Jumia has assets and some of the best in continental Africa. But Jumia also has natural competitors when its best customers are being pulled down by economic gravity. For Jumia to outperform, it has to deal with the double whammy of economic paralysis in its major market (Nigeria) and currency deterioration affecting marketplace players who import most of the things listed therein.

As the customers become pulled down by economic weights, they move informal, patronizing open markets, which most times do not charge VAT, artificially making their products cheaper. These factors continue to affect the results.

Jumia Technologies (NYSE: JMIA), the e-commerce leader in Sub-Saharan Africa, missed revenue estimates for the second quarter by 7%, showcasing revenue of $40.2 million, and slightly beat the loss prediction of analysts. Jumia reported losses of $0.41 a share for the quarter. Wall Street had predicted a loss of $0.44 per share on revenue of $43.3 million for the quarter.

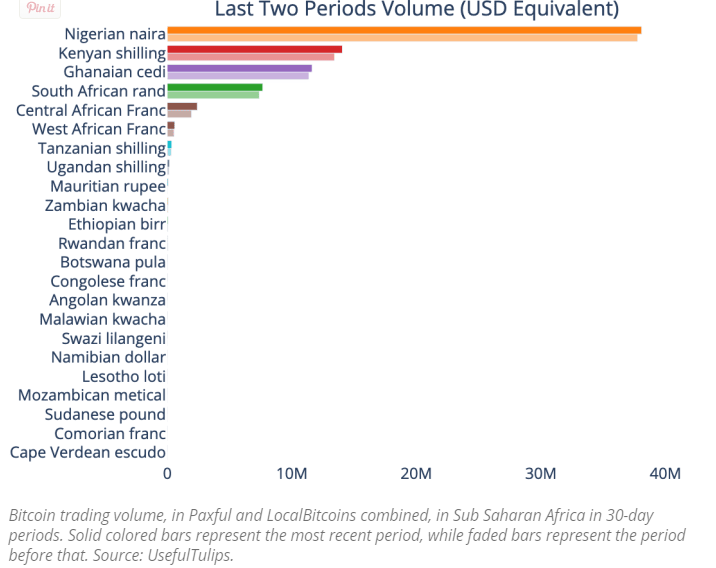

I see three key areas in Jumia business: JumiaPay, fashion and food delivery. If I have to speak to the Jumia board, I will ask it to make JumiaPay its core double play, feeding from the one oasis of the Jumia marketplace.

My proposal would be to have a holding company where Jumia can run JumiaPay as a quasi-fintech which becomes open to non-Jumia customers. With a microfinance bank license, it would become a digital bank. The goal is total fintechnolization of the Jumia platform where lending and other financial services can happen at scale.

African-focused e-commerce giant Jumia reported revenues of $40.2 million in Q2 2021, up 4.6% year-over-year. Jumia’s operating loss, which declined in Q1 2021, increased 24.7% to $51.6 million in Q2 2021. The company says transactions on JumiaPay increased by 12% from 2.4 million in the second quarter of 2020 to 2.7 million in the second quarter of 2021, making it the fastest transactions growth rate over the past four quarters. (Techloy)

If Kuda has 1.4 million customers and is valued at $500 million, Jumia with an excess of 10 million customers should be more than the current $1.84 billion valuation. If you feed Jumia logistics, food delivery and fashion (wigs, etc) into JumiaPay, agnostic of platform, you have one of the largest fintechs in Africa. That alone should be more than $2 billion. Then add the pieces and you have a great holdco which Wall Street will connect.

