I concluded in my last article on Silicon Valley Bank (SVB) that (1) the Federal Reserve of US should step in (2) cut rates and start a quantitative easing (QE) program (QE is a monetary policy where central banks spur economic activity by buying a range of financial assets in the market). I now stand to be corrected as I hold only my first conclusion. Yes, the Fed should step in but stay put on rates or hike slightly to continue to check inflation, which is on its way higher if a FUD takes place or a rate cut or QE happens.

Not to be alarmist but we’re in Armageddon and the end of an era of money. The current monetary and financial system cannot survive for long in the internet age where it takes 48 hours to tumble a bank and an economy.

Since all roads lead to inflation, the most important solution now is reducing the impact of the FUD, which is bound to happen regardless because everywhere is already heated up, except something miraculous happens. We actually need a miracle at this point, we need a break from all these uncertainties, I didn’t think I’ll be spending my early to mid-twenties under an economically repressive regime in Nigeria and my late twenties in a global economic meltdown.

The Fed should as a matter of urgency ensure that SVB continues operations as normal under a new entity, providing some level of relief to the market frenzy. If the frenzy is left unchecked, inflation will spiral out of control with increasing cash in circulation due to mass withdrawals, and the economy overheats and burst. Bailouts, especially for individuals, will also heat up the economy until there is a burst.

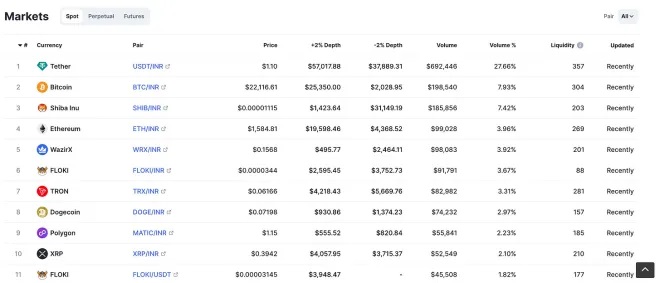

Let me add that a flight to treasuries will send bond prices higher and drop yields so hard that it will be more profitable to hold cash and spend, leading to inflation of course again. Many will argue about a flight to crypto or alternative assets but I don’t see that happening at least in the short term. It will be difficult to educate everyone in one year on the difference between custodial and noncustodial wallets.

The current inertia is crazy. We’re dealing with a loss of trust in everything we know about finance and money. Centralized crypto failed last year, and now the banking and fiat system. The only miracle now, which is highly unlikely, is that we don’t give into FUD and avoid triggering mass bank withdrawals, either way, we may have a crisis. The best bet as I mentioned is a hawkish Fed stance ~ hike rates even further or stay put. The Fed may also potentially ensure that there is enough liquidity in the banking sector to meet the withdrawal frenzy, which will increase system liquidity and inflation again. Inflation seems to be our nemesis in all of this. You fight it, you kill the economy, you allow it, you kill the economy.

The great reset is here

Now, this is where I rant. I saw a thread where founders were advised to cut costs and be in wartime mode, which is true. But it is very ridiculous that we went on a money-spending spree and jettisoned unit economics under the guise of high growth not minding the broader economic implications.

Crazy high valuations, oversized venture rounds, mismanaged funds, stupendous marketing budgets & CAC spending, excessive salaries pricing talent too high, now we can all rest and build more sustainable businesses. Startups and VCs also threw risk management out the door concentrating all their funds in single accounts. We will see less competition from too many businesses doing the same thing and racing to zero with revenue. I continue to expect more consolidations, faster exits, and the emergence of category kings.

Before I continue my rant, I’m now more curious about businesses that enable business models and individuals to manage and operate multiple bank accounts and wallets at the same time.

Now back to my rant; for banks like SVB, it’s even more annoying when you think about it. The concept of fractional reserve banking means that a bank doesn’t need to have all of its deposits readily available to meet withdrawals. They just need to have a portion and can chase yields by investing or creating loans. This may have worked in the pre-internet world, but in today’s world, it takes just 48 hours to crumble one of the world’s largest financial institutions by spreading information about insolvency.

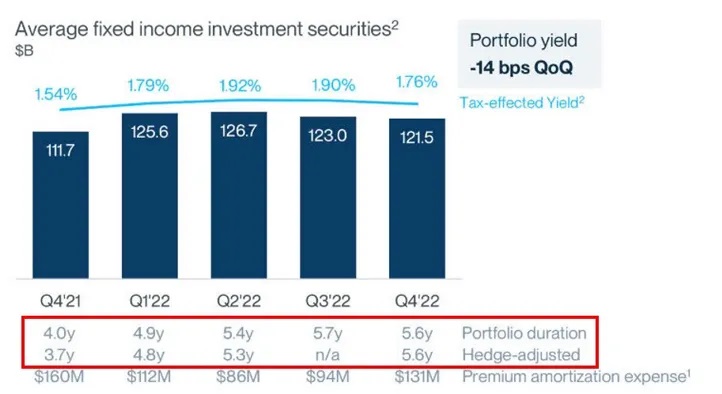

The chart below shows poor management of risk as SVB’s duration and interest rate risk were essentially the same, implying they didn’t even have any interest rate hedges on nearly $200B of assets.

For me, this is the end of an era of money, fractional reserve banking is dead at least without strict withdrawal limits, yield chasing is dead as demand for securities will drive prices up and lower yields, and everything we know about inflation and fighting it is also dead. Trust in the financial system and regulators guiding the economy is dead.

All of a sudden, we all agree on the need for regulation and institutions to save us from ourselves somehow; despite spending the better part of the last decade building innovation to replace regulation. I honestly think the age of regulation is also dead. I make it bold to say that the Fed has lost its control of the economy in the Information Age. I already highlighted in my last article about Fed’s role in the whole crisis by sending wrong signals to the market.

The new reality is until we embrace a new financial order, we will keep having these frequent boom and bust cycles in a much faster-paced world.

Final thoughts

I’m sorry to break the sad news, but we are in for a long haul, the next five years at least are set before us. I don’t see how we can escape a meltdown. Money and banking need to be fixed, or else we keep having frequent cycles of boom and burst. In a digital, more connected, and faster world, we could be seeing these cycles every three years, until we collectively rethink money. Perhaps, we may all eventually agree that crypto – “Internet money” is sound money and the future of money.

The best option is to start thinking of how to profit from the market. I have ideas.

I will be watching how things unfold over the next 6-9 months and if my postulations hold through, I’m going all in on the market.

With an equity-first strategy, I’d pick up blue-chip tech and non-tech stocks with strong cash flows and reserves at cheap prices in a couple of months. I’d also buy bitcoin and ethereum when they collapse. At least, we get a rare opportunity to start all over. Might be an actual wealth transfer as we get to invest at the bottom of the market.

One can also look out for breakout companies in AI, the future of work and money, with sound corporate governance. On fixed income, yields are dead, so lending especially venture debt to them with strict covenants may flourish.

Most importantly, swift rotation between cash and investment is important to win in these times. Same old buy low and sell high or wait for 20-30 years in hope of an innovation that truly advances human progress.

Be safe. Hope to write again soon.

Like this:

Like Loading...