In a surprising move on Friday, the Central Bank of Nigeria ordered all banks in the country to close all accounts conducting crypto related transactions.

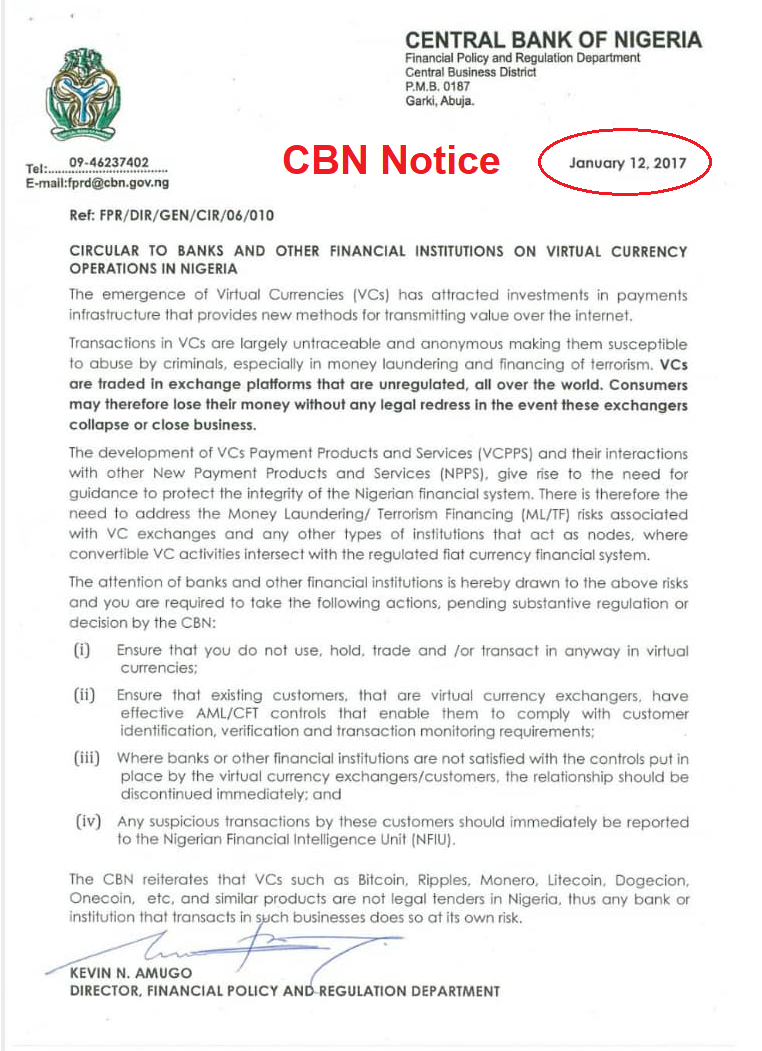

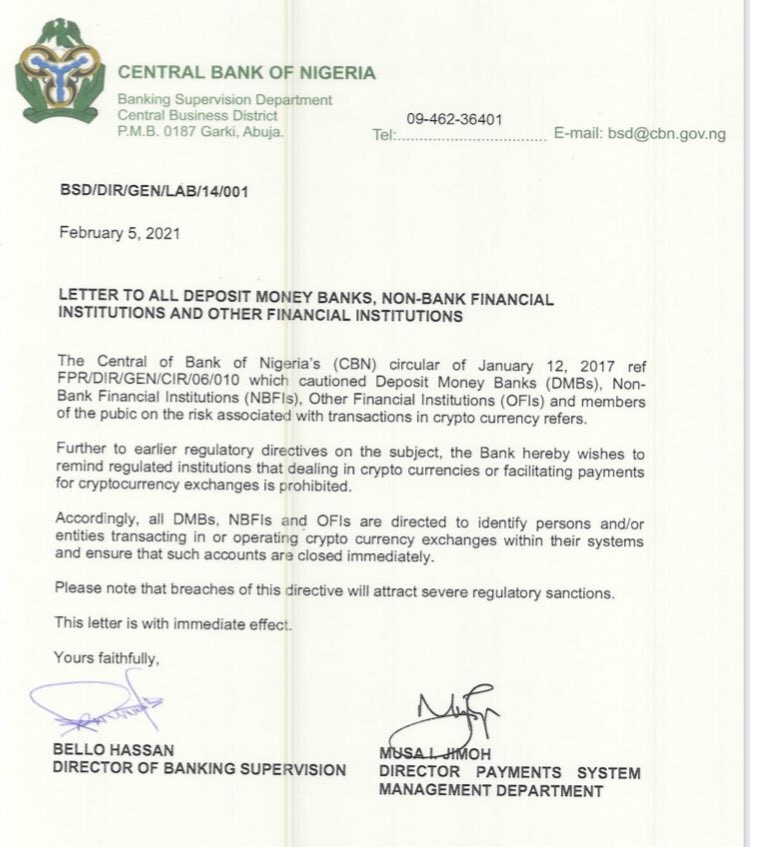

A circular which was allegedly shared by the apex bank to all financial institutions in Nigeria made reference to 2017 circular by the CBN, which cautioned all Deposit Money Banks about the risks of crypto currency.

