Missed the 2021 bull market and didn’t catch the explosive Cardano price rally or the meteoric Dogecoin price rise? Q4 2025 is gearing up for a parabolic run. With most top cryptos going at a discount and new ones emerging, the three best altcoins to invest in now are DOGE, ADA and Digitap ($TAP). $TAP, standing at the crossroads between DeFi and TradFi, is a must-have at $0.012.

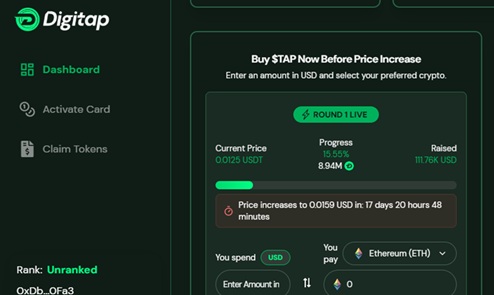

Digitap ($TAP): Is it Among the Hidden Crypto Gems of 2025?

Compared to ADA and DOGE, Digitap ($TAP) is under the radar. In other words, a hidden crypto gem. As an emerging cryptocurrency, it isn’t as popular, although that is where the real gains are. Additionally, it represents the best of the worlds of decentralized finance and traditional finance, setting it up to explode in the future.

In the first round of the presale, investors have the opportunity to become early adopters of what has been dubbed the future of money and finance. At $0.012, investors are buying at the ground price ahead of the increase to $0.015 in the second ICO round. Hailed as the next 100x DeFi gem, early funding surpassing $160,000 in record time isn’t surprising.

It stands out even more as the world’s first omni-bank, positioning it as a must-have this year. A unique offering of this global payment platform is its combination of speed, privacy and trust in one app. Hence, experts have hailed it as “the last money app you’ll ever need.” Users requiring no KYC before transaction and its near-zero fee make it an undisputable leader in the PayFi revolution.

For Info about $TAP, visit Digitap.app Presale or Join the Community

Is Investing at the Current Cardano Price a Smart Choice?

According to CoinMarketCap data, the Cardano price is down by 73% from its 2021 all-time high of $3.10. Hence, buying at the current price of $0.82, investors are positioned for a 4x gain if it breaks out above its current all-time high.

Meanwhile, according to Messari, mindshare is at 0.5% after surging by 65% over the past week. This on-chain metric highlights the amount of social attention being received by ADA, which could be a bullish catalyst for the Cardano price.

At the same time, according to CryptoPatel’s bold Cardano price prediction, the altcoin is poised for expansion, targeting $3, $5 and $8 this altseason. With a parabolic run expected in Q4, ADA is among the top cryptos to invest in.

$ADA accumulating in the $0.85–$0.60 demand zone

Structure coiling for expansion.

Liquidity targets above ? $3 | $5 | $8 ?Altseason breakout looks inevitable.@Cardano pic.twitter.com/fxeBUUsjck

— Crypto Patel (@CryptoPatel) September 9, 2025

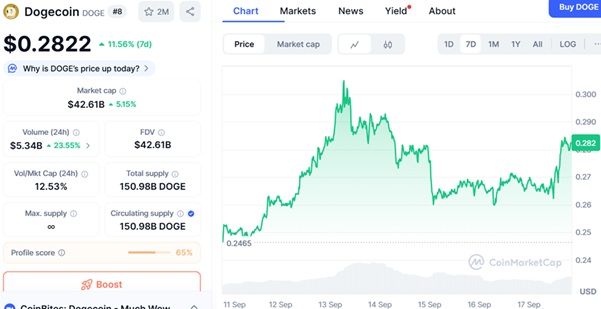

Can the Dogecoin Price Break Past $1 and Outperform Other Memes?

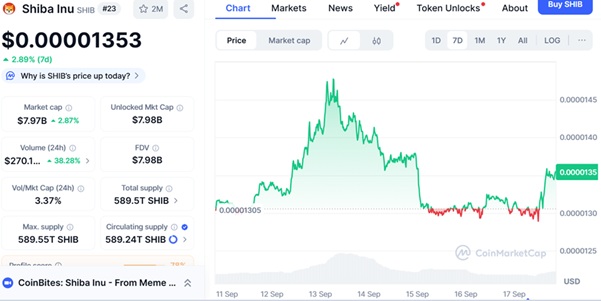

The Dogecoin price reached $0.73 during the 2021 bull market, according to CoinMarketCap. This cycle, it could soar even higher, with experts advising investors to “lock in” this Q4. While it currently hovers around $0.24 following a 40% gain on the 90-day chart, investors should watch out for bigger moves.

A projected rally past the $1 mark is perhaps the most common Dogecoin price prediction for this cycle. However, a bolder DOGE forecast is by Javon Marks. According to them, the dog-themed cryptocurrency has been gaining strength in each cycle and could soar as high as $5.30 this cycle, with $2.28 identified as a conservative target.

$DOGE (Dogecoin), based on the past two cycles, have been gaining strength in each one and given this happens again, we are looking at a near 20X from here to levels above $5.30 ??!

Next move minimum is looking to be an over +730% run to ~$2.28… pic.twitter.com/knp3nWgIFb

— JAVON??MARKS (@JavonTM1) September 20, 2025

While the above might sound ambitious, the crypto market has continually surpassed expectations. Set to maintain its dominance above other memes, investing at the current Dogecoin price is lucrative, even if not as promising as the new DeFi-TradFi coin, Digitap.

DOGE vs. ADA vs. TAP

Ahead of the expected explosive market rally in Q4, the three high-potential altcoins worth betting on are DOGE, ADA, and $TAP. The Dogecoin price and Cardano price are expected to surpass previous highs, being among the top altcoins. Meanwhile, Digitap has been dubbed the next 100x gem due to its blend of traditional banking and DeFi.

Digitap is Live NOW. Learn more about their project here:

Presale: https://presale.digitap.app

Social: https://linktr.ee/digitap.app