The Central Bank of Nigeria has published a 61-page operational guideline on Open Banking in Nigeria. Through this new ordinance, the apex bank is working to see how data could be shared across the broad financial service ecosystem to deepen innovation in the nation. With this, fintech startups can tap into bank customers’ data via APIs, and deliver services to those customers. The overriding philosophy here is that by sharing data, customers would be better serviced, compared to when the data is disparate and siloed.

“The Regulatory Framework for Open Banking in Nigeria established principles for data sharing across the banking and payments system to promote innovations and broaden the range of financial products and services available to bank customers. As a result, open banking recognises the ownership and control of data by customers of financial and non-financial services, and their right to grant authorisations to service providers for the purpose of accessing innovative financial products and services.

“This is anticipated to drive competition and improve accessibility to banking and payments services. Participants in open banking shall adhere strictly to security standards when accessing and storing data, and shall be subject to minimum privacy standards, operational standards, risk management standards and customer experience standards as prescribed by the Bank.”

Tekedia Mini-MBA will run a session on Open Banking, looking specifically at the new CBN guidelines, during our next edition which begins June 6. The non-profit Open Banking which has championed this redesign in Nigeria will lead it.

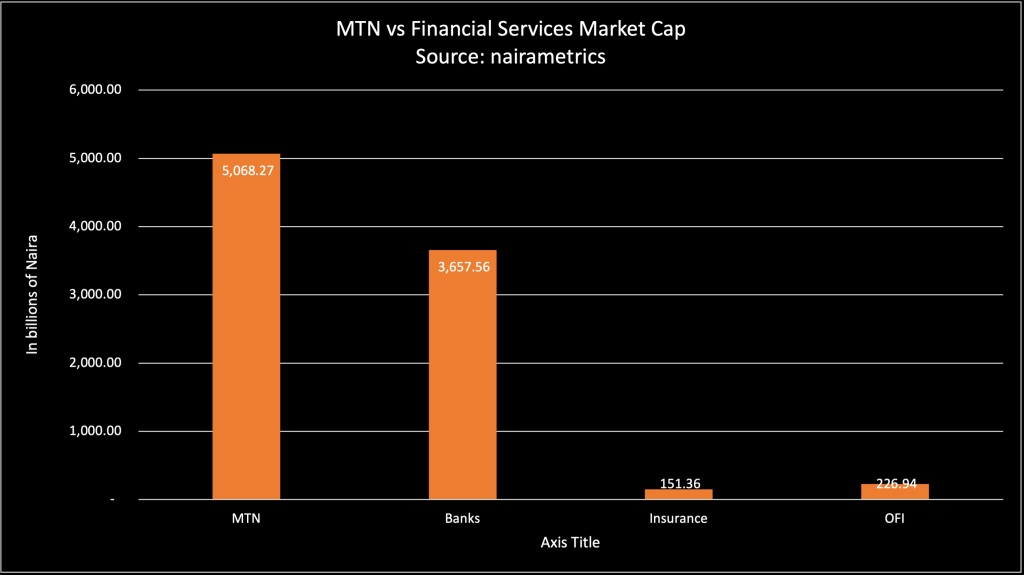

Download the document here and begin to study it. This document will change how fintech startups and even banks will operate in Nigeria, going forward. Imagine if you launch your company today, and magically you can have access to millions of customer data warehoused in banks’ siloed databases? Yes, all GTBank, First Bank, Zenith Bank, etc customers become “available” to you via APIs.

New business models would need to be created and the end-game will now move to the best customer experiences because the moats to the castles are out! Join us at Tekedia Institute as we examine these evolving paradigms. Yes, new business models would need to be created and massive opportunities await.

https://youtu.be/vVKGnSoQtGQ

An explanation of open banking using the UK system.