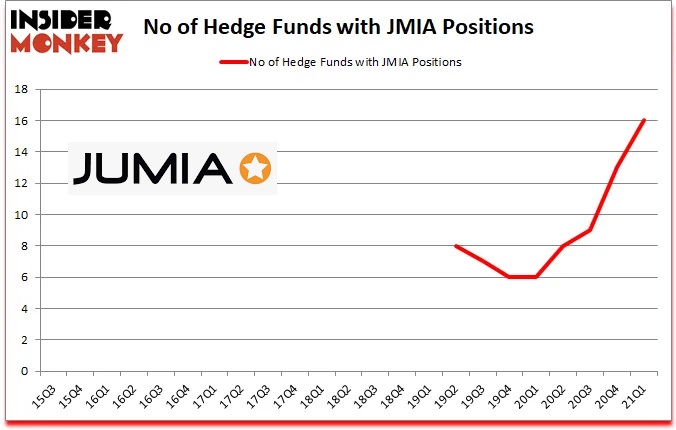

The hedge funds think this company can outperform. I do believe it since Jumia added JumiaPay. But it needs to allow that piece to fly. And if it does, Jumia will have a great party. No one has made money directly on ecommerce in the emerging world; you always use it to capture value via other verticals.

Jumia should be worth at least $7 billion in America!

LinkedIn Comment on Feed

Comment #1: Although Jumia has the core advantage of the eCommerce platform to draw traffic to its payment application, the truth is that the space JumiaPay operates in is one of the most competitive in the Nigerian fintech space – a space where most big players primarily have strong customer acquisition points, but rarely a distinctive unique value proposition.

Customer Apathy is a real thing, and while JumiaPay may look promising, there’s nothing that guarantees that people who download the app for eCommerce purposes will use it for payments also, considering they already have what they originally use and eCommerce is really not something you do everyday.

In the long run, I see Jumia’s logistics business as it’s core advantage, with a good network and a couple of partnerships here and there, Jumia could position itself as the logistics operating system for all things eCommerce in Nigeria, and probably Africa.

The logistics space is Lagos is saturated, however, most players can’t properly connect Nigeria and this is where Jumia can position itself. Gokada is probably one of the smartest players in the Lagos logistics space; real time tracking, strong B2B model etc. Jumia can borrow some leaves from their booklet and connect nationally.

My Response: Get a microfinance license, send N500 awuuf for anyone to click a button to have a Jumia bank account, tomorrow report that your digital bank has 10 million users. Offer 10% discount for paying with a Jumia Bank account instead of Visa/Mastercard cards. Save those fees. That loop will feed food delivery which happens often, logistics, etc. Thenopen it for other players. If they use, their users save 5% via in-merchant fees. This is fintechnolization: JumiaPay will have the largest customers in Africa and will become the category-king on day one. It has brand recognition already.

Comment #2: Great point, but incomplete picture?

Jumia’s brand assets are built on customer relationship, and Jumia has a very low brand score on this.

Jumia borrowed Amazon’s playbook to play locally, but Jumia missed what made Amazon Amazon – CUSTOMER FIRST. Ask the so-called “online Nigerian buyer” to choose between between “faraway Amazon” and “backyard Jumia”, and they will choose Amazon without blinking an eye.

Jumia is a great company, but I think they missed out Amazon’s page on “customer first.” For reasons unknown, Jumia has allowed “bad sellers” to corrupt its “customer relationship engine.”

Customers are still complaining bitterly on how they bought a particular product spec, colour and size on Jumia, only to receive something totally different from what they ordered.

To make Jumia Jumia, Jumia should:

1) Take out the bad apples by creating some sort of quality assurance/ customer service feedback program.

2) Apologize to the millions of customers they’ve hurt or allowed to be cheated by these bad sellers.

3) Get customers to verify this – thanks to cheap social media.

Until they do this, Jumia will only be casting a long shadow…

One that might come back to haunt it.

Like Beowulf’s monster…

Response: “Jumia borrowed Amazon’s playbook to play locally, but Jumia missed what made Amazon Amazon – CUSTOMER FIRST.” – that may not be fair. Unlike Amazon, Jumia runs its own postal service, security, waterboard, etc and does not get free cash via Amazon Prime. Jumia is doing well; try to run a business in Nigeria where some of these delays can be caused by Lagos 5-hour traffic for a trip planned for 25 minutes. While Jumia has to improve but I tell you one thing: running a delivery business in Nigeria without a postal service cannot be like America with a working postal service.