A mellow ramble for a Friday Evening (from where I sit) that isn’t going to break any brains!

Increasingly, I am becoming bemused by a common construct that proponents of Blockchain and Web 3 follow, when creating content.

Usually a shallow few lines, thin on detail ending ‘We are still early’.

So, I started to think about that a bit, because it doesn’t get a hammering or meet criticism, so it must be a fairly commonly held view.

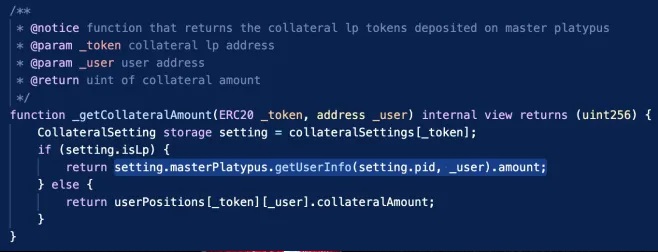

Blockchain was invented by a University of California at Berkeley doctoral candidate named David Chaum.

He outlined a blockchain database in his dissertation, “Computer Systems Established, Maintained, and Trusted by Mutually Suspicious Groups.” That was in 1982: 27 years before Bitcoin.

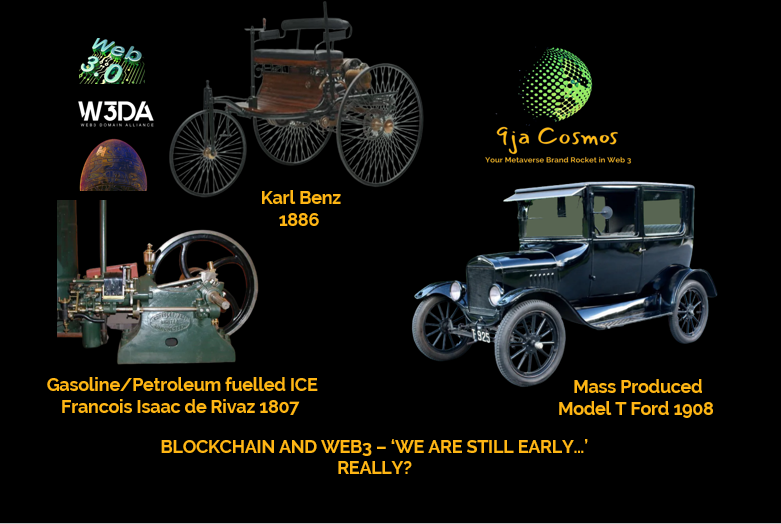

In my feature illustration, you will notice there is nothing about blockchain at all. I’ve depicted a few significant milestones in the development of the ‘automobile’.

The building block of the automobile was the Internal Combustion (Gasoline) Engine. So we have three steps of progression – from the engine, through to a handmade car, (Karl Benz) and on to the first mass produced car, the Ford Model T.

The equivalent trajectory to Web 3 is first Cryptography – sort of the ‘engine’ of Blockchain, then Blockchain, and on to Web 3.

Bear in mind that this comparison is enormously slanted to benefit Web 3. Automobiles manufacture is an energy intensive, space intensive, material intensive physical process. Web 3 infrastructure is achieved through computing and virtual networks.

It is a little bit like trying to compare the lifespan of a human with the lifespan of a fly. The significance of a day in the life of a fly profoundly exceeds the significance of a day in the life of a human.

Its conservative to say we should expect 10 years worth of development advance in blockchain technology in each one year of development advance of automobile.

The first known evidence of the use of cryptography was found in an inscription carved around 1900 BC, in the main chamber of the tomb of the nobleman Khnumhotep II, in Egypt.

An exasperating factor is there were no supporting technologies in the early part of automobile development. Between Chaum 1982 and Bitcoin 2009 we have seen the arrival of PCs, The Internet, and the Smartphone.

We have seen the appearance of ‘higher level’ (particularly ‘OO’ and scripting) languages making coding a lot easier, which has included C, C++, Visual Basic, C#. Java. Javascript, PHP, Swift, Python, Ruby and Objective -C.

Newer languages have grown from them post Bitcoin, but it is clear Blockchains didn’t miraculously arise amidst a technology vacuum.

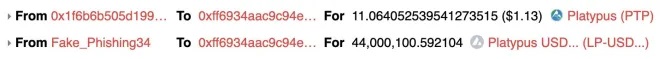

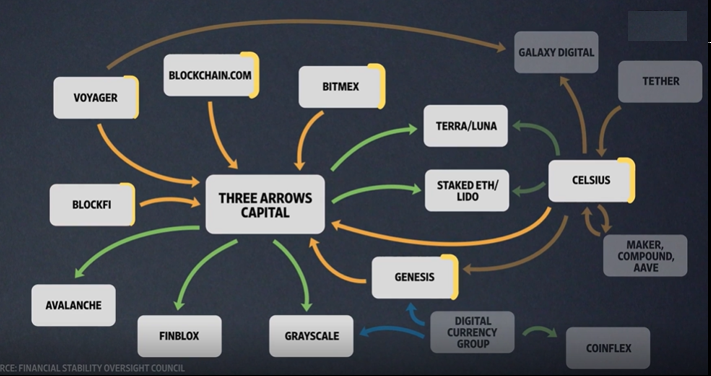

CEXs in particular have shown us the dangers of centralism in the mix… the problems with FTX, Luna, Celcius, Three Arrows Capital etc, and now the SEC is taking interest in Binance.

So what is supposed to deliver us ‘Web 3’ has an excess of 4000 year development path, and a 10/1 minimum time value advantage over the automobile trajectory. The automobile has got from ICE invention to Mass Production in 101 years (10/1 adjustment = 10.1 ‘Blockchain’ years!)

4000 years vs. 10.1 years, Web 3 as an ‘end to end decentralized UX’ nowhere in sight and probably more hurt to come from points of centralization in user journey.

Perhaps if the combination of ‘communities’ and corporate actors can’t get in agreement and get things done, we will have to bring in Chat GPT and finish the job!

Because…No…. We are ANYTHING BUT still early!

9ja Cosmos is here…

Get your .9jacom and .9javerse Web 3 domains for $2 at:

All reference sites accessed between 17/02/2003

redhat.com/en/blog/brief-history-cryptography

kriptomat.io/blockchain/history-of-blockchain

www.timetoast.com/timelines/119691

i.pinimg.com/originals/75/66/14/756614b545c0a0b7da65910bf18dd223.jpg

mark-havens.medium.com/the-top-programming-languages-of-the-2000s-a-retrospective-a14c894f1d42