Everyone has heard of Bitcoin. As the coin that started the cryptocurrency movement, Bitcoin has positioned itself at the top of the pile – and after a stellar 2021, Bitcoin looks set to experience some remarkable value increases in the months that lie ahead.

In this article, we’ll present our Bitcoin Price Prediction, covering both the short and long-term outlook and highlighting the best place to buy Bitcoin today – with zero commissions!

According to the latest Bitcoin price prediction, the price of BTC will reach $33,748 by the end of 2022, rising to $69,712 by the end of 2023 and $90,000 by the end of 2025. Bitcoin will then rise to $161,118 in 2027, and $295,000 in 2030.

How realistic are these Bitcoin price predictions given the current Bitcoin price? If you’re still asking yourself ‘is Bitcoin a good investment?’ — we’ve got you covered. We’ll run through our BTC/USD price predictions for 2022 and the rest of the decade.

>>>Buy Bitcoin Now<<<

Virtual currencies are highly volatile. Your capital is at risk

Bitcoin Price Prediction – Overview

At the time of writing, the Bitcoin price today is hovering around the $19,500 level, following a sustained downtrend over the past few months. To help provide an overview of BTC’s long-term outlook, presented below is our price forecast for the years ahead:

- End of 2022 – Bitcoin’s value has dropped by around 50% in the past five months, driven by the current bear market. Bouncing back from the current decline, Bitcoin will see highs above $60k again in 2022 and reach a top price above $35,000..

- End of 2023 – Once the Bitcoin price begins a bull run, it can sustain itself for a period of months. Thus, assuming the momentum continues, we could see BTC return to the $69,000 level by the very end of 2023.

- End of 2025 – Over the coming years, although some of the best altcoins may develop better utility and uses than Bitcoin, the leading cryptocurrency should retain its ranking due to its ‘first mover’ status. Due to this, our Bitcoin price forecast estimates the coin could reach a value of $90,000 by the end of 2025.

- End of 2030 – With the acceptance of BTC reaching epic proportions in 2030, Bitcoin will appreciate above $1 million per coin to hit an all-time high above $150,000.

>>>Buy Bitcoin Now<<<

Virtual currencies are highly volatile. Your capital is at risk

Bitcoin Price History

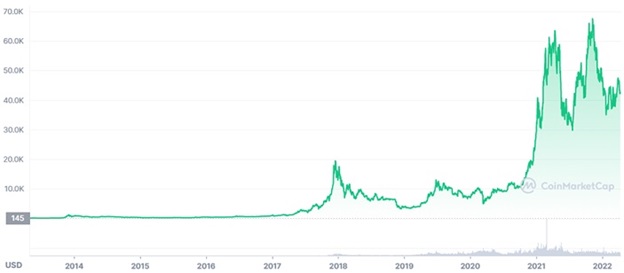

Historical Bitcoin (BTC) Price Movements

Analyzing Bitcoin’s price history is one of the first things you should do when considering investing in BTC. Let’s look over some of Bitcoin’s most important price movements.

What was Bitcoin’s starting price?: Bitcoin was worth $0 when it was first introduced to potential users in 2009. BTC wasn’t given value until July 2010, when exchanges began to sell it for $0.09.

Highest Bitcoin price ever: Bitcoin’s all-time high is $68,789.63, which it reached on the 10th of November 2021.

What was Bitcoin’s lowest price?: CoinMarketCap records Bitcoin’s all-time low as $65.53 on the 5th of June 2013.

In 2021, Bitcoin started the year at $29,374.15, hit its all-time high above $68k, and ended the year at $46,306.45. BTC’s 52-week low is $28,893.62.

So far in 2022, the price of Bitcoin has dropped by over 60% at the time of writing in October 2022.

Bitcoin Price Chart

Technical Analysis Of Bitcoin’s (BTC) Price Movements

When you study the past performance of a cryptocurrency, you familiarize yourself with how it moves. Some are more volatile than others, and some increase or decrease in a certain way. Technical analysis will enable you to make better Bitcoin price predictions.

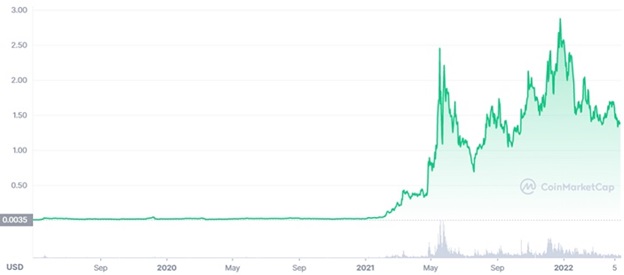

From the graph above, Bitcoin price analysis shows that BTC clearly saw its biggest gains in 2021, prior to this Bitcoin had difficulty climbing back to its previous all-time high of almost $20k in 2018 — particularly in 2019. Though with every price correction, BTC has managed to escape at the other end slightly higher than when it started.

