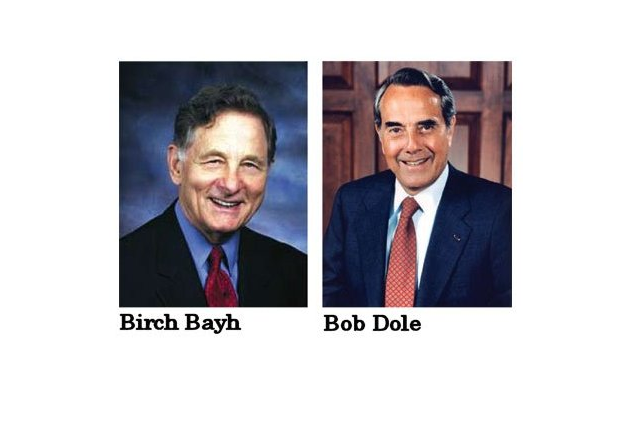

The Bayh-Dole Act is arguably the most important business legislation of the last few decades in the United States. It made it possible for government-funded research to be commercialized by individuals and entities. In other words, in the past, after great discoveries, only government entities were expected to commercialize the outcomes. But when this Act came, the researchers could under license take those outcomes to the market.

Without Bayh-Dole, there will be no Google, Akamai and a host of many companies, which began life in university labs, funded by the US government.

For Africa, our challenge is not just doing quality research. But also, finding a mechanism to commercialize the little we have done. The US reduced the barriers, and companies can go to US patent libraries, discover great ideas and then push to commercialize them. The outcome: you do not leave great ideas on shelves; you take them to markets where people and companies can buy products created out of them. My PhD thesis was a beneficiary as the US government saw it, and paid to use the idea out of it.

Indeed, Africa can learn from the Bayh-Dole Act especially now the nations are trying to emerge from the most devastating global recession since the Second World War, with policymakers, business communities, academia, and governments looking at ways to accelerate growth and competitiveness. Governments matter and a single legislation could have impacts that can redesign a nation’s economic destiny. Globalization makes it necessary that nations must compete not just on technologies, but on policies upon which those technologies are developed and commercialized. It is the policy that makes it possible that two universities in two separate countries can develop similar technologies with one creating Fortune 500 companies within a decade and another having the idea locked up in a cabinet. So the policies or legislations made by our parliaments on what happens to inventions funded with public money matter.

Comment on Feed

Comment 1: I did a quick Google search after reading this and found out that the Nigerian government approved N4.7b research grant for academics.

Do you have any idea if the academicians or affiliated institutions can commercialise their works?

My Response: Since Nigeria has no system, any professor can commercialize government-funded research provided you are not very successful in the market. But if that idea becomes very successful, and it can be linked to a government grant, you may have a legal matter to deal with in that university/government.

I will not fund any professor’s idea, coming out of a government grant, unless we see a written document from the minister of science/tech (for federal) or commissioner (for state school), granting rights as appropriate, in Nigeria. But in South Africa, I do not have that problem as they’ve created an equivalent and unambiguous Bayh-Dole clone which removes any future expropriation risk.