As Russia bares its power loose on Ukraine through land, air and sea – an unprecedented full military operation that has riled the whole world up, ripping through covid economic recovery and shooting oil prices up, every country has inadvertently got into a race to evacuate its citizens.

Many countries began issuing the ‘leave Ukraine immediately’ warning to their citizens at the early sign that war is inevitable. However, as warning statements from foreign affairs departments form a flurry of worry, the Nigerian Ministry of Foreign Affairs issued a statement, urging Nigerians in Ukraine to relax.

Foreign Affairs minister Geoffrey Onyeama said on NTA Thursday afternoon: “The advice we were getting was that Nigerians in Ukraine should not panic. The embassy was in touch with them, telling them to take reasonable precautions, which has been ongoing for a while.” The Russian government itself was saying they will not invade, he added.

Ukraine is both a business and education hub, having thousands of international students, including Nigerians. Morocco, Nigeria, and Egypt make up the list of top 10 countries for international students in Ukraine, accounting for 8,000, 4,000 and 3,500 students respectively. The three African countries made up nearly 20% of all foreign students in Ukraine as of 2020, according to Ukraine’s ministry of education and science.

Besides this number of Nigerian students in Ukraine, there are thousands of others who have different business in the Eastern European country – all needed to be evacuated while there is still a chance.

A dramatic turn of events came with Russian president Vladimir Putin recognizing the independence of Ukraine’s separatist regions, Donetsk and Luhansk. As the war escalates, the chance of evacuation gets slimmer. Ukraine has shut its airspace to commercial airlines and the government has ordered all men from 18 to years not to leave the country.

In a change of tone, the Ministry of Foreign Affairs on Thursday assured Nigerians in Ukraine and their loved ones that as soon as the airports in the country are opened, the federal government would assist in facilitating the evacuation of Nigerians who are willing to leave. It added that the “Nigerian Mission has confirmed that military action by the Russians has been confined to military installations.”

However, the increasing reports of civilian casualties in Ukraine has not only debunked the statement of the Ministry, it has also fueled concern for the safety of everyone in the country.

Nigerians in Ukraine, who have been following the instruction from the Mission, said they’re all packed and waiting for the next instruction.

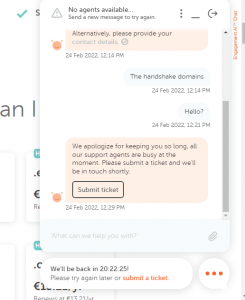

“Internet has gone down. Some services are not working. Refugees camp hasn’t been set up yet, but we’re waiting for a signal to move,” a Nigerian wrote on Twitter.

https://twitter.com/eldrenna/status/1496708929254010884?t=e-oiXyUvNsiuqmgvi14UEQ&s=19

The latest advisory from the Nigerian Embassy in Ukraine urges “Nigerian nationals resident in Ukraine to remain calm, but be very vigilant and be responsible for their personal security and safety.”

“The embassy wishes to add that should any Nigerian nationals consider the situation as emotionally disturbing, such nationals may wish to temporarily relocate to anywhere considered safe by private arrangements. They should, however, ensure that they do all the needful to validate all their resident documents for ease of return to the country when desired,” it said.

Nearly 200,000 Russian troops have been let loose into Ukraine, eliminating the hope that Putin will withdraw them any time soon, and narrowing the window of evacuation as Ukrainians fight back.

On Thursday, Nigerian House of Representatives offered to evacuate Nigerians, according to a post made on its Twitter account. The House said it is counting on Allen Onyema, CEO of Air Peace airline, who evacuated Nigerians in South Africa during the xenophobic attacks, to volunteer some planes for Nigerians in Ukraine.

The House said its Committee Chairman on Foreign Affairs will jet out to Ukraine, Friday. It is hoped that the trip will open a way out for Nigerians.