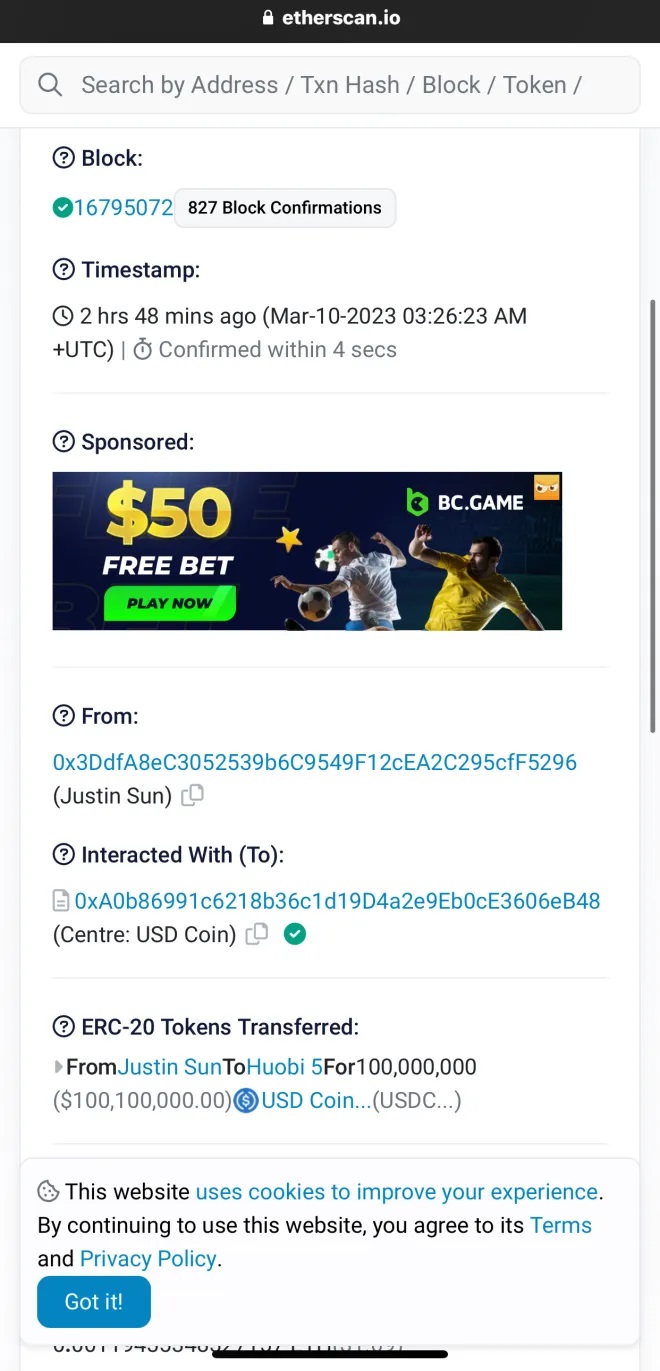

A savvy crypto coder has transformed $71 into $1.59 million in an instant through a new Ethereum-Arbitrum lending platform. According to the on-chain analysis firm Looksonchain, an ethical white hat hacker discovered and leveraged a major vulnerability in the borrowing and lending protocol Tender.fi (TND).

Due to the misconfigured oracle of https://t.co/Hw715UqCeV, a white hat "0x896d" borrowed ~$1.59M assets by depositing only 1 $GMX($71).

If you have deposited assets on https://t.co/Hw715UqCeV, please pay attention!https://t.co/XO3yQHwk3M pic.twitter.com/G96h2EC0Fm

— Lookonchain (@lookonchain) March 7, 2023

Due to the misconfigured oracle of Tender.fi, a white hat “0x896d” borrowed ~$1.59 million in assets by depositing only 1 GMX ($71). If you have deposited assets on Tender.fi, please pay attention

Tender.fi is a platform built on the Ethereum scaling solution Arbitrum, its designed to let investors collateralize the crypto assets GMX and GLP.

The hacker – who by definition is not malicious and will alert Tender.fi to their vulnerability and return the funds – appears to have caused a precipitous drop in the price of the protocol’s native crypto asset, TND. TND has dropped 16% in the last 24-hours, trading at $2.45 at time of publishing.

Dogecoin Surpasses Polygon Matic in TVL

According to market data, Dogecoin currently has a market capitalization of $9.45 billion, while MATIC has a market capitalization of $9.3 billion, making these the eighth and ninth largest digital assets by the metric, Behind Cardano ($ADA) and ahead of Solana ($SOL).

Dogecoin surpassed MATIC after the latter saw a flurry of whale transactions moving over 30 million tokens to leading cryptocurrency exchange Binance, with the community believing the funds were then sold off on exchanges as a result.

9,000,000 MATIC (9,532,573 USD) transferred from unknown wallet to Binance Exchange

— Whale Alert (@whale_alert) March 9, 2023.

Dogecoin has, meanwhile, seen a significant whale wallet accumulate millions of tokens, to the point they are now the 20th largest wallet on the cryptocurrency’s blockchain, with over 700 million DOGE.

The whale’s accumulation was first spotted by blockchain monitoring resource Lookonchain, which pointed out on the microblogging platform Twitter that the whale first added 200 million $DOGE, worth around $39 million to their wallet, before adding 250 million, worth $63 million after a price surge, the following day.

Moreover Coins.ph, a popular cryptocurrency exchange in the Philippines, recently announced that it would be adding support for Dogecoin. The cryptocurrency has in recent years gained popularity due to support from billionaires such as Elon Musk. Dogecoin was created in 2013 as a “fun and friendly internet currency” and features a Shiba Inu as its mascot.

As CryptoGlobe reported, Polygon added 46 million new addresses to its network over just six months while the price of its native token, used to pay for transaction fees and secure the network via staking, kept on outperforming the wider crypto market over the cycle.

Polygon is set to launch the beta version of its zkEVM mainnet, a scaling solution that utilizes zero-knowledge proofs to facilitate smart contracts compatible with Ethereum, on March 27.

The team behind Polygon says that zkEVM can support up to 100 times more transactions per second than Ethereum, all while maintaining decentralization and security. Additionally, Polygon has unveiled a $100 million grant initiative aimed at incentivizing developers to construct applications on the zkEVM platform.