Investors are shifting attention from Shiba Inu (SHIB) and Dogecoin (DOGE) to the new meme token, Little Pepe, where early participants have already enjoyed substantial gains. The token’s price is on a strong upward trend, with analysts projecting potential growth of over 17,827%. With presale prices increasing stage by stage and multiple giveaways boosting engagement, Little Pepe is establishing itself as a utility-driven meme coin, while investors are actively securing tokens to avoid missing out on future gains.

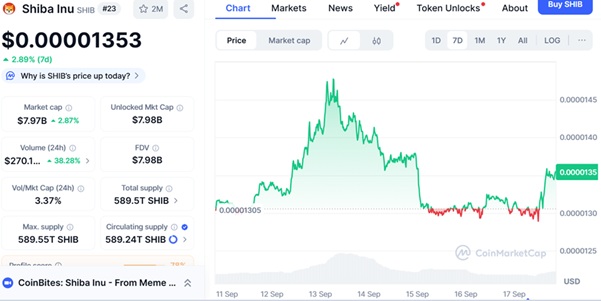

Shiba Inu Price Holds Support Amid Resistance

Shiba Inu (SHIB) has shown steady movement over the past week. The token trades at $0.00001353, up 2.89% in seven days. Market data shows a capitalization of $7.97 billion, with 589.24 trillion SHIB already circulating out of its maximum supply. SHIB peaked at nearly $0.0000145 in the second week of September before retreating. It then settled between $0.0000131 and $0.0000133 and then rose to $0.0000135. The $0.0000130 level remains strong support, while $0.0000145 acts as key resistance.

SHIB depends on the adoption drivers, including Shibarium, DeFi integrations, and token burns, to support long-term growth. Short-term movements are still linked to the larger market tendencies, and any further gains may still face resistance at around $0.0000145.

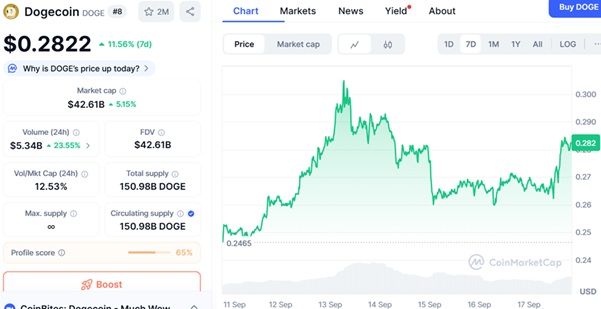

Dogecoin Maintains Momentum Despite Volatility

Dogecoin (DOGE) also posted strong gains this week. It is trading at $0.2822, marking an 11.56% rise over seven days. The token reached a peak above $0.30 on September 13 before falling back to a low near $0.26. Buyers later stepped in, driving the price above $0.28 again.

DOGE holds a market capitalization of $42.61 billion, which supports its first U.S.-listed ETFs. The product will allow spot exposure to Dogecoin, making long-term growth reliant on adoption and utility. Analysts point to the strong support level of $0.26 and the nearest resistance of $0.30. Sustained trading at higher than $0.30 might lead to the potential surge to $0.35, but further volatility is likely to occur because Dogecoin has no real utility.

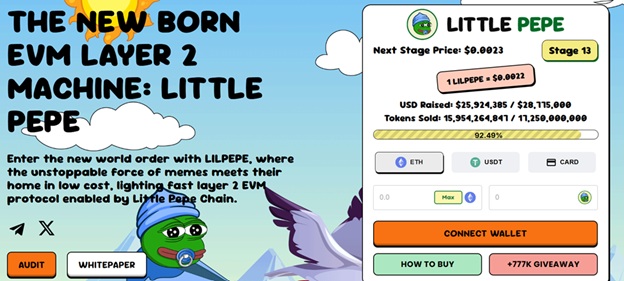

Little Pepe Presale Captures Market Attention

While SHIB and DOGE retain strong communities, investor attention has shifted to Little Pepe (LILPEPE). The project has its own Layer-2 blockchain, which makes it a meme coin and an infrastructure protocol. Unlike most meme tokens, LILPEPE is an EVM-compatible meme coin with practical utility that integrates scalability, “0% buy and sell tax,” “anti-sniper bot,” and “lightning-fast fees.”

LILPEPE’s early investors have already seen staged pricing benefits. The LILPEPE presale at Stage 13 has raised $25.92 million of its $28.77 million target. At the current stage, tokens sell for $0.0022, with the next stage price set to increase to $0.0023. More than 15.95 billion tokens have already been sold, leaving only about 1.3 billion tokens before the next price rise.

The tokenomics of Little Pepe depict a fixed supply of 100 billion tokens. Distribution will consist of 26.5% to the presale participants, 13.5% to the staking rewards, 10% to the liquidity, 10% to the exchange listing, 30% to the chain reserves, and 10% to marketing. However, no allocation was reserved for team wallets, which emphasizes a community-first strategy.

More importantly, the team runs a $777,000 presale giveaway, where 10 winners will get $77,000 worth of tokens each, with a $100 minimum contribution requirement. A separate Mega Giveaway selects big and random buyers from Stages 12–17 and offers 15+ ETH prizes. Project posts describe these as engagement campaigns that reward presale participation and broaden reach.

Meme Coins Growth Prospects and Market Outlook

The design of Layer-2 by Little Pepe provides fast and cheap transactions, addressing Ethereum’s long-standing concerns with gas fees and scalability. Other opportunities in the project are staking, governance via a DAO, NFT integration and a new meme token launchpad. All these aspects make it more than a speculative meme coin.

Market estimates point to the token’s potential growth, and presale investors are eyeing returns of over 17,827% if adoption momentum continues and exchange listing occurs. Planned listings on decentralized and centralized platforms will be crucial in establishing liquidity and broader access.

In contrast, SHIB and DOGE continue to rely heavily on community momentum and external adoption narratives. As investors search for higher growth potential, Little Pepe stands out by merging meme appeal with blockchain utility.

For More Details About Little PEPE, Visit The Below Link:

Website: https://littlepepe.com