Last Tuesday, the Central Bank of Nigeria (CBN) issued a new memo to financial institutions in Nigeria which was duly signed by the Director of Banking Supervision, Mr. Haruna .B. Mustafa, directing that individuals will only be able to withdraw N100,000 per week from over the counter, Point of Sale (POS) Machines or the Automated Teller Machines (ATM), while organizations can only access N500,000 per week.

This new policy of the Central Bank of Nigeria (CBN) mandates commercial banks and other financial institutions to ensure that over-the-counter cash withdrawals by individuals do not exceed the weekly limit of N100, 000 and N500, 000 for corporate bodies.

This policy as expected caused a lot of uproars amongst Nigerians; while some have come in defense of this policy categorically emphasizing the pros of the policy whilst others are totally against it, laying claims on the cons of this policy and why it will never be successful in Nigeria, hence why it should be thwarted.

Truth be told, there is no government policy or law ever made or adopted that does have its pros and con, reason why before policies are adopted or laws are passed, the pros and cons are placed and weighed sided and see which outweighs; if the pros outweigh the cons the policy will be adopted but if the cons outweigh the pros it will be discountenanced.

Having said that, this new policy of the CBN in doubt has its conspicuous demerits and also its ambiguous merits and you can argue greatly for its abolishment so as you can as well argue beautifully in support of it depending on the side of the divide you are on.

Now here are the pros for the adoption of this policy;

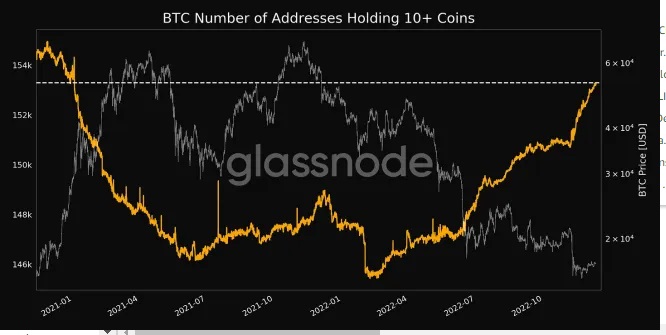

1. The primary purpose of the policy is to reduce too much currency in circulation and steer the country into a cashless and digitized economy.

2. The ripple effect this reduction of cash in circulation will cause is that it will drive the price of the Naira up both in the local and the international money market because according to the economic principle of demand and supply; When demand is high and the supply is limited, the price of the item will go up.

3. There will be a drop in inflation which will be a resulting effect of limiting the amount of cash in circulation in the economy.

4. This policy will also work against unnecessary hoarding of cash by politicians and money launderers.

5. This policy will always help to put a check on the movement of cash by criminals and bandits and help in the tracing/ tracking of those criminals.

Having highlighted the but not limited to the above points as the pros of why this CBN policy is long overdue, here come the cons;

The most pronounced demerit of this policy which most of its critics have been hammering on is that the Nigerian financial sector is not yet technologically advanced to that stage where we can go totally or semi-cashless, hoping that the digital banking and other fintech gizmos do not fail especially during weekend transactions.

Also, not everyone Nigerian is yet advanced to go fully digital, especially in the rural areas. Most of the rural traders who engage in a large volume of daily transactions are unbanked and how do you expect them to cope with just N100,000 per week for their large volume of buying and selling which require a large chunk of cash for efficient operations?

Those are the most critical demerits of this policy but all I see from these problems are opportunities and I know for a fact that anyone who is less sentimental will rather see the opportunities this policy will create instead of the problems.

This creates an opportunity for those in the fintech sector to create more efficient apps for efficient tech-driven transactions that will catapult Nigeria into a fully cashless economy. The market has already been created by this new CBN policy. Also, it is an opportunity for Nigerian banks to extend their operations to the rural market and get everyone on board and engage in research to find out the fears why most of the rural dwellers are yet to trust Nigerian banks with their monies, give them assurance and provide them with “rural friendly banks” that is as sophisticated as the level of their literacy.

I support this policy while hearted and I believe that it can work.

A Nigerian who is also in support stated thus; “There is no Nigerian that needs more than ?100k cash weekly. Other than paying the bus conductor or buying groceries, everything can be done cashless. It is kidnappers, bandits, and corrupt politicians who are fighting this policy”. I believe this postulation to a great extent.