The Aftermath of the Violence and Massive Looting in Nigeria

“Sir, this year no balance o. There were only six months this year so I will pay half rent…Don’t worry sir, you can’t take me to court or call the police for me or even call the army because all of them are not working now.”

That was the banter I had with my landlord’s lawyer some days ago when he called to remind me that my rent will soon be due. We laughed over it and made more silly jokes about the current situation of things in the “post-protest-and-looting” Nigerian era. We actually had a lot of stories to tell concerning this point in time.

But I stopped laughing about our predicament when I left my house for my office. I stayed in a gridlock for about an hour and began to curse the absence of the traffic wardens. You might not believe me if I tell you that there was no reason for this traffic jam except that every driver wanted to be the first to cross a T-junction. We all wanted to get to our destinations in time and so everybody nosed his car into the road, hoping that the ones coming from the other directions will wait for him. But when everybody is in a hurry, no one gets to his destination on time. And so, we stayed on the road, cursing and abusing one another until military men from the 84 Division came to the rescue.

That moment I was stuck in the gridlock reminded me of the importance of law and order. I was not only afraid of being crushed by trailers struggling on the road with us but also scared that someone might reach out through the window and make away with my belongings. There was no police officer in sight and there was no one that would have stopped something sinister from happening. It was all man to himself. Everybody was on his own. The strong suppressed the weak and the big sat on the small. Nigerians really showcased their “talents” at that moment.

But gridlock is just one of the happenings in Nigeria today. Have you gone to market after the violence and looting that rocked the country? What can you say about the sudden surge in the prices of goods? Have you noticed something about certain food items becoming scarce all of a sudden? What can you say about onions, tomato puree (aka tin and sachet tomato), rice, meat, among others? Can we survive this one so?

What about obtaining cash? Have you noticed how POS centres are springing up left and right and centre within this past week? How much did you pay to withdraw money from POS? Here in Enugu we pay five to ten percent of the amount you are about to withdraw. It is more like buying cash these days. As for the ATM, we all know how they were vandalised. The ones that were still left standing were either not operational or loaded with little cash. It is so bad that by the end of the day, you might stay an hour on ATM queue and be told “Temporarily unable to dispense cash” when it comes to your turn.

The essence of stating these is just to reveal some of the aftermath of the violence and looting the country experienced the past week. The hoodlums and the looters first destabilised the security system in the country to make sure they will not be “bothered” as they carried out their operations. But the majority of us clapped for them and encouraged them. We thought they were dealing with the “government” forgetting that nobody’s name is “government” and that those things that were destroyed will be repaired with “our money”. Someone told me that those in authority will use the money they would have looted to fix the damages but she forgot that no one will force the government to fix them on time. Hence, we are going to “enjoy” the mess caused by our children until god knows when.

But the looting and damages on private properties is what many of us did not envisage. Like the Igbos say, “Onye nna ya ziri ori na-eji ukwu agbawa uzo”, meaning that when you encourage a person to do what is wrong, he will go the extra mile. Hence, while we clapped for and fanned the flame of destruction in the “youths”, we never knew that the fire we helped to create will locate us. So here we are, finally paying for all those things in different forms – scarcity of food, scarcity of cash, lawlessness, loss of lives and properties, loss of jobs, mental and psychological disturbances, and insecurity.

I am happy the IGP of police, Adamu Mohammed, has enjoined the police officers to go back to duty, even though I am worried that he asked them to start defending themselves whenever they feel threatened. Hopefully, the return of the police will bring in some sanity. Maybe when they come back to work, the scarcity of cash as a result of non-working ATMs will be a thing of the past. Maybe distributors and traders will feel more at ease with moving their goods around the country. Maybe I will not be stuck in a gridlock for hours again.

MTN Group Made At Least $160 Million Gain On Its Jumia Investments

MTN Group exited by selling all its stocks in Jumia: “The MTN Group has now fully exited its 18.9 percent investment in Jumia Technologies AG (Jumia), realizing a total consideration of approximately R2.3 billion (US$138 million). Yes, it sold the remaining 18.9% investment for $138 million.

According to Bloomberg, MTN Group invested $243 million in Jumia: “MTN Group Ltd. is planning to sell part or all of its $243 million interest in Jumia Technologies AG as Africa’s biggest wireless carrier looks to pay down debt and enter new markets, according to people familiar with the matter”.

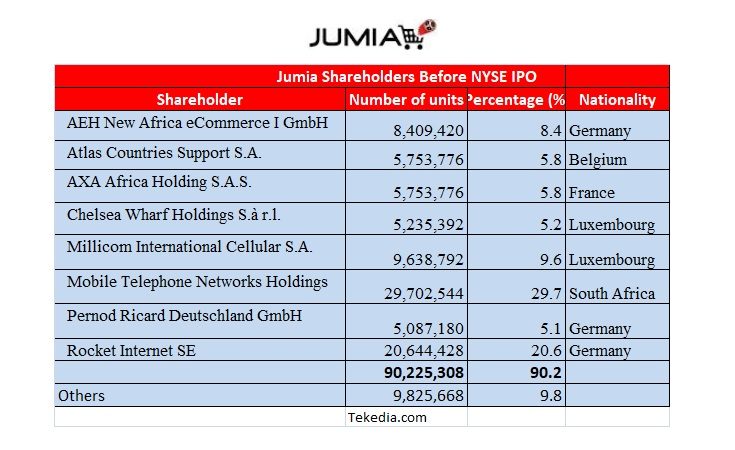

More so, according to GSMA, an industry organization, “in December 2013, MTN, together with Millicom and Rocket Internet, became a 33.3% stakeholder in Africa’s e-commerce and digital services company Jumia Group (formerly Africa Internet Group (AIG). MTN has since invested an additional $143 million in Jumia Group, increasing its stake to 41.4 percent.”

By the time Jumia went public, MTN held 29.7% of the company. The implication is this: MTN sold 11.7% during the IPO process. Jumia began trading at $14.50.

Now, the interesting part: the recently sold 18.9% brought in $138 million. This implies that MTN sold the latest batch when Jumia cap was around $695 million. Running the numbers, it came down to $7 per share. Let us approximate that it was sold at half the IPO value. Also, the other part of the 29.7% (as at IPO date) was sold when Jumia has been falling. Because of the lockout period, MTN would not have sold when the stock was high. Possibly, it sold around the $7 window.

Here are the three sales buckets:

- 18.9% for $138 million at about $7 per unit

- 10.8% at about $7, which gives about $80 million

- 11.7% during the IPO process at $14.50; that comes around $180 million

So, the total realized sales for MTN Group would be in the neighborhood of $400 million. MTN had invested $243 million. So, the company realized before tax and fees around $160 million.

*I have relied on public documents for this analysis; do not send me confidential financial statements as I do not use non-public documents in my articles. I am not a journalist that breaks news – I focus on the analysis of broken news! A good academic exercise! Tax people, do not rely on this to summon MTN.

MTN Sells Off its Entire Jumia Stake, Raking in $138 million

The MTN Group announced that it has successfully exited Jumia, selling its remaining 18.9 percent stake and raising $138 million from the deal.

The announcement was made on Friday through MTN Group’s Q3 2020 financial report.

“The MTN Group has now fully exited its 18.9 percent investment in Jumia Technologies AG (Jumia), realizing a total consideration of approximately R2.3 billion (US$138 million).

“We are proud to have been a partner in the evolution of one of Africa’s pioneering online marketplace businesses and will continue our relationship with Jumia through ongoing operational partnerships in some markets,” the statement said.

Pan-African e-commerce unicorn Jumia became Africa’s first tech firm to list in New York in 2019, when its shares soared to give the company a market valuation of nearly $2 billion.

But it has so far failed to make a profit, and its shares have since fallen by two thirds, also partly driven by a short-seller casting doubt on its sales figures, according to Nasdaq.

It is not clear what MTN intends to do with the fund it raised from the sales, although there is a rumor the South African telecom giant is preparing to service part of its debt with it. The telco also announced it has fully exited localization of an 8 percent shareholding in MTN Zambia, with a net proceeds of R204 million.

The group said it also intends to sell 12.5% of its investment in MTN Ghana with a focus in local shareholding. The move will increase MTN Ghana’s free-float on the Ghana Stock Exchange (GSE) to 25%.

And as part of its sales plan, MTN said it intends to exit its 75% stake in MTN Syria and plans to sell its 20% shareholding in Belgacom International Carrier Services SA (BICS). All these led to the conclusion that the South African telecom giant is working to offset its debt.

