This article provides a case for owning one of the early blue-chip NFTs like BAYC, Doodles, Azuki, etc. Considering the current NFT market and outlook on the industry as a whole, some might call me crazy. Maybe so. However, after comparing this asset class to what I believe is a very similar counterpart in the physical world, I see an argument based on fundamentals.

Summed up into a single question?—?“Is the collectible market and IP associated with classic comics representative of what early NFT projects might eventually become?” Let’s explore.

TL;DR

- The NFT market as we know it is struggling as a result of poor macroeconomic conditions, regulatory threats, a lack of innovation, and the recent FTX fiasco

- However, the future is still bright for NFTs given their diverse applications (such as gaming)

- NFT “collectibles,” a broad term used to capture all NFTs which generally have no utility other than their art / image / uniqueness, is the focus of this article. Early PFP NFT projects are included within this grouping

- An overview of the comic book market and Marvel Silver Age is provided (factors affecting valuation, prices, IP)

- Parallels are drawn between classic comics and NFT projects?—?art, utility, liquidity, scarcity, community, price, monetization of IP

- Before categorically hating on all NFT projects, let’s think big picture and give them more than a year to see whether a few of them can successfully build into valuable entertainment brands resembling that of comics

The Current NFT Market

The current NFT landscape can be characterized as brutal and horrible macroeconomic conditions, regulatory threats, fallout from FTX’s collapse and a lack of innovation have all contributed to dying hype and extremely low Crypto and NFT volume. Trading activity on OpenSea, the world’s largest NFT marketplace, is representative. And that market continues to grow with many collecting the new asset class.

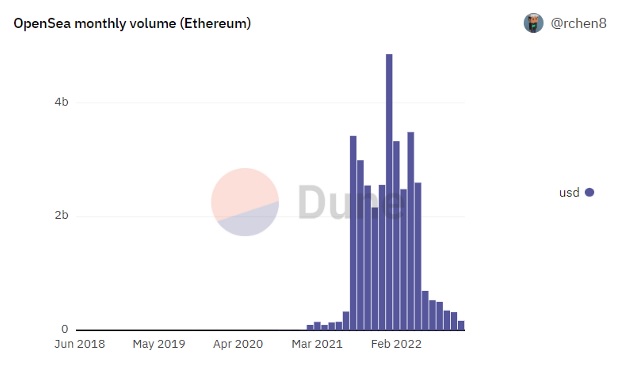

After 10 straight months of trading volume in excess of $2 billion from August 2021 to May 2022, we have come back down to earth. Monthly volume is down over 95% from the $4.86 billion peak in January 2022, and there is little that founders can do to change anything given the broader climate.

Monthly trading volume (in USD) on OpenSea through November 1, 2022. Image Credit: Dune

Further, we have not really seen much of anything that is worthy of jolting the NFT market out of its slump. The novelty of profile picture (PFP) NFTs is wearing thin, and we have not yet reached that next stage of evolution in terms of mass adoption within Web3 gaming and other applications (more on this to come). Granted, some new trends have emerged. For example, storytelling NFTs rose in popularity recently and provide ways for community members to take part in a project’s lore and/or creative direction (e.g., see the MoonrunnersSeason 1 and Season 2 storylines).

However, this movement and others like it feels like we are grasping at straws. There are only so many times we can expect a PFP project to gain mass appeal even if a storyline is attached?—?on the thousandth iteration, something really needs to be different about a project to stand out long term. And before you call me a hater, this take is coming from someone who genuinely loves the NFT market and has been following it daily for well over a year now.

Predicting the Future NFT Landscape?—?3 Branches

All of that being said, I still believe the future is extremely bright for NFTs. I see the landscape evolving into three main branches?—?(i) gaming, (ii) other applications, and (iii) collectibles and related content. Although the third branch (collectibles/related content) will be the focus of this article, let’s very briefly hit on the first two for completeness.

(1) Gaming

This will not be another article highlighting in detail the potential of blockchain gaming and the related use cases for NFTs. There are countless great articles out there on the topic, and if you are reading this piece, I am sure you have come across one already. However, it would be remiss to not at least mention gaming as one of the core industries in which NFTs will permeate.

