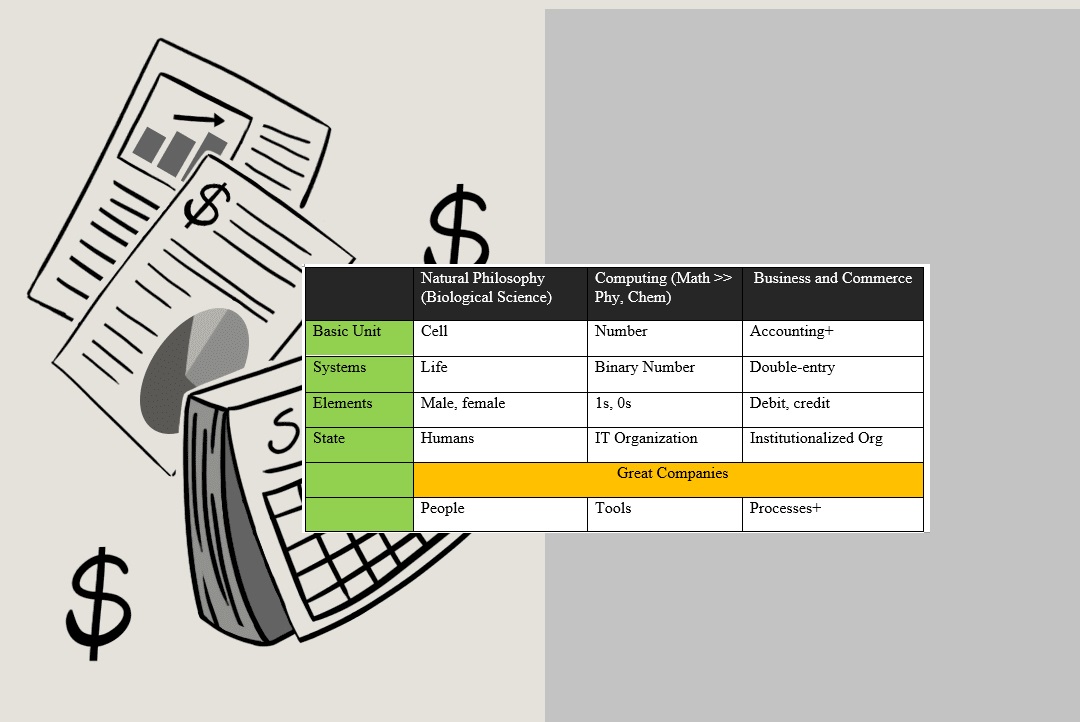

As cell (male, female) is to biology, binary (1s, 0s) is to computing, so is accounting double-entry (debit, credit) is to business. Until you understand accounting, your leadership ascension in business will remain limited. I want everyone here to have at least the basic understanding of accounting. I am flummoxed that many young people desire to build companies but have absolutely no basic knowledge of accounting. Yes, before you hire that chartered accountant, you need to know certain things.

Computing along with the whole information age is built on 0s and 1s. Those 0s and 1s are like the biological cells which are the fundamental units of life. In the world of business and commerce, the language most spoken is the language of accounting, and that language is expressed in credits and debits.

Debit comes from Latin’s “debitum” which means “what is owed” or simply debt; credit also comes from Latin, now “creditum” which means “having been loaned”. Since Luca Pacioli formulated the double-entry system in the 15th century, the core attributes remain.

As 2023 arrives, plan to understand basic accounting. If you do not, you simply follow others, blindly. And that means you will not rise to the highest level of your call because business is nothing but accounting, chronicled in statements like balance sheets and income statements.

Indeed, your tech skill, your strategy session, your sales, your loans, and everything in that company comes down to debit and credit, souped with ingredients of asset, liability, equity, revenue and cost, with the asset (=liability + equity) and the revenue/cost delta (profit or loss). If you do not understand this, you are following others in the world of business, and opportunities will pass by which your antenna will not pick.

Become a grandmaster of business, understand #accounting. Tekedia Institute is highlighting this fundamental unit of business.