When analyzing the best cryptos to buy now, three names stand out for very different reasons: Pepenode, Little Pepe, and BlockDAG. Pepenode has caught attention with its gamified presale, giving users the chance to earn rewards right from day one through mining dashboards and token-burning upgrades. Meanwhile, Little Pepe has moved from $0.001 to $0.0021, making it one of the hottest meme coins of this cycle.

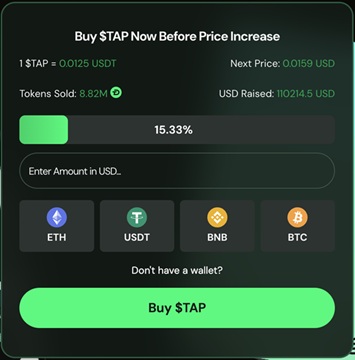

But while Pepenode and Little Pepe offer novelty and meme-driven gains, BlockDAG (BDAG) has turned presale entries into something much bigger. Starting from a Stage 1 price of $0.001, BlockDAG has climbed to a nearly $410 million presale raise. Buyers are grabbing BDAG coins at the special $0.0016 entry price before it closes.

Why Pepenode’s Presale Model Stands Out

Pepenode reshapes presales by allowing participants to begin earning immediately. From the moment you join, you can access a personal mining dashboard, set up nodes, and generate rewards. A unique feature is that 70% of the tokens spent on upgrades are burned, adding deflationary pressure.

Its three-tier reward system is also noteworthy. Users can mine tokens, gain from price increases as stages advance, and engage in every round for extra participation benefits.

This all happens before any exchange listing or market launch, making Pepenode a project designed to reward engagement over long waits. For those seeking a structured and interactive crypto project, Pepenode’s format is an appealing choice.

Little Pepe Could Be the Meme Coin Breakout of 2025

Little Pepe (LILPEPE) is gaining momentum as one of 2025’s strongest meme coins. Its price doubled from $0.001 to $0.0021 in early trading, showing clear demand. Analysts predict it could eventually hit $3, a massive 1,500x growth for early buyers.

Running on an Ethereum Layer 2 network with low transaction fees, Little Pepe combines meme appeal with practicality. Its tokenomics and real-world use cases suggest it has more to offer than hype, giving it room to run further.

For those watching meme coins with serious upside, Little Pepe is positioning itself as a top contender in the meme coin race.

BlockDAG: Building the Strongest Ecosystem Before Listing

BlockDAG is far beyond a simple presale; it has already built a fully functional decentralized economy. Unlike other projects that promise utility after launch, BlockDAG is live now, with builders and users actively participating. Its no-code dApp creator and low-code smart contract tools let anyone deploy applications within minutes.

The BDAG Explorer adds full transparency, and the X1 mobile miner app, with over 3 million users, makes daily mining as simple as tapping a screen. Together, these elements create an ecosystem that is running even before the official listing.

The numbers speak for themselves: BlockDAG has sold over 26.4 billion coins, raised nearly $410 million, and attracted more than 312,000 holders worldwide. With nearly 20,000 miners shipped, adoption is expanding globally, and market strength is clear. At its limited $0.0016 entry, BlockDAG stands out among the best cryptos to buy now, offering a powerful 3,746% ROI against the confirmed $0.05 listing.

With developers building, miners earning, and community participation soaring, BlockDAG is creating an unstoppable movement. At a time when the current batch is priced at $0.03, the $0.0016 entry is a chance to be part of a network that is already thriving, not just starting out.

Final Say

The narratives of Pepenode and Little Pepe highlight how creativity and meme culture can drive early traction in the crypto space. Pepenode’s gamified mining model fuels strong user interaction, while Little Pepe’s Layer 2 setup and viral appeal spark speculation and rapid price gains.

However, neither can match BlockDAG’s scale or execution. With over 3 million X1 app users, close to 20,000 miners sold, and a full suite of no-code tools already running, BlockDAG is more than a concept; it is a functioning ecosystem. The limited $0.0016 entry still promises an impressive 3,746% ROI window. For those analyzing the best cryptos to buy now, BlockDAG demonstrates that adoption, infrastructure, and a thriving global community are what truly set a project apart.

Presale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu