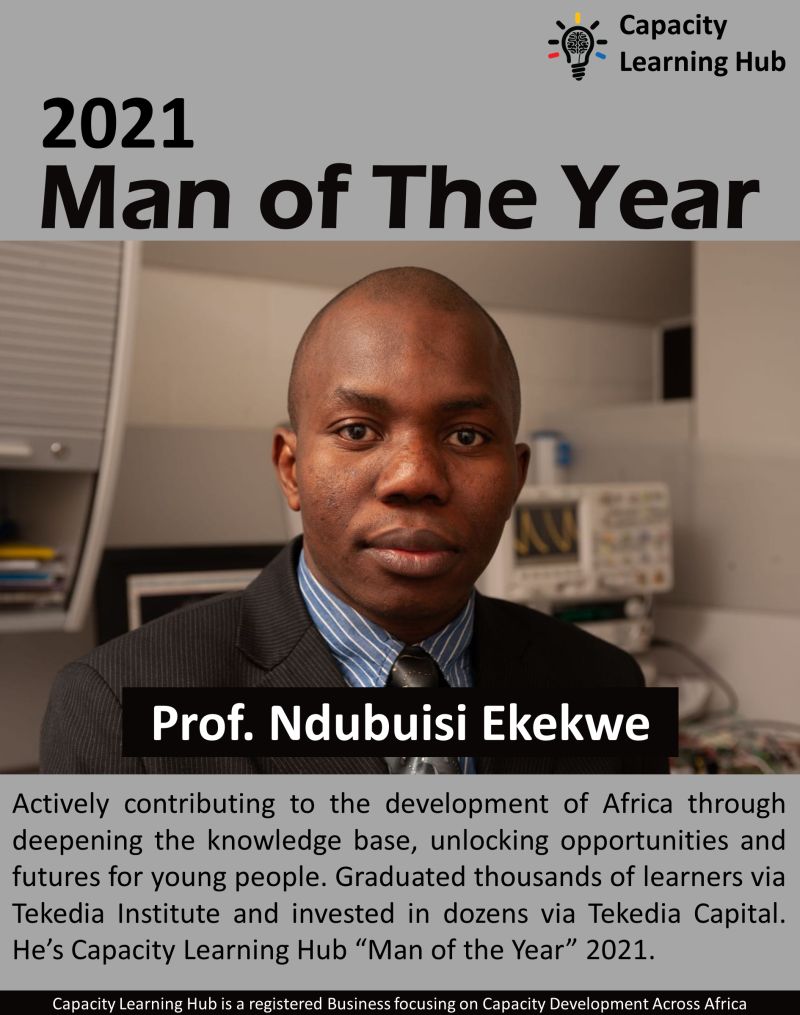

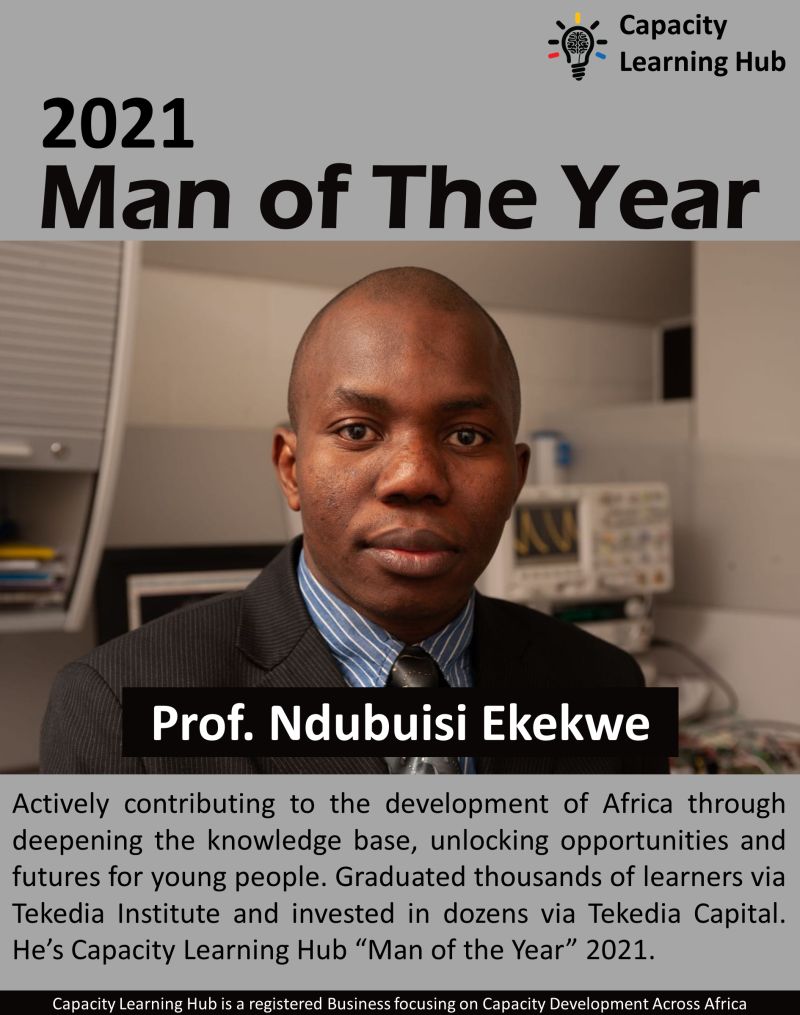

Capacity Learning Hub Honours Ndubuisi Ekekwe As “2021 Man of the Year”

Tekedia Businessperson of the Year 2021 is Cornelius G. Vink of TGI/ Titan Trust Bank

I was to end the year 2021 without naming any business leader in my yearly Tekedia Businessperson of the Year. The fact is this: while there was effervescence here and there, there was no clear person in Nigeria I would have bestowed the honour for 2021.

Sure, the startup founders raised money. But generally, as a village boy, I have never used raising money as a demonstration of broad excellence. I see it as I Owe You to investors, and until there is a great exit, I do not anoint anyone. And I think I am correct: old Konga raised close to $100 million and still “failed”!

So, with the startups out, I waited to pass this Tekedia tradition. But magically, the Union Bank acquisition by Titan Trust Bank came from nowhere. And I felt that any human who orchestrated for a two-year bank (not sure I have ever said Titan Trust Bank before) to acquire one with more than a century of tradition should be unique.

After doing all my research, I have found the businessman behind the deal. Cornelius G. Vink (MFR) is the Chairman and Founder of TGI. TGI is a conglomerate and an investment powerhouse. It is not new in Nigeria but buying Union Bank is a clear ascension. TGI itself is owned by Vinc Corporation which is a foreign company.

Vinc Corporation controls about 24 companies in the expansive conglomerate empire, out of which Chi Limited that was recently sold to Coca Cola for $1 billion. This company is in every sector.

For that, Cornelius G. Vink (MFR) is Tekedia Businessperson of the Year 2021.

Titan Trust Bank Acquires 89.39% Majority Stake in Union Bank Nigeria

Why Magodo Residents are currently running Kiti kiti, Kata Kata

On Tuesday, been the 21st of December, 2021, residents of the Magodo Phase 2 Estate in the Shangisha area of Lagos State woke up to see the estate gates locked; no one was allowed access in and no one was allowed access out, at the outside of the gate is parked loads of demolition trucks, bulldozers and caterpillars. Manning those heavy duty equipment are policemen, area boys (thugs), court bailiffs and some other law enforcement agents. They were trying to gain access into the estate to demolish some buildings and properties which had been marked for demolition, by this reason, the estate residents and landlords in the estate decided to shut the gate in order not to grant them access or any other person access till the situation gets handled.