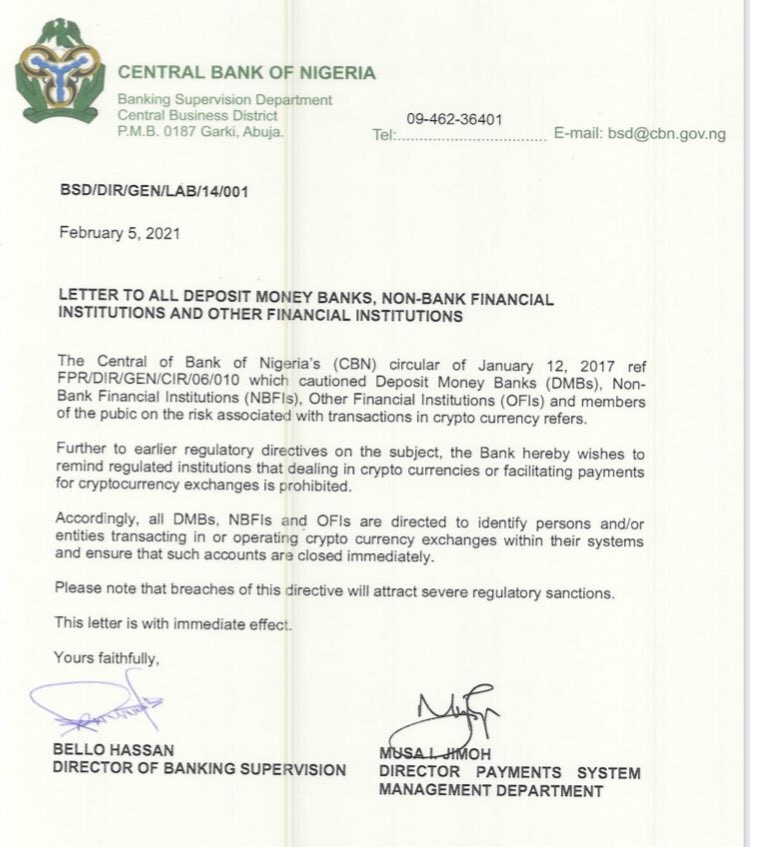

LETTER TO ALL DEPOSIT MONEY BANKS, NON-BANK FINANCIAL INSTITUTIONS AND OTHER FINANCIAL INSTITUTIONS

The Central of Bank of Nigeria’s (CBN) circular of January 12, 2017 ref FPR/DIR/GEN/C1R,06/010 which cautioned Deposit Money Banks (DMBs), Non-Bank Financial Institutions (NBFIs), Other Financial Institutions (OFIs) and members of the pubic so the risk associated with transactions In crypto currency refers.

Further to earlier regulatory directives on the subject, the Bank hereby wishes to remind regulated institutions that dealing in crypto currencies or facilitating payments for cryptocurrency exchanges is prohibited. Accordingly, all DMBs.

NBFIs and OFIs are directed to identify persons and/or entities transacting in or operating crypto currency exchanges within tier systems and ensure that such accounts are closed immediately. Please note that breaches of this directive will attract severe regulatory sanctions. This letter is with immediate effect.”

Since the EndSARS protest, which was funded through cryptocurrency donations to evade government’s clampdown on the protest, the Nigerian government has intensified efforts to curb the use of the digital money in the country. To beat the government’s clampdown during the protest, the innovative young minds switched to bitcoin to receive donations. Bitcoin accounted for nearly $400,000 raised in donations.

Consequently, it appears that the CBN has ordered all commercial banks to close all accounts belonging to crypto exchanges and other businesses transacting in cryptocurrency, in a bid to curtail future events such as the protest that could be funded through cryptocurrency.

The shocking move has been widely condemned and described as draconian and unprogressive.

Nigeria ranks tops among the countries using cryptocurrency. In December, Bitcoin trading platform Paxful analyzed the coins transaction flow for the past five years (2015-2020), to find that Nigeria traded more than $566 million worth of bitcoin during the period. It thus becomes the world’s second largest peer-to-peer (P2P) bitcoin market after the U.S. which traded $3.75 billion in the same period.

Paxful’s analysis noted that Nigeria traded the equivalent of 60,215.7 BTC, a transaction record that puts it ahead of other countries apart from the United States with trade volume of 535,660.3 BTC.

Nigeria’s highest volume of trade was recorded in 2020 during the lockdown when a 30% spike was recorded. Paxful said between January to September, it recorded a 137% increase in new registrations from Nigeria.

The interest of Nigerians in cryptocurrency has recorded unprecedented upsurge recently. In September 2020, the Nigerian Securities and Exchange Commission (SEC) had recognized bitcoin as an asset, which led credence to the involvement of many more Nigerians in the trade and transactions of cryptocurrency.

Paxful’s co-founder and Chief Executive Officer Ray Yussef had attributed the high volume of cryptocurrency transactions in Nigeria to cross-border challenges that the West African country has been facing.

“Africa’s largest economy has problems and restrictions in sending and receiving money from inside and outside its borders,” he said.

Nigeria has strict money laundering laws that bitcoin has helped individuals and businesses to beat. It is believed to be among the reasons the central bank has ordered the financial institutions to close the accounts of those dealing in digital currencies, as there is no other way to stop the growing momentum.

“People want to be able to buy and sell, transact internationally and the more the traditional channels are being restricted the more people trade crypto and mainly bitcoin. And the best thing about it is that it’s almost impossible to stop. If you block the exchange it moves to peer-to-peer platforms that are non-custodial,” said Eleanya Eke, co-founder of BuyCoins Africa last year.

With this move, the Nigerian government, who has been advised to develop a regulatory framework that will guide the use of cryptocurrencies in the country, has taken food off the table of many Nigerians who trade cryptocurrencies for a living, and may have sounded a warning that the most populous Black nation in the world is anti-progress.

On Thursday, the world richest man Elon Musk, in a series of tweets hailed bitcoin as the future, and admitted that he’s “late to the party.”

With Nigeria’s government clamor for foreign direct investments, the move to ban cryptocurrency in the country sends a message many investors don’t want to hear.

Like this:

Like Loading...