The report of the inspection shall be considered by the NBTE along with the completed application forms in relation to meeting the provisions of the Education Act.

– The recommendation of the management is then submitted to the board for consideration and recommendation to the minister of education to approve the establishment of the institution.

NBTE’s Action on the Minister’s Decision

– Where the NBTE is satisfied that the institution has not met the conditions for approval, it shall inform the proprietor to carry out such required remedial actions before the institution is recommended to the Minister of Education for approval.

– The NBTE shall inform the proprietor of the decision of the Minister of Education where the application is unsuccessful. The letter to the proprietor shall state reasons for denying approval of the licensing application.

Can a polytechnic licensing application be resent after being initially rejected?

Yes it can after making sure that all deficiencies and errors highlighted in the earlier rejected application have been corrected.

What are the requirements for academic programme accreditation or mounting by the NBTE?

Any programme offered by a polytechnic or monotechnic which leads to the award of an Ordinary National Diploma (OND) or Higher National Diploma (HND) must be accredited before making the award. This award consists of 2 stages which are :-

a). An approval to mount the programme

b). Full accreditation

To mount a new programme, an application (preferably through legal counsel) must be made to the NBTE showing :-

– A justification for the proposed programme

– Evidence of demand for manpower in the discipline of proposed programme in the country and in the world

– Statistics on the availability of students for the programme

– Evidence of availability of physical resources for the proposed programme.