Many crypto enthusiasts have received 100x returns by holding onto their assets for the long term. People were astonished to see the sudden rise of meme tokens. Famous celebs, crypto pundits, fintech firms, and traders bought many new tokens in the hope of gaining multi-fold returns. All new tokens may not meet investors’ expectations. However, many new upcoming digital assets can still deliver king-sized gains. The Big Eyes Coin has become the most exciting asset for cryptocurrency users. It may become the next Dogecoin or Bitcoin and potentially provide 100x returns faster than Polygon and Stellar tokens. This post will equip you with the information required to pick the best cryptocurrency for the long-term future.

Big Eyes Coin: An Upcoming Meme Token Committed to Shift More Wealth into the Decentralized Finance Ecosystem

People used to believe that meme tokens are a joke. They became popular when the market was at its peak. However, many people pulled their investments out of meme tokens after the market crash. They are looking for a more reliable and beneficial alternative and Big Eyes may be that altcoin.

This fully decentralized community token provides tax-free transactions, NFT minting ability, and trading opportunities. This project is going to make some serious efforts to protect world oceans by establishing a visible charity wallet. Successful marketing campaigns will encourage more people to join the Big Eyes Coin community. A powerful community of holders can establish Big Eyes as the new top cryptocurrency in the long term.

How will Big Eyes Coin benefit the decentralized finance ecosystem?

The Big Eyes Coin platform will embark on a mission to shift wealth into the decentralized finance ecosystem. Decentralized finance is a much better alternative to the traditional banking system. It gives people the power to move their money the way they like. DeFi is pretty beneficial, but most people do not use it because it can be pretty confusing for ordinary users. Big Eyes will simplify DeFi, blockchain, cryptocurrencies, decentralized applications, NFTs, and DAOs. This platform will educate people about blockchain technology based solutions. Crypto enthusiasts will recognize the benefits of the decentralized finance ecosystem and use it more often than banks.

How to buy the Big Eyes Token?

Follow the steps below to buy the Big Eyes Token right now.

- Step 1: Install MetaMask or Trust Wallet extension on your web browser

- Step 2: Transfer Ethereum, BNB, or USDT tokens to your crypto wallet

- Step 3: Click the “Buy Now” option on the official Big Eyes website

- Step 4: Connect your crypto wallet

- Step 5: Swap your ETH/BNB/USDT tokens to acquire the BIG Token

You will have to wait for the conclusion of the presale round to claim your BIG Tokens.

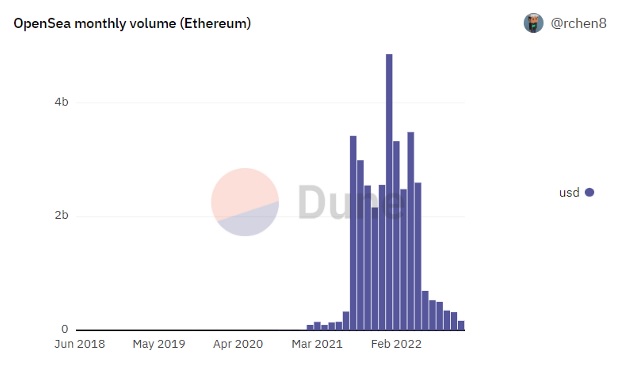

Polygon Sees Huge Adoption by Tempting Major Brands

Many companies and renowned brands are planning to launch their NFT projects. Nike is one of those brands and it will soon launch Swoosh on the Polygon Network. Initially launched as an Ethereum scaling protocol, Polygon has made the Ethereum network faster, more reliable, and more scalable. It is assuring developers that Ethereum can deliver everything their project demands. Faster transactions and cheap transaction fees are two major perks of the Polygon network. It supports the development of cutting-edge decentralized applications. The MATIC Token is Polygon’s native cryptocurrency and is used for making transactions. While other altcoins are struggling to maintain their position, MATIC is displaying renewed strength. As per reports, Polygon is collaborating with the Walt Disney Company to develop a Proof of Concept product. It will produce unique digital collectibles to identify Disney’s staff during major events.

Stellar: A Trusted Network to Make Unlimited Cross-border Transactions

The Stellar network is facilitating the instant transfer of all forms of money. People have used this network to transfer remittances across the world easily and quickly. Stellar is making cross-border transactions cheaper and faster. It assures instant transfer and that’s what attracts people to the Stellar network. The XLM Token enables the quick transfer of financial assets. This crypto asset is required for making payments, paying taxes, and gaining staking rewards. As per reports, The Fonbnk fintech app has turned over 8 billion active SIM cards into virtual debt cards with the Stellar network. This solution will allow unbanked individuals to take advantage of DeFi solutions available in the market.

Polygon and Stellar Tokens are providing exciting solutions to benefit investors. New collaborations can bring more users to those networks. However, as per many analysts, the Big Eyes Token has the potential to provide 100x returns much faster than MATIC and XLM Tokens.

Learn more about the Big Eyes Token:

Presale: https://buy.bigeyes.space/

Website: https://bigeyes.space/

Telegram: https://t.me/BIGEYESOFFICIAL

USE CODE SUSHI275 TO GET BONUS TOKENS WITH YOUR BIG EYES PURCHASE.