Ordinal Bitcoin NFTs have two key features that distinguish them from others. Firstly, they are made up of on-chain data, meaning the actual image for the NFT is stored directly on the blockchain, rather than being linked to an external website like most NFTs on Ethereum.

This makes them unique and more secure, as the data cannot be lost or altered without affecting the blockchain itself. Eric Wall, a Swedish researcher and former Arcane Assets CIO, believes that storing fully on-chain NFTs is now seven times cheaper on Bitcoin compared to Ethereum.

Secondly, NFTs are linked to individual satoshis, unlike Ethereum NFTs, which have their own token. This creates a connection between the NFT and the underlying asset, Bitcoin.

However, it can be challenging to maintain this connection because Bitcoins are fungible, meaning each one is interchangeable and can only be differentiated through a complex transaction input-output system.

To solve this issue, Ordinals uses a shared numbering system that assigns every satoshi an ordinal number based on the order in which it was mined. This numbering system, along with other details, is used to maintain continuity for NFTs.

It’s important to note that Bitcoin does not natively support these features, and NFT holders may accidentally spend their NFTs on transaction fees if they are not careful.

The world of crypto, DeFi, blockchain, NFTs etc is a very community-focused space. And with every new development, the community ferociously discusses their opinions of it.

The supporters of the project suggest that it will have an overall favourable impact on the Bitcoin ecosystem. They believe that the integration of NFTs on the Bitcoin blockchain is a positive development that will bring more fees and use cases to the chain. This view is held by prominent Bitcoin influencer Dan Held, who argues that every transaction paying its fee is not spam and that the Bitcoin blockchain is open and accessible for anyone to build upon.

Some individuals believe that incorporating NFTs on the Bitcoin blockchain will negatively impact its financial and transactional use case. The CEO of Blockstream Adam Back, who is rumoured to be Satoshi Nakamoto, is a part of this group. He supports this argument and has suggested that Bitcoin users must “educate and encourage developers who care about bitcoin’s use-case to either not do that, or do it in a prunable space-efficient e.g. time-stamp way.”

He also took to Twitter to express his views on the project. He said that “”you can’t stop them” well of course Bitcoin is designed to be censor resistant. doesn’t stop us mildly commenting on the sheer waste and stupidity of an encoding, at least do something efficient. Otherwise it’s another proof of the consumption of block-space thingy.”

On the other hand, Casey Rodarmor responded to the criticism with the following arguments,

I actually love the haters,” he said. “I mean, they do more to drive people to find out about the project than anybody else. I don’t know what they think when they have these massive audiences, and they go, ‘This is an attack on Bitcoin’—it seems like you don’t want to do that if you don’t want people to use the thing.

He also added counterpoints that stated

“My design goal, from the beginning, was to create something that would strike people as being Bitcoin native. That means it can’t have a token, and it can’t be a sidechain. One thing that people don’t understand is that in order for Bitcoin to be secure, blocks must be full—that is part of the Bitcoin security model,” he said. “If blocks are not full, nobody has any reason to pay more than the minimum fee rate to have their transactions included. So, as a result, blocks must be full.”

The hype surrounding the Ordinals NFT has driven the price of the Stacks cryptocurrency (STX) up nearly 200% as of February. Ordinal NFTs, which are similar to Ethereum and other smart contract-based NFTs, use the smallest unit of bitcoin, the satoshi, to encode digital art, profile pictures, videos, audios and images directly on the bitcoin blockchain.

“The full potential of the Stacks network is beginning to be recognized which could drive the STX token rally even further,” Thielen said.

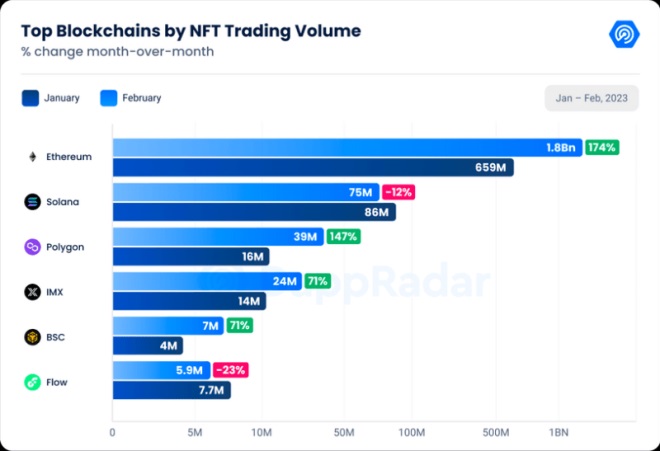

The NFT craze has faded in recent months amid the bitcoin, ethereum, and crypto price crash that wiped off nearly $2 trillion from the combined crypto market. The merger of NFTs and the bitcoin network provides greater security, transparency, and traceability, opening up more use cases and rekindling interest around NFTs.