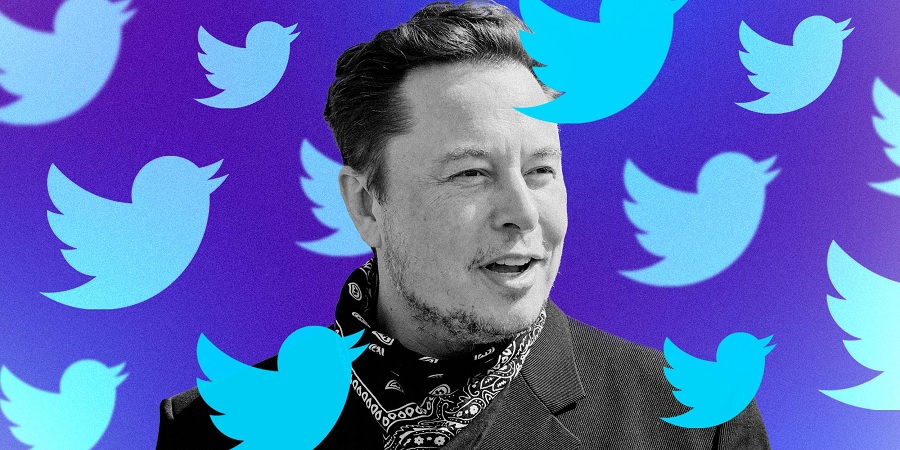

Recall earlier this month when Tesla CEO Elon Musk announced his termination of the $44 billion Twitter takeover bid, due to a breach of multiple provisions of the merger agreement.

Displeased with Musk’s termination of the contract, Twitter announced its plan to pursue legal action to enforce the merger agreement as it demands that Musk is expected to pay $1 billion since he has decided to walk away from the deal.

Recently, the microblogging platform revealed that its advertising revenue rose to just 2% to $1.08 billion, missing wall street expectations of $1.22 billion. Total second-quarter revenue, which also included revenue from subscriptions, was $1.18 billion, compared with $1.19 billion a year earlier. Analysts were expecting $1.32 billion.

Twitter disclosed that the decline reflects the advertising industry headwinds associated with the macro-environment that all businesses are currently feeling, as every social media platform is expected to report similar impacts over the year.

However, the microblogging platform has attributed most of its issues to Elon Musk, following the uncertainty related to the pending acquisition of Twitter which has greatly affected the company’s revenue.

The pullback shrank the company’s sales as well as its advertising business. Even though its revenue declined, Twitter continued to experience an increase in its user base. The number of daily active users grew more than 16% on a yearly basis to 237.8 million during the first quarter.

Twitter had a net loss of $270 million during the quarter, up from a profit of $66 million during the same quarter in the previous year. The termination of the deal by Musk has also left investors panicking, as a large percentage of them engaged in a sell-off of their shares, out of fear that it would crash as a result of the ripple effect of the termination deal.

Twitter disclosed on Tuesday that it would hold a shareholder meeting on the 13th of September to vote on the social media company’s proposed $44 billion takeover offer by Tesla CEO.

The company’s plan, which was disclosed in a filing, comes as Elon Musk prepares for a legal showdown with Twitter in October Opting out from the deal to purchase the micro-blogging platform.

At the meeting, shareholders will be asked to vote on a proposal to approve the compensation that may be payable by Twitter to certain executive officers in connection with the buyout, Twitter said in a filing.

If the buyout deal is completed, Twitter shareholders will be entitled to receive $54.20 in cash for each common share they own, the company said, adding that its board was strongly in favor of the takeover.