What led to this situation:

During the military government in Nigeria in the year 1984, the military government forcefully seized, demolished and acquired some land belonging to some indigenous people of the Shangisha area of Lagos state; currently where the Magodo phase 2 estate is located. Since the properties were purportedly acquired by the military government for “public use”, then the indigenous owners of the land couldn’t do anything because public use overrides personal use and a government; be it democratic government or military government can acquire and take over anybody’s property for public use.

The land which was purportedly acquired for public use was subsequently sold by the military to some government officials and to some other persons connected to the government for private use. This made the indigenous people of Shangisha that the land was snatched from by the military government to approach the court for redress. Praying the court for their land to be given back to them since it’s not longer to be used for the public benefit as it’s already been sold to private owners.

The matter lingered for many years in court and finally got to the Supreme Court and on February 10th, 2012, the Supreme of Nigeria decided in favor of the Shangisha Landlord association who were the original owners of the land that the military forcefully snatched from them in the year 1984.

Since 2012 that the dispute was finally decided by the Supreme Court, the Shangisha landlords association according to report have done all they could to get the Lagos state government to sign the writ of possession to enable them execute the Supreme Court judgment to enable them take possession of the property or the government finding another amicable way to settle them, but that all proved abortive.

On Tuesday, 21st December, 2021, they decided to come down with court bailiffs and some law enforcement agents to execute the court judgement and take possession with an inscription which reads ‘ID/795/88 Possession Taken Today 21/12/21 by Court Order,’ pasted on various property on the estate.

