UnionPay, the gigantic Chinese payment company, has overtaken Visa on the global debit card market, commanding 40.03% in 2022, with Visa 38.8%, on settlement volume of $16.227 trillion and $14.109 trillion respectively. A decade ago, Visa held 80% of the market while UnionPay was just around 1-2%. The country called China has bulldozed itself into the center of the world economy in many domains.

The Report

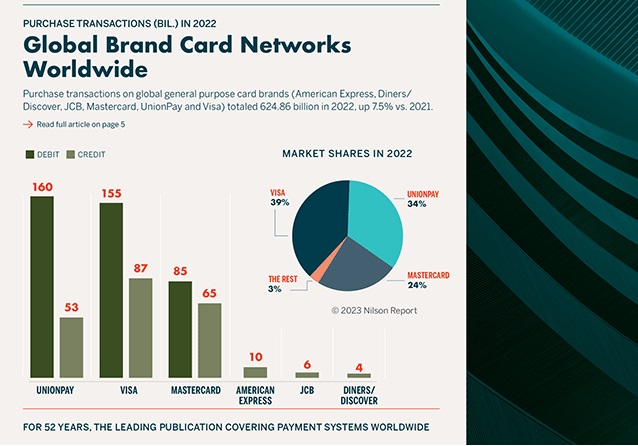

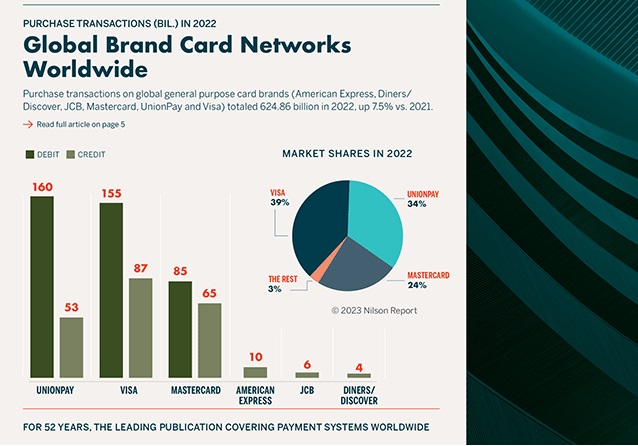

Credit, debit and prepaid cards carrying the brands of Visa, UnionPay, Mastercard, American Express, JCB and Diners Club/Discover—the global card networks—generated a combined 624.86 billion purchase transactions worldwide for goods and services in 2022, up 7.5% over 2021. Consumer, small business and commercial card products are included in those purchase transactions. All debit card figures mentioned in the text and used in the charts and tables on this page and pages 6, 7 and 8 include prepaid cards.

Of all global network purchase transactions worldwide in 2022, Visa brand credit and debit cards generated a 38.76% market share. This was a decline of 10 basis points (bps) from 38.86% in 2021. Visa credit cards generated 38.73% of credit card purchase transactions, an increase of 121 bps. Visa’s share of debit card transactions was 38.78%, down 82 bps.

UnionPay credit and debit cards accounted for a 34.04% share of global network purchase transactions, a slip of 4 bps from 2021. Debit cards with the UnionPay brand held a market share of 40.03% of all debit card purchase transactions, an increase of 139 bps. The market share for UnionPay credit cards among all credit card purchase transactions was 23.45%, a decrease of 230 bps.

Credit and debit cards with the Mastercard brand held a 24.00% market share of all global network purchase transactions worldwide, down 11 bps from 2021. Debit cards with the Mastercard brand held a 21.19% share of all debit card purchase transactions, a decline of 57 bps. Mastercard brand credit cards had a 28.97% share of all credit card purchase transactions, up 56 bps.

American Express credit card purchase transactions had a 4.61% market share of all global network credit products in 2022, up 37 bps from 2021. JCB cards had a 2.53% share, up 12 bps. Diners Club/Discover cards had a 1.72% share, up 4 bps.

Debit cards accounted for 63.88% of total purchase transactions on the global networks in 2022. This was a decline of 78 bps from 2021. For Visa, debit card purchase transactions were 63.91% of the network’s worldwide total, down 198 bps. UnionPay purchase transactions were 75.12% debit, an increase of 182 bps. Mastercard purchase transactions were 56.40% debit, a drop of 196 bps.

Total volume—purchases of goods and services combined with cash advances and withdrawals—was $40.645 trillion in 2022, a local percentage increase of 4.4% over 2021. Visa and Mastercard cards combined accounted for 54.83% of total volume, an increase of 283 bps. UnionPay cards generated 39.93%, a decline of 357 bps. American Express, JCB and Diners/Discover accounted for 5.24%, up 75 bps.