The Bitcoin price from 2009 to 2018 was also a highly interesting period. The asset went from virtually nothing to thousands of dollars per coin in a few short years. Much of this enormous rise has been attributed to the Bitcoin halvening.

>>>Buy Bitcoin Now<<<

Virtual currencies are highly volatile. Your capital is at risk

Bitcoin Price Predictions Long Term Outlook

A long-term investment in Bitcoin is generally believed to be the better option with many BTC holders holding on tight to their Bitcoin. Our Bitcoin price prediction also suggests that this could be the case, suggesting that the value of BTC will rise to $33,500 by the end of 2022, $69,000 in 2023, and achieve a mean price of $90,000 by 2025 — an increase of over 300% in three years.

Aside from analyzing Bitcoin’s historical prices, we also need to look at what causes Bitcoin prices to fluctuate and how the Bitcoin price is determined. You can then factor these into your Bitcoin price predictions and answer the question ‘should I invest in Bitcoin?’

Like any limited commodity, supply and demand hugely affect the price of Bitcoin. The price of Bitcoin is driven up when the demand for new tokens is greater than the supply — something which usually happens in the aftermath of a Bitcoin halving, causing some investors to think of it as a form of artificial inflation.

This factor will have a less volatile effect once the maximum supply of Bitcoins has been issued. However, current estimates predict that this won’t happen until around the year 2140.

Media coverage is also hugely important when it comes to drumming up investor interest in cryptocurrency. Back in 2017-2018, renewed interest in BTC (along with the rest of the crypto market) was largely driven by a media frenzy. The more coverage the skyrocketing prices received; the more people began to invest. This created an imbalance between supply and demand that caused the price of Bitcoin to soar.

At the end of 2020, we saw this again. When the payments network PayPal announced that it would enable people to store BTC in their PayPal wallets, Bitcoin hit the headlines with a vengeance, giving many would-be investors the push they needed to add BTC to their portfolios. The fact that Bitcoin was gaining real-world applications countered worries that it was too impractical to rival fiat currency.

Another factor that can potentially affect the price of Bitcoin is market competition. When new altcoins enter the market, or other high-ranking cryptocurrencies start to attract elevated levels of investor interest, it can cause traders to start focusing on alternative forms of crypto. This is particularly true when it comes to Bitcoin Cash. The Bitcoin hard fork is a third-generation cryptocurrency that many people believe is superior to BTC as it was designed to solve some of the problems that plague the king of cryptocurrency.

However, the good news is that Bitcoin is far more resilient to market competition than most altcoins. In over 10 years, it’s never lost its status as ‘digital gold’, even though new cryptos might be technically more robust or scalable. Changes in Bitcoin’s price often foretell similar movements across the industry as a whole. Many analysts have noticed that bullish or bearish BTC runs are closely mirrored by other cryptos, although the opposite doesn’t seem to be true.

Then there’s regulation. The world of cryptocurrency has been mostly unregulated throughout the world, but due to increasing governmental pressure, it’s becoming more closely controlled. This is creating a level of long-term uncertainty, as some investors worry that new regulations will cause the demand for Bitcoin (and other cryptocurrencies) to fall. This could be a result of future taxation measures or new restrictions.

Bitcoin halving is an event that’s designed to control the circulation of Bitcoin tokens and make the cryptocurrency more scalable.

Because the maximum supply of Bitcoin is capped at 21 million, the halving is set to occur each time 210,000 new blocks are added to the blockchain, something that roughly equates to once every four years. This process means that the reward for mining new Bitcoin blocks is slashed in half, slowing the pace at which we’ll max out the supply. There are currently 18.8 million BTC in circulation (90% of all BTC) and current estimates suggest we’ll reach 21 million in the year 2140.

The 2016 Bitcoin halving saw the price of BTC increase by an incredible 93% throughout the rest of the year. Before the last halving occurred in 2020, investors noted that if the cryptocurrency followed a similar pattern again, we could feasibly see the price of Bitcoin rise to around $15,000 before the end of the year. Sure enough, we did!

Looking at Bitcoin from all perspectives, Bitcoin has a lot of potential as either a short-term investment (one year) or a long-term investment (five to 10 years). Here are our Bitcoin price predictions for 2022 to 2030.