Take home lesson: Don’t buy any property (even from the government) without first consulting a lawyer so you don’t find yourself in this same situation like the Magodo residents.

Visa Announces Plan to Incorporate Crypto to Facilitate Easy Payments

Visa is taking a new approach to its payment business that will involve incorporating cryptocurrency to facilitate cheaper and faster cross-border payments. This is coming a month after Amazon cut ties with Visa UK, over high cost of transaction fees.

In an interview with NDTV, Cuy Sheffield, Visa’s head of crypto, said the payments giant has partnered with about 60 leading crypto platforms “to launch card programs that make it easy for consumers to convert and spend digital currency at 80 million merchant locations worldwide.”

“We’ve built a lot of momentum in this space, and we’ll continue to support the crypto ecosystem in several ways,” he said.

In November, Visa suffered a huge blow following Amazon’s decision to no longer accept UK-issued Visa credit cards from Jan. 2022. Amazon said that technology advancement should be making payment processing fees reduced, instead of increasing it.

Visa’s rival, Mastercard, has been onboarding crypto firms to accommodate the effects of decentralized finance (DeFi), which has removed the cost emanating from intermediary fees on processed transactions. Visa appears to have learned a vital lesson from Amazon’s incident, and it is therefore speeding the pace to tag along the blockchain-powered crypto industry that is changing the world’s financial ecosystem.

“At Visa, the scale and scope of our work in crypto has grown dramatically. The number of people cross-functionally at Visa working on crypto in some capacity is now in the hundreds — up from just a handful of employees. And we’ve more than doubled our number of partnerships with crypto platforms in the last 18 months — up to 60 partnerships today,” Sheffield said.

He explained that Visa has partnered with more than 60 of the leading crypto platforms, like FTX, Blockfi, Crypto.com, Coinbase, and Binance, to launch card programs that make it easy for consumers to convert and spend digital currency at 80 million merchant locations worldwide.

“Crypto-linked cards make it easy for consumers to convert and spend digital currencies, without requiring coffee shops, dry cleaners, or grocery stores to directly accept crypto at the checkout,” he continued. “All the conversions from crypto to fiat happen instantly, behind the scenes. In-store, online, it’s as easy as a standard Visa transaction,” he said.

Visa announced the launch of its crypto advisory services in early December, which is expected to be available in territories where its payments services are available.

India is a huge market for Visa, but the government has been making moves to outlaw cryptocurrency, following China’s steps. The situation poses a big challenge to Visa’s crypto incorporation plan.

When asked if Visa’s crypto services will cover India, Sheffield said that “Visa aims to provide our crypto advisory services to clients globally wherever there is interest, and currently, we offer services in markets where the regulations permit such transactions.”

Sheffield said Visa will build on existing crypto momentum that it has garnered to serve its network booming with millions of merchants.

“At the end of the day, we want to serve as a bridge connecting the crypto ecosystem with our global network of 80 million merchant locations and more than 15,000 financial institutions,” he said.

The Egoras Business Model And Building A Quant Team

Let me share this as 2022 arrives. It is largely to inspire and motivate young people to organize themselves and look for complementary skills as they seek opportunities in markets.

Egoras team began with a business model which originally struggled. They wanted to pivot to something new. But to do that, there were many unknowns: how can you offer interest-free loans and still make money? They invented inventory fees. To model the risk and potential returns, young people with understanding of calculus were brought in.

It is that season of business reviews. This one is one of the fastest growing startups in Nigeria today. Ugoji Harry and the whole team are doing an amazing job, for pioneering a new business model, and the customers have responded well. And in less than 6 months, it has grown from 4 staff to over 100. Egoras offers “Interest-Free Loans” backed by physical or crypto assets within minutes; you only pay inventory fee. Phones and accessories go for $0.37 per day; Refrigerators for $0.49 – $0.98, etc on fees.

They were to solve many equations which were largely: minimize risks while maximizing returns while keeping prices at a range that the market would like. With dozens of variables – asset type, asset age, asset value, income, etc- to feed into the model, the optimization equation was a good one for a master’s degree.

As the numbers were coming, they started pushing products to the market. Today, Egoras has a sweet spot, growing from 4 to over 100 team members in months. It will open in Enugu on the way to Onitsha, Aba, Osogbo, etc in coming months.

This is the lesson: you can code but can you solve the equations? Would you hire that brilliant math graduate to help? Ugoji Harry likes his engineers and he also admires the mathematicians who are building the models. Of course, he is happy that he has a good math teacher as an advisor!