Tekedia Institute believes that by Q4 2022, the Central Bank of Nigeria will sell forex (US dollars, GBP, Euro, etc) directly to Nigerians and companies via the e-Naira digital currency. Our expectation is that once e-Naira is stabilized, Nigerians will have quasi-accounts with CBN with all information populated from their BVNs (bank verification numbers).

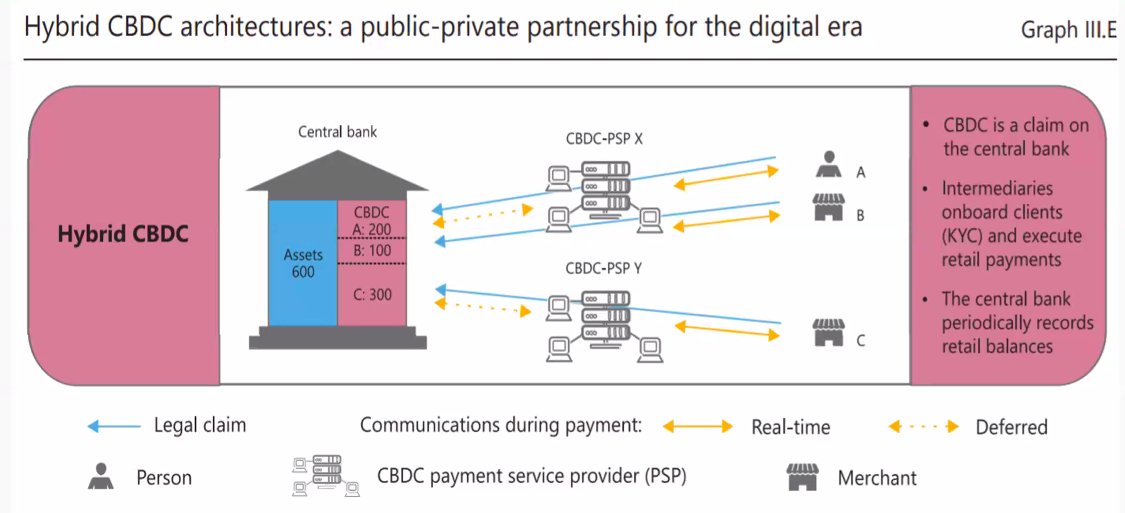

E-Naira, a central bank digital currency (CBDC), is virtual money backed and issued by central banks. As cryptocurrencies and stablecoins have become more popular, the world’s central banks have realized that they need to provide an alternative—or let the future of money pass them by. Nigeria is expected to pilot e-Naira from October 2021.

Specifically, CBN will use that regime to directly manage disbursement of forex. Forex management remains one of the most challenging things in Nigeria today. And the apex bank has lost confidence in many of the players and wants to engineer a new future for Nigeria. If all goes well, every forex bought in Nigeria could be traceable, deepening transparency while reducing abuse.

Yes indeed, since Nigeria does not use US dollars in Aba, Alaba, Kano, Uyo, markets, there is no reason to sell it on the streets. For those traveling and coming into the nation, e-Naira will simplify that process. Technology is known to reduce frictions; e-Naira offers a promise to do that in the forex space in Nigeria.

Watch this video where Tekedia Mini-MBA had a conversation on CBDCs – we just decided to make it public for the community.

Through CBN, your bank can debit your Naira account and give you credit for USD. And when visiting from abroad with USD, you can also get value in Naira if you want. But where you have no bank account, the unlicensed bureau de change (BDCs) can still serve you. While BDCs have not been banned, they are not getting US dollars from the government.

What we expect to happen is that over time, with your NIN and BVN, you can connect to e-Naira irrespective of location. Today, you can wire funds from Citibank bank account in New York to your Nigerian bank account via fintechs. The destination is evident: by Q4 2022, the Central Bank of Nigeria will exchange US Dollars and other key foreign currencies directly with Nigerians and companies via e-Naira digital currency, with only marginal support from commercial banks.

This is going to become a major disintermediation as the apex bank looks for ways to be in control of forex management in the nation. Yet, the risk remains since banks must keep deposits to have resources to lend to customers: “Magically, if people cannot borrow from banks because the money is in the CBN vault, the economy will crash as we cannot have growth. I do expect the CBN to cap how much people can keep in e-Naira; otherwise, our economy will fold.”

There is a massive promise on the ascension of a digital currency, e-naira, in Nigeria. But e-Naira can also crack Nigeria’s economy. I have a 25 document which I have been creating on E-Naira as I continue to evaluate the opportunities and risk. The fact is this: if E-Naira launches, expect everyone to move his or her money from retail banks to CBN (Central Bank of Nigeria) – and if that is the case, retail banks will have limited money to lend, freezing banking as we know it.

Yet, this will not save Nigeria’s economy. But effective forex management can improve the efficiency of the utilization of factors of production which can boost production in the nation. It is only when we have done that right – the ability to make things in Nigeria – would we expect the rise of Naira. I just believe that the apex bank is looking for paths to support manufacturers, and if this redesign can bring transparency and stabilize the Naira, that would be good. I expect the Naira to lose value in the next coming months, but by mid 2022 to begin to fully stabilize due to structural changes on demand and supply equilibrium which e-Naira will cushion.

In Tekedia Mini-MBA edition 6, we will discuss these issues through a Special Case Study I have developed: Business Opportunities in the New Era of Sovereign Digital Currencies like e-Naira, e-Euro, e-Yuan and e-Dollars – Prof Ndubuisi Ekekwe. I invite you to join us.

Update – The Naira will not come down to N423/$ since what makes the Naira go up is not fully under the control of banks and the CBN HQ. The warehouses and factories (modern and old types) need to wake you, posting exports to help Naira. Without them running, Naira will continue to underperform despite any financial engineering in CBN. Yet, recent policy by CBN will help the Naira to stabilize despite any short-term spike.

The Bankers Committee of Bank Chief Executive Officers, headed by the Chief Executive Officer of Access Bank, Herbert Wigwe, has assured Nigerians that the exchange rate will drop to around N423 to a dollar. The Committee of Bank CEOs addressed the media on Thursday following the halt in the sales of forex to Bureau De Change operators by the directive of the Central Bank of Nigeria (CBN). Addressing the question on the sharp spike which saw the dollar hit N523, the Chief Executive Officer of Guarantee Holding (GTCo), Segun Agbaje said: “What we saw in the market yesterday and today is an aberration. “The rate will come down. Very soon, you will buy at N423 or N425 at most.”

No Future for BDCs As E-Naira Arrives And Central Bank of Nigeria Goes Retail