Nigeria has one major decision to make – how to keep the NAIRA stable. That is the unified growth strategy for that nation as nothing else matters. If we cannot keep the Naira stable, we have no economy. I am not writing as an economist (I am not one); I am writing as a business owner, employer of labour, and a proud Nigerian. In all the conversations I have about market systems in Nigeria, the one issue which typically comes up is this: “what would happen to the Naira?”

That layer distorts everything, pushing demand and supply models of fixing market frictions, by finding and unlocking opportunities in the market, into something no one has any firm control over. The gyration of the Naira is a national security and economic threat in Nigeria.

Nigeria will not have any sustained growing economy until we can fix the Naira. Doing that requires making hard decisions which no one has shown the character to do. It is very offensive to the Nigerian people that we have accepted that the Naira MUST be losing its value seasonally since the 1980s. This is a nation of smart men and women, but we have failed the most important symbol and asset of our economy. The struggle of Naira is a national calamity and a disgrace to our generation. There is no reason we should put Naira in this position.

In the United States, the Federal Reserve, their version of the Central Bank of Nigeria, has two main core roles: keep the U.S. dollars stable (by reducing inflation) and maximize employment through interest rates. Magically, the Federal Reserve uses all the tools in its power to make sure the value of the US dollars is predictable, and stable, and based on that, markets can function. Yes, players can enter into contracts with the market makers, mainstreet merchants and rainmakers having good night sleeps.

As they do that, they also ensure they use interest rates to boost employment by adjusting the cost of capital. When the interest rate is high, the cost of capital goes high and that affects borrowing which can affect investment and then employment. It plays that game, mixing high and low rates to ensure the economy is not too hot or cold.

For Nigeria, we are not even working to fix employment. That means, we need to fix and stabilize the Naira. Interestingly, if we do that, magically, the employment rates will improve in the nation. I know more than 50 people who will invest in Nigeria if you guarantee them that Naira will hold stable for five years. I am invested in more than 15 Nigerian companies and startups (excluding listed public companies). I do them to support the nation but my case is easy as I am a Nigerian; I would be fine with tons of Naira with no need to repatriate the proceeds back to the US. But for foreign investors, they do not have that privilege, and that means a stable Naira is a necessity on their investment thesis. We need to offer that stable Naira.

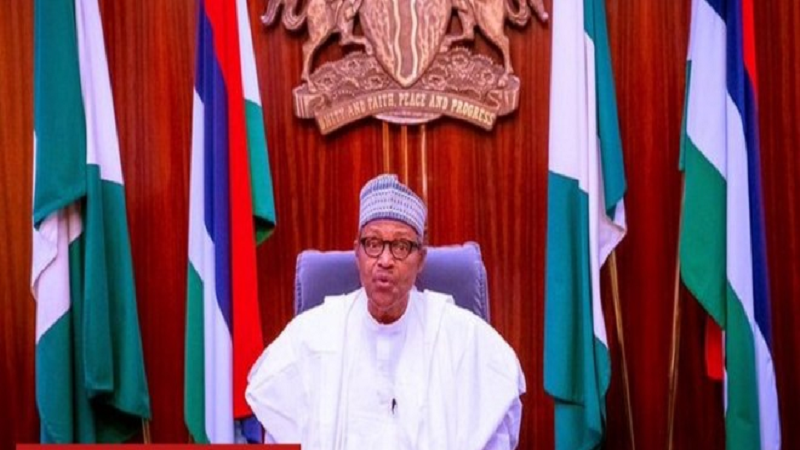

I call on the President, Vice President, Finance Minister and the Central Bank Governor to sit down and get orthogonal thinkers and find a solution to this national security threat. We have great minds in Lagos, and it is time we try new things. We are wasting a generation with the state of the economy which we can link to the inability to stabilize the naira. Everything depends on Naira!

Comment on LinkedIn Feed

Comment: Ndubuisi, I understand your point. However, I disagree strongly with that position. The Nigerian economy doesn’t depend on the Naira as much as Naira depends on the Nigerian economy.

What’s happening to Naira is a secondary problem emanating from a failing economy. Fix the economy and Naira will fall in line. While Naira is the currency of the Nigerian economy, it is the economy that however drives the currency. Not Vice versa, which is what you stated.

Once there’s a more robust, productive and competitive Nigerian economy, there’s going to be a rising demand for exports and hence the currency. But the continuing failure to address the fundamental and primary economic policy issues in Nigeria will reverberate in a ceaseless worthless and depreciating Naira.

My Response: There is really nothing you disagreed with technically. You look at the issue from the Left while I might have looked from the Right. A “robust, productive and competitive Nigerian economy” will NEVER happen until you can stabilize Naira, and Naira cannot be stabilized until you have a “robust, productive and competitive Nigerian economy”. We are saying the same. When I write, I like to use a known element which everyone can relate with: we see Naira and touch it unlike the economy

Comment: here is. You’re focusing on a secondary problem – the currency that depends on the primary issue – the economy. Nigeria’s fiscal policies are rudderless. As such, their monetary policies alone cannot move any economic and currency needles. Currency or monetary policies are effective when the economy is almost functionally and fundamentally stable. And Nigeria** is far from there.

But to cut you some slack, stable economies use a combination of fiscal and monetary policies to stabilize both their economies and currencies. But to propose a fix on the currency without having to first build a stable economy will just be wishful thinking. **corrected from Niger.

My Response: “But to propose a fix on the currency without having to first build a stable economy will just be wishful thinking.” If you remove the double Naira exchange window, investments will arrive Nigeria in tons from tomorrow. That is policy and which can help the economy. My point remains that it is far easier to have a policy that boxes the Naira than one that boxes the economy. It is nearly impossible to “build a stable economy” when investors cannot invest due to a failing currency.

I will pick my luck, work on removing double exchange, and then move up to fix the economy. Your proposal of fixing the economy even in a double exchange regime is your call: I do not think it can come first because it has never worked anywhere on earth.

“You’re focusing on a secondary problem – the currency that depends on the primary issue – the economy. ” In US, China, and Europe, that is true. In Nigeria, the economy depends on the Naira. Check the data: FDI fails when Naira has the highest variance. Nigeria has the highest per capital income of $2563.90 in 2014 when currency was stable for years. When they moved it from N197 to N310, the economy went. Currency rules here and economy follows.