Crypto markets are coming into a renewed phase of power as capital rotates back into foremost altcoins and investor sentiment improves across the board. Ethereum, Dogecoin, and Shiba Inu are all displaying sturdy setups for potential breakouts, with technical structures, liquidity levels, and network momentum aligning for a promising rally.

Yet even as these popular assets gear up for meaningful gains, analysts widely agree that Ozak AI is the project with the steepest long-term trajectory. With early-stage pricing, deep AI-native infrastructure, and accelerating global demand, Ozak AI is increasingly viewed as the next real 100x contender of the upcoming cycle.

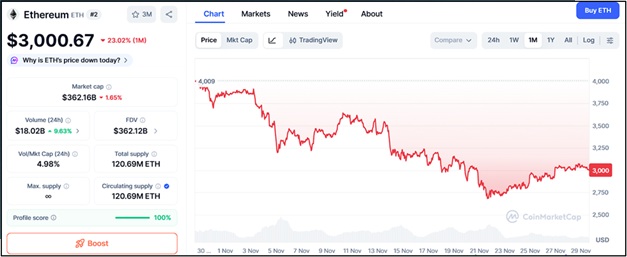

Ethereum Builds Toward a Strong Bullish Continuation

Ethereum (ETH), trading around $3,000, continues to bolster structurally as network interest rises and institutional adoption grows. ETH maintains reliable aid at $2,925, $2,785, and $2,640, zones in which buyers always acquire at some stage in market pullbacks. These levels highlight the confidence surrounding Ethereum’s function as the backbone of DeFi, tokenization, and Layer-2 scaling ecosystems.

For Ethereum to extend into its next major upside move, it must break resistance at $3,115, $3,260, and $3,410. Historically, when ETH clears these thresholds, it enters sustained, multi-week expansions driven by increasing transactional activity and rising staking demand. Ethereum is widely expected to push much higher during the next cycle, but its large market cap limits its ability to deliver anything close to a 50x–100x multiplier.

Dogecoin Shows Renewed Strength as Meme Liquidity Returns

Dogecoin (DOGE), buying and selling close to $0.1492, is gaining momentum again as the meme-coin hypothesis reawakens throughout the marketplace. DOGE maintains to hold strong support at $0.1451, $0.1386, and $0.1324, levels that reflect strong network-pushed accumulation and renewed hobby within the meme coin.

For DOGE to interrupt into a deeper uptrend, it needs to push above resistance at $0.1563, $0.1641, and $0.1745. Clearing these stages has traditionally brought about fast movements fueled by way of social sentiment spikes, celeb mentions, and retail-driven inflows. While Dogecoin may supply powerful short-term pumps—probably even a multi-x rally—its dependence on sentiment and its market length obviously limit its long-term multiplier potential.

Shiba Inu Prepares for Another Upside Attempt

Shiba Inu (SHIB), hovering around $0.000008521, is likewise displaying renewed energy as Shibarium improvement expands and retail investors return to high-volatility property. SHIB sits firmly above aid at $0.00000826, $0.00000795, and $0.00000768, zones wherein the market continually steps in to build up.

For SHIB to accelerate into a breakout, it must clear resistance at $0.00000882, $0.00000910, and $0.00000942. Once SHIB flips these zones, it often experiences sharp, sentiment-driven expansions. Analysts believe SHIB could produce a strong rally in the next phase of the cycle—but, like DOGE, its large established valuation limits its odds of achieving exponential returns.

Ozak AI Emerges as the Most Powerful Long-Term 100x Project

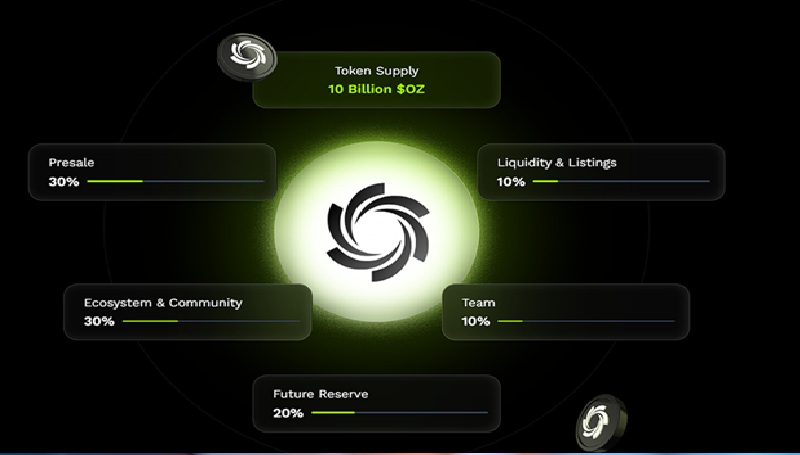

While Ethereum, DOGE, and SHIB may all pump strongly, Ozak AI (OZ) is the project capturing the most attention for long-term exponential gains. Unlike meme coins or large-cap platforms, Ozak AI is built on real, scalable AI-native infrastructure designed to upgrade Web3 intelligence, trading, analysis, and automation.

Ozak AI integrates millisecond-speed prediction agents capable of real-time market scanning, cross-chain analytics engines monitoring multiple networks simultaneously, lightning-fast 30 ms trading signals via HIVE, and autonomous SINT-powered AI agents capable of executing tasks, trades, and voice-driven commands. This positions Ozak AI as a next-generation intelligence layer rather than a speculative token.

Because Ozak AI is still early-stage, with a small initial valuation and massive real-world demand, analysts believe its growth curve is far steeper than any major altcoin. It sits at the core of the rapidly accelerating AI revolution—a sector expected to become one of the defining technological forces of the decade.

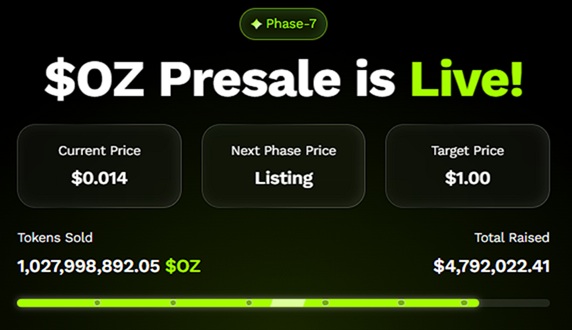

Presale Momentum Confirms Ozak AI’s Explosive Potential

The Ozak AI presale reinforces its 100x potential, with over $4.7 million raised and more than 1 million tokens sold. This level of early global demand mirrors the early patterns of past bull-market leaders that went on to deliver extraordinary gains. Because Ozak AI offers real utility, not just hype, analysts see its multiplier potential as significantly higher than that of ETH, DOGE, and SHIB.

Ethereum, Dogecoin, and Shiba Inu are all showing strong signs of upcoming growth, supported by robust technical structures, improving sentiment, and strengthening ecosystem fundamentals. Each could deliver meaningful gains in the next cycle.

But Ozak AI stands apart as the most promising 100x candidate, driven by real AI-native utility, early-stage affordability, and explosive presale traction. As AI becomes the dominant force shaping the future of Web3, Ozak AI is emerging as one of the most compelling long-term opportunities in the entire market.

About Ozak AI

Ozak AI is a blockchain-based crypto assignment that provides a generation platform that specializes in predictive AI and superior information analytics for financial markets. Through machine gaining knowledge of algorithms and decentralized network technology, Ozak AI permits real-time, correct, and actionable insights to assist crypto fanatics and businesses in making the proper selections.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi