The World Trade Organization (WTO) has postponed a General Council special meeting on the appointment of the next Director General. The organization announced on Friday that the meeting, previously slated for Nov. 9, has been postponed until further notice due to “health situation and current events.”

“It has come to my attention that for reasons including the health situation and current events, delegations will not be in a position to take a formal decision on Nov. 9,” David Walker, General Council Chair of New Zealand said in a written statement to all members.

“I am therefore postponing this meeting until further notice, during which period I will continue to undertake consultations with delegations,” he added.

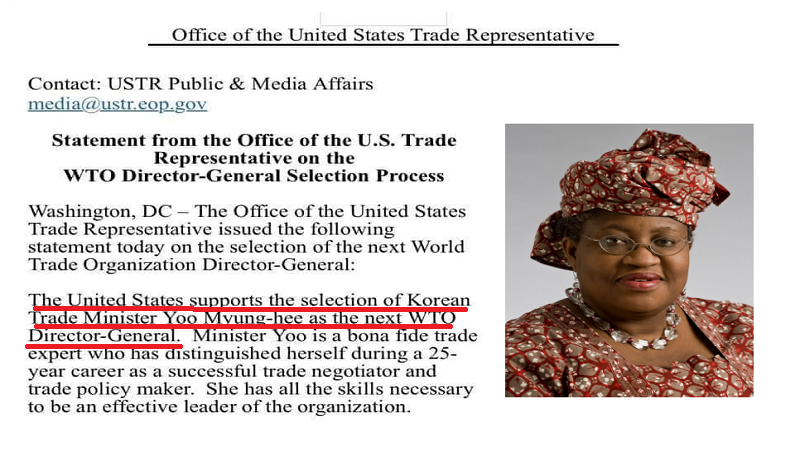

United States’ opposition to the appointment of Ngozi Okonjo-Iweala as the DG of WTO created an urgent need for meeting for the trade organization’s delegations. The US had vetoed her appointment on the ground that she lacks expertise in trade, preferring South Korea’s Yoo Myung-hee.

A statement from the US Trade Representative, which advises President Donald Trump on trade policy said Yoo had “distinguished herself as a trade expert and has all the skills necessary to be an effective leader of the organization.”

Okonjo-Iweala has the support of 164 members of the WTO, except the United States who has vowed to support its preferred candidate Yoo.

Nevertheless, on October 28, Walker told WTO members at a Heads-of-Delegation meeting that based on their consultations with all delegations, the candidate best poised to attain consensus and become the new Director-General was Ngozi Okonjo-Iweala of Nigeria.

“She clearly carried the largest support by members in the final round and she clearly enjoyed broad support from members from all levels of development and all geographic regions and has done so throughout the process,” Walker said.

In view of the US’ objection, the organization had scheduled Nov. 9 to set matters right in accordance with its constitution which requires that its 164 members appoint a Director-General by reaching a consensus.

Rockwell told reporters earlier that there would likely be “frenzied” activity to secure a consensus for Okonjo-Iweala’s appointment. She has the support of European Union.

Thus, the postponement of the Nov. 9 meeting till further notice suggests a strategy to beat the US hurdle. The World Trade Organization appears to be waiting for the outcome of the US election, hoping Biden’s presidency, who has made promises to support international organizations, would support the decision of other members of the organization.

The US President Donald Trump has been very critical of the WTO, describing it as “horrible” and accusing it of bias toward China.

As the votes count in favor of Biden in the US election, the World Trade Organization seems to be playing a waiting card and would likely reconvene next year, after Biden might have been sworn in.

Okonjo-Iweala who has responded to US’ objection to her appointment by referencing her works in trade and reiterating her readiness to lead the organization to great heights, expressed her gratitude for the WTO’s decision to postpone the meeting.

“Thank you WTO for today’s (Friday) step in the formal recording of my leading position as Most likely to Attract Consensus for WTO DG. Every step is important. Look forward to further progress at the appropriate time,” she said.