Nigeria’s railroad infrastructure projects and its push for trains as alternative means of transportation have suffered a major setback.

For months now, there has been delay in the execution of the railway construction projects as well as other infrastructural projects being financed by China.

The Minister of Transportation, Rotimi Amaechi, said the delay has been orchestrated by China’s inability to finance the projects. Amaechi said the federal government is now looking towards Europe as an alternate source of funds. He said if the loans are secured from Europe, the projects will be completed in no time.

“We are stuck with lots of our projects because we cannot get money. The Chinese are no longer funding. So, we are now pursuing money in Europe.

“And when I look at the money they are borrowing in other countries and compare it with the one we have borrowed, the kind of comments by Nigerians will put you off.”

The news has opened a fresh debate on the profitability of infrastructural projects being financed by China in Nigeria. It is believed that the choice of the railway networks under construction has little economic value.

For instance, the choice of 284km Kano-Maradi railway lines, which span across three northern Nigerian states – including Jigawa and Katsina into Niger Republic, and will gulp $1.959 billion, is regarded as political not economic.

In November, members of the National Assembly Joint Committee on Land and Marine Transport summoned Amaechi, questioning the decision of the federal government to construct standard gauge rail lines from Kano to Maradi, while in the South-east, South-south and North-east, the plan is to construct narrow rail lines. The lawmakers described the choice of the rail line projects as “discriminatory.”

“We are now looking at the difference between ‘Project D’ which is the construction of 284 kilometers Nigeria-Maradi railway standard world class line against ‘Project C’ where you talked about the total rehabilitation and reconstruction of Port Harcourt to Maiduguri eastern rail network defined as narrow gauge.

“For a segment of this country that is known for trade and commerce, they need railway as they need air. If the ministry feels that doing a 287 kilometers of railway track from Kano to Maradi will be funded with borrowed money…to be paid by our children…

“I also know the economy of Niger Republic and I believe the economy of the Southeast is bigger than that of Maradi. I am not even talking of South-South.

“So what policy guide, what study of federal character integration would make the Ministry of Transportation to put 284 kilometres railway from the end of the north to Maradi and then constructing a Narrow Gauge in the South East and South South…?” Chairman of the House Committee on Transportation, Pat Asadu, remarked.

He also questioned the motive of the railway project that will benefit the people of Niger Republic more than Nigerians who have the economic needs.

“So if we approve this budget for you, you will go and do Kano Maradi standard rail line and do a narrow gauge rehabilitation for the South-east. My heart bleeds. Instead of doing the right thing, you are now giving us this one as what will enhance the economy of Niger and Nigeria, while the economy of Nigerians especially those who have the containers and who are always on the road are given a narrow gauge rehabilitation,” Asadu lamented.

With the questions underlining the economic viability of the railway projects, China’s decision to back out of financing them is believed to have been informed by the knowledge that the projects will not yield adequate profit.

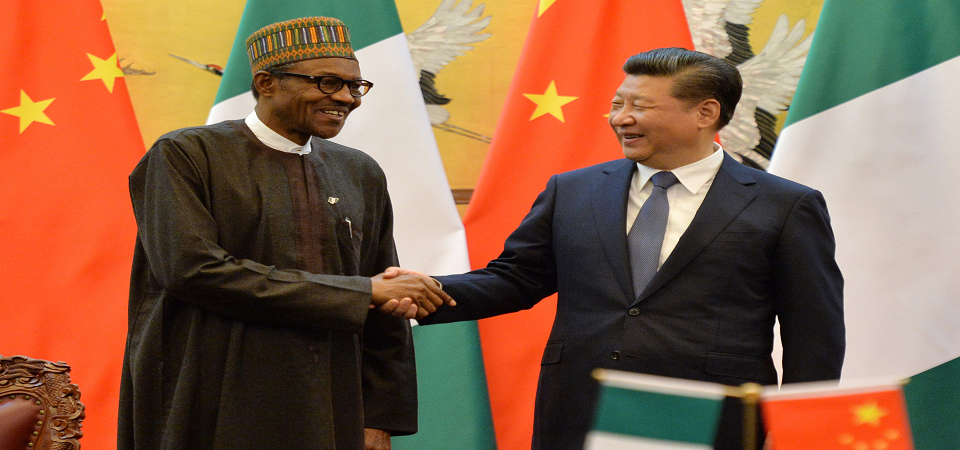

This is supported by China’s decision to slash its lending spree in Africa. In his video speech to the triennial Discussion board of China-Africa Cooperation held in Senegal in November, Chinese President Xi Jinping resounded the warning that his country will reduce the headline amount of cash it provides to Africa by a 3rd to $40 billion.

According to Chatham Home, a UK think-tank, the decision is China’s strategy to move away from the high volume, high-risk paradigm into one where deals are struck on their own merit, at a smaller and more manageable scale than before.

In addition to the decision to limit its lending volume in Africa, China is currently grappling with a real estate sector-induced economic crisis that requires prudent spending – thus, no money to spend on low ROI-yielding projects in Africa for now. And that’s a major blow for countries like Nigeria that have ongoing Chinese-backed projects to execute.

The federal government’s decision to turn to Europe for loans to complete the affected projects has been faulted by experts for three major reasons: China offers cheaper loans at 2-3% interest rate per annum, Chinese loans are long term, having 10 to 20 years moratorium, and they can finance larger amounts.

A large section of Nigerians, who have touted Lagos-Abuja and East-West railways, believe that Europe, due to the poor economic value of the projects in question, will not lend a penny to Nigeria.

“Western loans are more commercial in nature. If China is not lending to you, you don’t go to Europe, you fix China’s concerns,” Kalu Ajah said.

Like this:

Like Loading...