Debit card purchase volume, which excludes debit card cash withdrawals, tied to UnionPay, Visa and Mastercard cards reached $16.711 trillion in 2022. This was up 1.2% from 2021. Credit card purchase volume for all network brands, which excludes credit card cash advances, reached $19.462 trillion, up 8.7% from 2021.

When comparing worldwide purchase volume—spending for goods and services—by product type, UnionPay debit cards had the largest market share for the 10th consecutive year. The second-largest product based on 2022 purchase volume was UnionPay credit cards, followed by Visa credit cards (which overtook Visa debit cards), Mastercard credit cards, Mastercard debit cards, American Express credit cards, JCB credit cards and Diners Club/Discover credit cards.

UnionPay cards accounted for $44 of every $100 in purchase volume handled by the global networks. This was down from $48 in 2021. Mastercard and Visa combined accounted for $50 of every $100, up from $47 in 2021. Visa cards accounted for $32 of every $100. Mastercard cards accounted for $18 of every $100.

On the Visa global network, credit cards accounted for 50.40% of its credit and debit card purchase volume, an increase of 248 bps from 2021. Credit cards accounted for 56.63% of Mastercard’s global purchase volume for all products, an increase of 104 bps. On the UnionPay global network, credit cards accounted for 49.02% of its credit and debit purchase volume, an increase of 61 bps.

When measuring only credit card purchase volume for all global networks, UnionPay held a 39.91% market share, a drop of 487 bps versus 2021. Visa credit cards held a 30.22% share, an increase of 218 bps. Mastercard’s credit card share grew 154 bps to 19.11%. American Express’s share grew 98 bps to 7.92%. JCB’s share was up 7 bps to 1.60% and Diners Club/Discover’s share was up 9 bps to 1.25%.

When measuring only debit card purchase volume, UnionPay’s market share fell 342 bps to 48.33%. Visa’s share increased 160 bps to 34.63% and Mastercard’s share grew 182 bps to 17.04%.

Cash withdrawals using debit cards plus cash advances using credit cards reached $4.471 trillion in 2022. This was 11.00% of total global network volume. In 2021, that figure was 11.64%.

Global network brand credit, debit and prepaid cards in circulation reached 16.72 billion at the end of 2022, up 4.2% from 2021. Of the global total, UnionPay cards accounted for 56.49%, down 101 bps from 2021. Visa cards held a 25.09% share, up 76 bps. Mastercard cards held a 16.23% share, up 12 bps. JCB’s share was 0.91%, up 2 bps. American Express’s share was 0.80%, up 4 bps, and Diners Club/Discover’s share was 0.48%, up 6 bps.

Visa, Mastercard, American Express and Discover credit cards issued in the US generated $5.451 trillion in purchase volume in 2022, an increase of 19.5%. US credit cards accounted for 28.01% of all global network credit card purchase volume.

Their market share grew 252 bps over 2021. Purchase volume tied to credit cards issued outside the US increased 5.1% to $14.012 trillion.

Mastercard credit card purchase volume generated by cards issued in the US grew 21.8% to $1.320 trillion. Outside the US, purchase volume on Mastercard credit cards increased 16.4% to $2.399 trillion. Visa purchase volume from credit cards issued in the US reached $2.840 trillion, an increase of 18.2%. Outside the US, credit card purchase volume tied to Visa cards grew to $3.041 trillion, an increase of 16.3%. American Express purchase volume generated by US credit cards reached $1.080 trillion, an increase of 20.9%. Amex credit cards issued outside the US increased 32.6% to $460.39 billion.

Purchase volume on Visa and Mastercard debit cards issued outside the US was $4.526 trillion, an increase of 11.3% over 2021. Purchase volume on debit cards issued in the US reached $4.109 trillion, up 5.4%.

Mastercard purchase volume tied to debit cards issued outside the US grew 21.6% to $1.728 trillion. Purchase volume on Mastercard debit cards issued in the US increased 2.6% to $1.120 trillion. Visa purchase volume tied to debit cards issued in the US grew 6.5% to $2.989 trillion. Outside the US, Visa debit card purchase volume grew 5.7% to $2.798 trillion.

Purchase transactions initiated by Visa credit cards issued in the US increased to 31.25 billion, up 14.1%. Outside the US, Visa credit card purchase transactions grew to 56.17 billion, up 13.0%. Debit card purchase transactions tied to Visa cards issued in the US were up 5.7% to 60.78 billion. Outside the US, Visa debit card purchase transactions reached 94.03 billion, up 2.9%.

Credit card purchase transactions tied to Mastercard cards issued in the US totaled 14.02 billion, an increase of 18.3%. Outside the US, Mastercard credit card purchase transactions grew to 51.37 billion, up 10.4%. Debit card purchase transactions initiated by Mastercard cards issued in the US were up 0.2% to 23.26 billion. Outside the US, Mastercard debit card purchase transactions reached 61.32 billion, up 4.7%.

Like this:

Like Loading...