This is a big deal: Britain plans to ban the sale of fossil-fueled cars by 2030 and phase out hybrids by 2035. The implication is this: from 2035, if they follow through, no one can make cars with petrol in the United Kingdom. In the United States, the success of Tesla has shown that Wall Street has made a decision: the future is electrons, and not carbons, when it comes to automobiles. In China, companies like NIO are changing the ordinance of the competition.

Britain will ban the sale of new gasoline and diesel cars by 2030, a decade earlier than its previous commitment, the prime minister said Tuesday. Boris Johnson made the pledge as part of plans for a “green industrial revolution” that he claims could create up to 250,000 jobs in energy, transport and technology.

The government said sales of new gasoline and diesel cars and vans will end in 2030, though hybrid vehicles can be sold until 2035. The plan is five years more ambitious than the one announced by California’s governor in September, which will see the sale of new gas-powered passenger vehicles banned from 2035.

Automakers have expressed concern about the target, saying the previous goal of 2040 was already ambitious

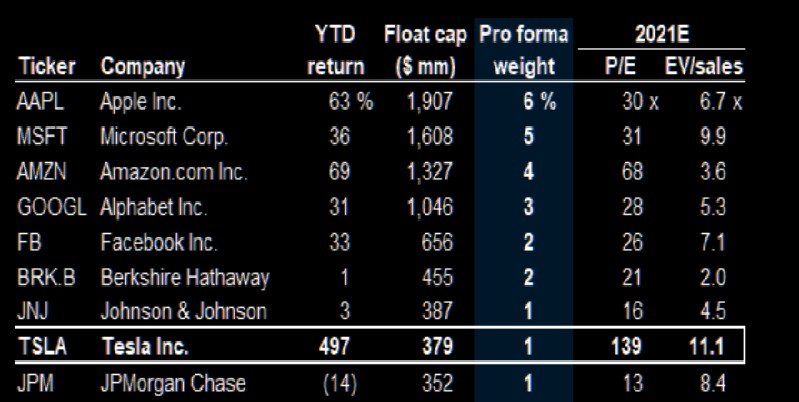

Today, the founder of Tesla, Elon Musk, can buy Porsche, Ferrari, Renault, Peugeot, Aston Martin and Fiat with the portion of Tesla he controls; I did not say Tesla could afford. What that means is that Tesla has grown in value and has morphed into the types of multiples you see in software companies.

As I have noted, I see Tesla as the only current “automobile” company in the world that has a clear playbook to make, possibly, more money on software and services than actually on sales of metals packaged as cars. First, the company is piling tons of money from regulatory credits: “In their most recent shareholder update, Fiat Chrysler Auto disclosed that as of March 31, 2020, its agreements represent total commitments of €1.1 billion”. Yes, that was how much Tesla made from FCA for selling credits which could have expired!

Yet, while the world is moving to EV (electric vehicles), nations like Nigeria cannot adjust that fast since we do not even have electricity to charge smartphones yet. So, expecting that we can power these EV systems would be an illusion.

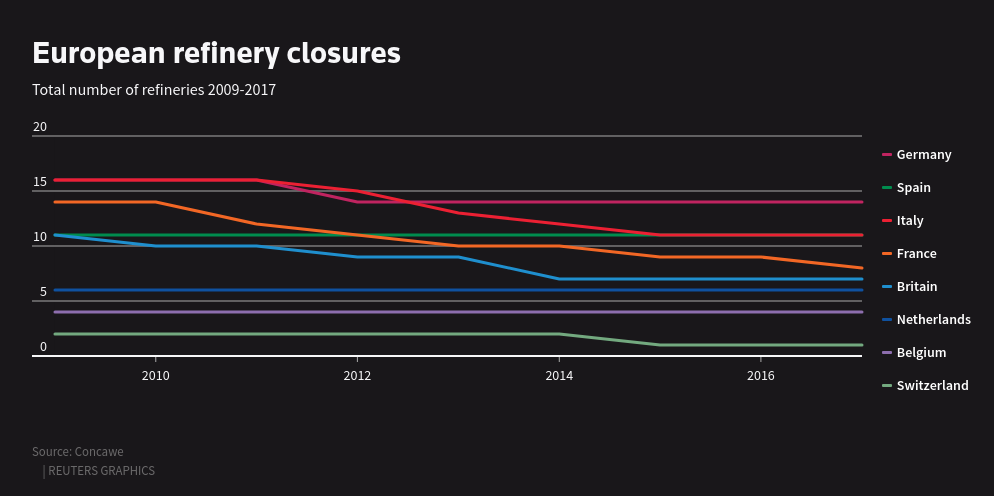

But here is the hard question: if the world’s leading governments ban selling of petrol cars, and with nations like Nigeria not having the purchasing volume to convince the automakers to keep making them, what would you think is the future of investing in refinery business in Nigeria today?

Sure, the next 25 years should be fine, but what happens after that if Toyota, Ford, Honda, etc are no more interested in producing petrol cars since the core markets that make them necessary and profitable have banned them? Likely, they will not be running those plants for countries like Nigeria since we do not buy a lot of new cars. More than 17 million new cars are sold in the U.S. yearly. Though data is scanty, I do not think Nigeria buys more than 200,000 new cars in a year.

Second only to China, the United States is one of the world’s largest automobile markets based on the number of new light vehicle registrations, with around 17.2 million new light vehicle registrations in 2018. However, of the 70.5 million passenger cars produced worldwide in 2016, less than three.