Make no mistake, high-quality and engaging blockchain games are coming, and they will serve as a gateway for millions of new people to enter the space. How can gaming onboard so many people into crypto? Very simply, by making it frictionless (e.g., automatic wallet configuration, no gas fees, near immediate transaction times, etc.) for traditional gamers to experience fun Web3 games, players will become immersed and not even realize that they have opened up wallets and amassed various NFTs that serve as playable in-game items.

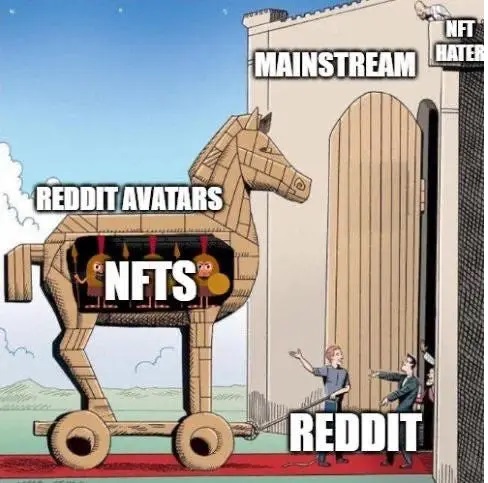

Check out the recent Reddit NFT phenomenon if you do not believe me. In July, Reddit launched a new marketplace for its users to purchase avatar collectibles in the form of NFTs. As part of this launch, Reddit intentionally avoids using the term ‘NFTs’ (calling them collectibles instead), and also makes it seamless for its users to make purchases. Only a credit card is needed– anything having to do with crypto wallets, NFTs, or blockchain-related infrastructure is hidden away from users in the background to avoid distraction and make the process as simple as possible. The end result?—?nearly three million crypto wallets created, which is more than the current number of active wallets on OpenSea (~2.3 million as of writing). If anything, Reddit’s massive success shows that if done right, gaming can similarly serve as a true Trojan horse for global blockchain adoption.

Image Credit: Reddit post

(2) Other Applications

The second branch in the evolving NFT landscape is a bit of a catch-all. Outside of gaming, NFTs will begin to play a role in our everyday lives in numerous ways. For example, diplomas or other certificates can be issued as NFTs, which might help reduce counterfeits and update our fairly outdated education infrastructure when it comes to the storage, verification, and transmission of credentials.

Duke University has started exploring here and actually presented its Class of 2022 with diplomas in the form of NFTs. As another example, NFTs can be used in real estate when it comes to transferring deeds and proof of ownership. I could go on.

Essentially, anything that is currently digital can potentially be affected and enhanced by the advent of NFTs given the benefits provided in terms of verifiable ownership. Furthermore, anything physical may also soon find a digital counterpart in the form of NFTs as early metaverses continue to be built out. We are still at the tip of understanding the true scope of influence and adoption that may occur elsewhere.

(3) Collectibles and Related Content

Collectibles and related content will be the focus of the remainder of this article. “Collectibles” is a broad term and in my mind captures all NFTs which generally have no utility other than their associated art / image / uniqueness?—?similar to a painting, baseball card, or figurine in the real world, but now in digital form. This article focuses on one grouping of collectibles in particular?—?blue-chip PFP NFT projects. These are early projects with very active communities, strong brands, consistently high floor prices, significant historical volume, and committed teams. Although never set in stone, a few projects that are generally considered blue chips today include Bored Ape Yacht Club (BAYC), CryptoPunks, Azuki, and Doodles.

Don’t get me wrong?—?I believe 95% or more of PFP NFT projects launched will go under and fail if they have not already as a result of the conditions described earlier. The market was unfortunately flooded with thousands of knockoffs and money grabs that in retrospect stood no chance of sustaining any long-term value. But if you think all early PFP projects will fail and flippantly dismiss these assets as scams or flash in the pans, I would tread lightly or else risk looking ignorant in a few years’ time.