As people continue to make sense of the collapse of startup-focused lender Silicon Valley Bank (SVB), U.S. Treasury Secretary Janet Yellen has recently disclosed that the U.S. government will not in any way bail out the bank.

She added that the government is more concerned about depositors and is focused on trying to meet their needs.

In her words,

“Let me be clear that during the financial crisis, there were investors and owners of systemic large banks that were bailed out, and the reforms that have been put in place mean that we are not going to do that again. But we are concerned about depositors and are focused on trying to meet their needs”.

Yellen’s comment is coming after several investors called on the U.S. government to step in after the Silicon Valley bank witnessed a financial implosion. Venture capitalist and former tech CEO David Sacks had called on the government to push another bank to buy SVB’s assets.

While responding to a tweet with the heading “Treasury and the fed cannot execute a bailout or force a bank merger on their own”. He tweeted, “where is Powell?, where is Yellen?, Stop this crisis now. Announce that all depositors will be safe. Place SVB with a top 4 bank. Do this before Monday opens or there will be contagion and the crisis will spread”.

Where is Powell? Where is Yellen? Stop this crisis NOW. Announce that all depositors will be safe. Place SVB with a Top 4 bank. Do this before Monday open or there will be contagion and the crisis will spread.

— David Sacks (@DavidSacks) March 10, 2023

Venture Capitalists investor Mark Muster agreed, he wrote, “I suspect this is what they are working on. I expect statements by Sunday. We will see. I hope so or Monday will be brutal”.

It is interesting to note that some U.S politicians opposed any bailout by the government with Rep. Matthew Louis Gaetz disclosing that if there is an effort to use taxpayer money to bail out Silicon Valley Bank, the American people can count on the fact that he will be there leading the fight against it.

Meanwhile, Investors are reportedly concerned that SVB collapse could lead to a lack of confidence in the banking sector, particularly mid-sized banks with under $250 billion in deposits. Benchmark investor Eric Vishria disclosed that if Silicon Valley Bank depositions are not made whole, then corporate boards will have to insist their companies use two or more of the big four banks which will crush smaller banks and make them too big to fail which may become a challenge.

Since the collapse of Silicon Valley Bank, reports disclose that financial regulators have taken over its deposits. According to press releases from regulators, the California Department of Financial protection and Innovation named the FDIC as the receiver.

The FDIC’s standard insurance covers up to $250,000 per depositor, per bank, for each account ownership category. The FDIC stated that uninsured depositors will get receivership certificates for their balances. The regulator said it will pay uninsured depositors an advanced dividend within the next week, with potential additional dividend payments as the regulator sells Silicon Valley Bank’s assets.

Whether depositors with more than $250,000 ultimately get all their money back will be determined by the amount of money the regulator gets as it sells Silicon Valley assets or if another bank takes ownership of the remaining assets.

The fallout of the Silicon Valley Bank collapse could be far-reaching. Startups may be faced with the challenge of paying salaries of employees in the coming days, venture investors may struggle to raise funds, and an already battered sector could face a deeper problem.

However, reports disclose that the FDIC could help startup companies with payroll in the case that there is a systemic risk exception, which could be an extraordinary procedure. SVB was a major bank for venture-backed companies which were already under pressure due to higher interest rates and a slowdown for initial public offerings (IPO) that made it more difficult to raise additional cash.

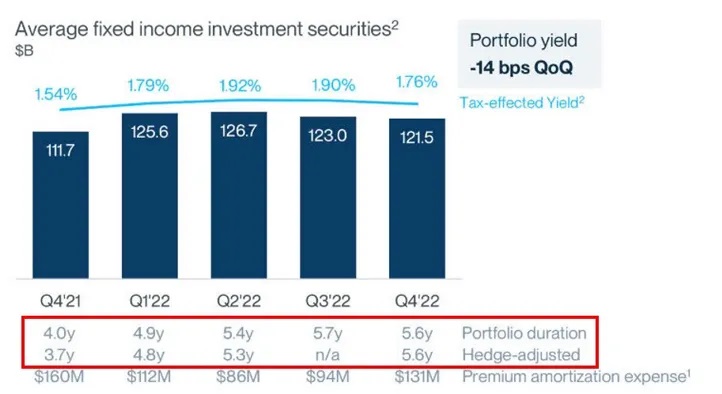

Silicon Valley Bank’s financial implosion began late Wednesday when it informed investors with the unpleasant news that it needed to raise $2.25 billion to shore up its balance sheet. This spurred customers to withdraw a staggering $42 billion of deposits by the end of Thursday.

The shares of the company fell 60% on Thursday and dropped another 60% in premarket trading on Friday before being halted. While many Wall Street analysts predict that the financial crisis of Silicon Valley Bank is unlikely to spread to the broader banking system, shares of the midsized and regional banks came under pressure on Friday.

American entrepreneur and venture capitalist Mark Suster believes that several bad actors in VC (venture capital) led to the collapse of Silicon Valley bank. He stated that he believes the biggest risk to startups AND VCs (and to SVB) would be a mass panic which would further compound more problems for the bank.

Within 48 hours, a panic induced by the very venture capital community that SVB had served and nurtured ended the bank’s 40-year run. Silicon Valley Bank’s failure is reported to be the largest since Washington Mutual went bust in 2008, a hallmark event that triggered a financial crisis that hobbled the economy for years.