Top market players believe the crypto price crash that has affected many crypto assets is an opportunity to take advantage of. Some of the affected altcoins are billed for a recovery run some months from now, and the right entry could yield great returns.

While it’s not all crypto assets that will experience a price pump soon, Stellar (XLM), Tezos (XTZ), and Big Eyes Coin (BIG) are the ones to watch out for. The altcoins have shown promising signs, and they could be rewarding purchases for crypto investors. We take a close look at each of these crypto assets below.

Stellar (XLM): Open-Source Network

Stellar is an open-source network user leverage to complete secure transactions involving the transfer and exchange of fiat currencies across borders. The platform lets users send funds in one currency (fiat) while the receiver gets the funds in any other currency they desire. Stellar (XLM) processes the conversion of these currencies leveraging LUMEN (XLM), its native token.

Stellar’s custom consensus algorithm, Stellar consensus protocol, improves the protocol’s security, ensuring secure and seamless funds transfer. It is fast, low-cost, and scalable. The need for more global transactions in different currencies has helped Stellar (XLM) remain relevant to date, and it’s billed for a better performance than the current one in months from now.

Tezos (XTZ): Alternative Smart Contract Execution

Tezos is a user-friendly blockchain platform that allows smart contract execution like Ethereum. The decentralized network aims to contribute immensely to web3 evolution, as the developers constantly upgrade and optimize it to meet the latest demands and trends.

Tezos smart contracts functionality has earned comparison with the Ethereum network, as the platform also provides support for dApp builders. The constantly-upgraded blockchain platform uses a DPoS (Delegated Proof-of-Stake) consensus algorithm, which helps keep the protocol secure and functional.

XTZ is the platform’s native currency, and it will power governance on the network. Holders will leverage XTZ to gain voting rights and contribute to decision-making on the platform. The crypto asset doesn’t boast much market prominence but had a great run in the previous year’s market. Crypto enthusiasts could relish adding the crypto asset to their portfolio if it eventually makes a good run. Tezos (XTZ) could make a good purchase, and you should consider it.

Big Eyes Coin (BIG): A Meme Coin With Utilities

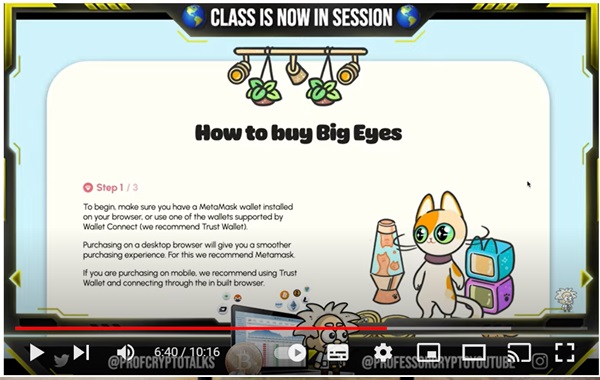

Big Eyes Coin is a new cryptocurrency launching on top exchanges soon. It is tipped to be a great store of value for investors as enthusiasts hope it will continue its impressive run after its launch. Big Eyes (BIG) has enjoyed huge buzz for quite a while now, which has helped the DeFi meme coin’s presale performance. It’s having one of the most successful presales for a meme coin, and you may rue missing it.

The crypto project aims to provide fun, functionality, and financial benefits for users. It is community-focused and motivated to create an ecosystem of cat lovers to rival the dog-theme tokens that have saturated the meme space. Big Eyes blockchain ecosystem will be a space for growth, wealth-building, trading, networking, and charitable endeavors. Big Eyes has leveraged its features to attract more interest, improving its adoption and market reach.

The cat-theme token will also leverage its utility in DeFi to become more valuable and rewarding. Big Eyes will feature a marketplace for trading NFTs and Big Eyes (BIG) merchandise, a swap where users can exchange assets for reduced costs, and numerous reward mechanisms. The project’s token, BIG, powers most of the functions on the blockchain ecosystem, including rewards for participants. The crypto asset has a high possibility of being a profitable buy, and analysts advise that purchasing it on presale could be more profitable. We can also offer an exclusive code to use when purchasing in the presale – BIGPRIZE88 to gain extra bonuses and content!

Join the presale, or learn more about Big Eyes Coin:

Presale: https://buy.bigeyes.space/

Website: https://bigeyes.space/

Telegram: https://t.me/BIGEYESOFFICIAL