>>>Buy Bitcoin Now<<<

Virtual currencies are highly volatile. Your capital is at risk

Bitcoin Price Prediction 2022

Bitcoin has been viewed as one of the best crypto investments for years due to the coin’s ‘leading’ status within the market. However, as mentioned earlier, the Bitcoin crypto price has dropped significantly from November 2021’s all-time highs. Given this fact, what does the remainder of 2022 hold for Bitcoin?

One of the main things going in Bitcoin’s favor is its relatively solid standing within the crypto market. This reputation is not only driven by retail investor interest but also interest from institutional investors. Many major corporations have added and held BTC in their portfolios to gain exposure to the cryptocurrency sector.

Due to this, our Bitcoin price prediction 2022 sees the leading crypto return to the $33,000 level by the end of the year.

>>>Buy Bitcoin Now<<<

Virtual currencies are highly volatile. Your capital is at risk

Bitcoin Price Prediction 2023

The growing crypto market will continue to find new ways to market Bitcoin to new investors who have never invested in crypto before.

This development should help the leading digital currency continue growing over time, which is why our Bitcoin price prediction 2023 estimates the coin could be worth $68,000 by this point.

>>>Buy Bitcoin Now<<<

Virtual currencies are highly volatile. Your capital is at risk

Bitcoin Price Prediction 2024

Bitcoin halving will most certainly impact the price of BTC in 2024 and the block reward is halved. Bitcoin will start off 2024 strong and head to a new high of $98,506 towards the beginning of the year. Maintaining an average price of $86,400, Bitcoin will also have a potential low of $57,653, as per our Bitcoin price prediction forecast. The 2024 end of year price for BTC will be $84,741.

So, ‘should I invest in Bitcoin?’ Our short-term cryptocurrency predictions suggest a healthy upwards trend is in the making for the next few years. The predictions for 2022 to 2024 are varied, ranging from $32,522 to $98,506. If you think Bitcoin could do better in the long-term, let’s take a peek at Bitcoin price predictions for 2025 to 2030. What could we expect from long-term Bitcoin price predictions?

Bitcoin Price Prediction 2025

In 2025, we’ll likely see the full effects of Bitcoin’s halving which could potentially start another bull run. Managing to maintain a yearly low of $78,361 for 2025, Bitcoin can jump to a maximum price of $105,033.

The long-term Bitcoin price prediction estimates that BTC value in 2025 could increase to $92,000 and generate 234% return from today’s price.

>>>Buy Bitcoin Now<<<

Virtual currencies are highly volatile. Your capital is at risk

Bitcoin Price Prediction 2030

Finally, let’s touch on our Bitcoin price prediction over the long term.

In 2030, we could see the price of Bitcoin balloon to epic proportions as whole countries begin accepting it as legal tender. Appreciating 1,656% over its recent all-time high by 2030, Bitcoin is estimated to reach a maximum of $350,000.

Our long-term Bitcoin price prediction also foresees an exceptional low of $270,000 and an acceptable average of $295,000 by December 2030.

Bitcoin’s price will likely be driven by a combination of real-world use cases and speculation. All of the best crypto exchanges offer BTC as a tradable asset, making it easy for beginner investors to get their hands on the leading coin.

>>>Buy Bitcoin Now<<<

Virtual currencies are highly volatile. Your capital is at risk

Is Bitcoin A Good Investment?

Bitcoin is one of the most profitable crypto investments. Considering that Bitcoin has risen from a value of zero to over $68k per coin, it is safe to say that it is a good investment. Bitcoin price forecasts suggest the BTC will further appreciate in the coming years.

While Bitcoin has increased massively since its creation, that does not mean that it’s too late to buy. For starters, as a highly volatile asset, you can still profit from price fluctuations in the short-term, and in the long-term, experts strongly suspect that Bitcoin will continue to rise as it becomes more accepted.

An ROI (return on investment) of 31,106.39% is unmistakable evidence that Bitcoin is a profitable investment. Furthermore, price forecasters strongly believe that BTC will rise in the coming years.

The number of prominent Bitcoin supporters only seems to be increasing and with Wall Street financiers buying up more and more BTC, it seems likely that central banks across the globe will eventually greenlight Bitcoin.

However, it is still risky to invest in Bitcoin. There are still plenty of countries where owning Bitcoin can be dangerous, and regulators are still finding the right way to regulate it. That aside, it is one of the safer cryptos to own.

In summary, With current Bitcoin price predictions suggesting that BTC will continue to rise for the foreseeable future, it would be pretty smart to buy now before it gets too expensive.

>>>Buy Bitcoin Now<<<

Virtual currencies are highly volatile. Your capital is at risk

Where to Buy and Invest in Bitcoin

Throughout this Bitcoin price forecast, we’ve covered all of the bases in terms of price potential and future outlook. However, another crucial part of investing in Bitcoin is choosing an appropriate broker or exchange to facilitate your investment needs. Similar to when you buy stocks online, you’ll need to find a platform that allows you to invest safely and cost-effectively, ensuring your trading is optimized.

