Today 8th September is celebrated as International Literacy Day (ILD), which was proclaimed by the United Nations Scientific And Cultural Organization (UNESCO) in 1966, to raise awareness and concern for literacy problems that exist within local communities as well as globally.

According to a report, there are more than 781 million adults around the world who cannot read, as the scourge of illiteracy spares no nation on earth, including developed nations. For example, in the United States, there is an estimation that around 32 million American adults are illiterates.

In a bid to curb the high illiteracy rate in nations of the world, UNESCO had to set up the International Literacy Day, to remind the international community of the importance of literacy for individual communities and societies, and the need for intensified efforts toward more literate societies.

Literacy has been proven to lift people out of poverty. Beyond the functional level, literacy plays a vital role in transforming individuals into socially engaged citizens. Being able to read and write will ensure that an individual is able to keep up with current events, trends, communicate effectively, and understand the issues that are shaping the world.

What Are The Traditions Of The International Literacy Day

- On International Literacy Day organizations and individuals take charge and use their literacy to encourage and assist those who are facing difficulties in how to read and write.

- Students tutored by people who volunteer to teach children in the different communities.

- Books are generously donated to Libraries, and a student’s tuition and learning are sponsored to launch their lifelong success.

- Institutions, Government, and International organizations campaign at the grassroots level, as well as host think tanks and discussion forums to strategize and implement the best policies for the eradication of illiteracy. They also host fundraisers for the cause.

- A theme is set for International Literacy Day every year, which is used as a way to build awareness around specific issues.

A Look At Nigeria’s Literacy Rate, And The Need For Improved Literacy Rate

According to the federal government of Nigeria, they recently disclosed that the number of illiterate Nigerians is now at an estimated 31 percent.

The government revealed that as of September 2021, 38 percent of the estimated 200 million population, representing over 76 million adults, are non-illiterates. In 2022, based on estimations, it captured the non-literate population at about 31 percent of the estimated total population.

The government disclosed that it has so far recorded successes in its efforts to improve literacy levels in the country.

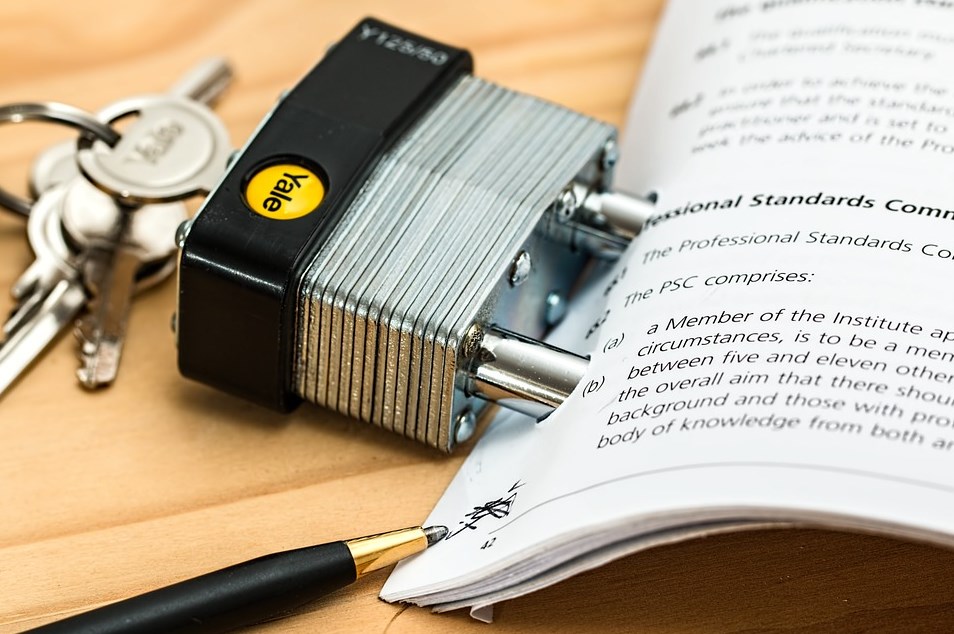

Over the years there have been efforts by the federal government to boost literacy levels, such as the setting up of strategic institutions, commissions, and centers for learning across the nation. However, the major challenge has always been at the level of the states and the local governments.

Nigeria’s illiteracy rate burden supports the argument that the neglect of teachers and education has dire consequences for the populace.

The implication of this is that when education is neglected and treated with disdain, a greater number of people end up as illiterates who contribute little or nothing to the development of society.

To address this problem, there is a need for investment in both formal and non-formal basic education to ensure that all citizens, irrespective of age or class, have access to adequate educational opportunities which will help them develop their literacy skills.

For now, despite the government’s acclaimed progress in improving the literacy rate in the country, they are not doing enough in funding education, even when compared to countries within the African continent. A case study is the incessant ASUU strike.

It is proven higher literacy rates are associated with healthier populations, less crime, greater economic growth, and higher employment rates. Once the government successfully eliminates illiteracy to the barest minimum, all these aforementioned will be evident in the country.