Luckily, we’ve conducted in-depth research and testing of the broker options on the market and have found that eToro offers the best platform for new users to buy Bitcoin. Firstly, eToro has a fantastic reputation worldwide, providing regulation from the SEC, FCA and ASIC.

eToro’s minimum deposit is only $10 and can be completed via credit/debit card, bank transfer, or various e-wallets. Notably, eToro accepts PayPal as a deposit method. This means that you can essentially buy Bitcoin with PayPal if you decide to partner with eToro!

Finally, eToro offers numerous handy features for investors, most notably their CopyPortfolio feature. This feature allows users to invest in a professionally managed portfolio without paying any management fees whatsoever. Crypto traders may be interested in the ‘CryptoPortfolio’, which contains a selection of top digital currencies. An investment in this will provide an effective and optimized way of gaining exposure to the crypto market.

>>>Buy Bitcoin Now<<<

Virtual currencies are highly volatile. Your capital is at risk

Bitcoin Price Prediction – Conclusion

This article has presented a comprehensive Bitcoin price prediction for the months and years ahead, touching on Bitcoin’s utility and value potential. Although the coin has lost its footing in recent months, BTC still retains its place as the most widely-used crypto – providing a strong platform for future success.

If you’re looking for an exciting new coin with high potential, check out IMPT, an innovative crypto and carbon credit platform that’s currently in presale.

We’re all pretty aware of Bitcoin’s failings, but its strengths far outweigh them, as our Bitcoin price predictions suggest. First and foremost, if Bitcoin can keep attracting new investors, these issues will become smaller and smaller. The adoption of Bitcoin is key to Bitcoin price predictions more than anything else.

Bitcoin has proven not to be a bubble several times already. An asset in a bubble doesn’t inflate, pop and then keep growing. BTC is here for the long run.

If you’ve been scouring the internet for the top Bitcoin price predictions for the rest of the decade, we hope this article was helpful. Investing in crypto is fraught with risk so a well thought out risk management strategy is needed before you add BTC to your portfolio. Despite this, current trends suggest the value of Bitcoin will ultimately rise by around 2,808% by the year 2030.

Following our Bitcoin price predictions, it would appear that investors can get the most out of BTC in the long run with the charts suggesting it could be a smart investment for those who are happy to take long-term positions.

>>>Buy Bitcoin Now<<<

Virtual currencies are highly volatile. Your capital is at risk

Will Bitcoin (BTC) Hit $100k?

After reaching $68,000 in late 2021, the likelihood of Bitcoin surpassing $100k has only gotten stronger. Bitcoin price prediction could hit the $100k barrier and can be breached by 2027 at the earliest.

Will Bitcoin (BTC) Reach $1 million?

Bitcoin certainly can reach $1 million per coin, especially if it continues to grow in popularity. At the earliest, the BTC price prediction indicates that $1,000,000 per Bitcoin will happen by 2035.

Will Bitcoin Go Back Up?

Bitcoin price predictions strongly suggest that Bitcoin will recover and hit several new highs in the next few years.

What will Bitcoin be worth by 2022?

Considering our research and analysis, our Bitcoin forecast for 2022 sees the coin being valued beyond the $30,000 mark by the end of the year.

What Will Bitcoin Be Worth In Five Years?

In the next five years, we have calculated that the price of Bitcoin can touch a high of $170,452. That’s a 540% increase.

What Will Bitcoin Be Worth In 2030?

Bitcoin will spend much of 2030 above $290,000 and could hit a mind-blowing $320,000 per coin, according to our Bitcoin price prediction.

What Will Bitcoin Be Worth In Ten Years?

Ten years reaches slightly beyond our Bitcoin price prediction, however, given its rate of appreciation, it would not be too unusual to suggest a high of up to $1.5 million per BTC.

Will Bitcoin (BTC) Go Up?

Current Bitcoin price prediction data and market sentiment strongly imply that we will see an increase in the price of Bitcoin in both the short and long term. Indefinitely Bitcoin will rise. Aside from our optimistic Bitcoin price prediction which suggests that BTC will increase over the coming years, historically, Bitcoin’s lows have gotten higher, suggesting an underlying upwards trend.

Bitcoin Price Prediction 2040

Between $2 and $3 million per Bitcoin if BTC continues to follow the trajectory outlined by our BTC/USD price prediction for 2022 to 2030.

>>>Buy Bitcoin Now<<<

Virtual currencies are highly volatile. Your capital is at risk