MTN, who initially had a 40% stake in Jumia, and had sold most of it before the end of 2019, had in August, announced it’s planning to sell off its 18.9% stake in Jumia, and telecom tower company, IHS Towers.

However, the development signals more trouble for Jumia, who has been struggling to keep its unicorn status.

In April last year, Jumia became the first African tech company to list on the New York Stock Exchange, a move which saw its shares skyrocket and its valuation hitting $2 billion. But it failed to maintain the status following reports of quarterly losses as a result of poor sales. A short-selling article from Citron, and issues with partners aggravated the situation, sending its stock further low.

Following these events, Jumia lost its unicorn status in six months, and at the wake of the pandemic, its shares were sold for as low as $3.

The situation appeared to have triggered the exodus of its investors. In March, German technology investment group, Rocket Internet sold off its entire stake in Jumia.

Surprisingly, the e-commerce company recorded a rebound that saw its stock rose 142%, putting it back to its unicorn status. This was as a result of some changes in business framework, including the launch of Jumiapay.

However, the recovery story was disrupted when MTN announced in August its intention to sell off its shares. Jumia’s second quarter result showed tumbling numbers that put its shares back to its ordeal.

But again, in October, things started to take good turn for Jumia once again. The change has been attributed partly to Andrew Left’s change of attitude toward the troubled online store. Left, the Citron writer who had been a fierce critic of Jumia, started writing positive short-selling articles about Jumia in October. His change of heart is believed to have attracted investors once more.

Jumia shares have maintained stability in the past seven days, trading between $16-$19 and its market has moved up to $1.5 billion, according to Techpoint.

The e-commerce company is expected to announce its Q3 earnings on Nov. 10, and there is high expectation despite the negative pre-market impact MTN’s announcement has created. Jumia is trading around $17.5, with a current valuation of $1.35 billion.

Zoom Becomes More Valuable than ExxonMobil

Zoom, like many other tech companies, has seen an increase in earnings during the pandemic that has pushed its valuation to $139 billion, more than Exxon Mobil’s $138.9 billion.

The teleconferencing app witnessed unprecedented surge following COVID-19 induced lockdowns that confined people at home, forcing a shift to virtual life.

Zoom’s market capitalization was $19 billion at the beginning of the year. Forbes compared Zoom to Exxon in the past 12 months and found that a huge revenue gap has been closed by the tech company.

Zoom posted $1.35 billion in revenue in the past 12 months while Exxon posted $213.8 billion in revenue during the same period.

The pandemic offered bitter and sweet experiences to both companies. Zoom saw an overwhelming increase in the use of its services as people started to embrace the new normal by working from home, while Exxon was badly hit as economies shut down, resulting in decline of oil demand, a situation that equally impacted the whole energy industry.

On Thursday, Exxon said in an announcement that it will cut 1,900 jobs in the US, as part of its global review, and its aim to curtail the strains of the pandemic.

“As part of an extensive global review announced earlier this year, the company plans to reduce staffing levels in the United States, primarily at its management offices in Houston, Texas. The company anticipates approximately 1,900 employees will be affected through voluntary and involuntary programs,” a statement from Exxon said.

Oil prices have dwindled since the outbreak of COVID-19, and show no sign of recovery in the near future. Oil companies, including Exxon are planning to divest to cleaner energy as alternate businesses.

As Exxon struggled through the strains of the pandemic, Zoom was basking on its advantages to record high earnings. The company beat earnings expectations in the Q2 that ended August 31, with a record $663.5 million in revenue, $163 million more than the $500.5 million analysts projected.

Zoom has a forecast of $690 million in revenue for the current quarter (through the end of October); the company also raised its financial guidance for the full fiscal year, through January 2021, to almost $2.4 billion in revenue, up from $623 million for the year through January 2020, according to Forbes.

The expectations are based on its current growth potential that is expected to linger for long.

As the teleconference company booms, its founder, Eric Yuan get richer. The past three months have been kind to the Chinese-American, as he has witnessed his fortune doubled. Yuan’s net worth has moved from $11 billion to $21.3 billion within this space of time in tandem with Zoom’s boom.

Zoom’s stock has risen more than 600% this year to rank among best performing stocks in 2020. A mark it earned through the unprecedented demand of its services around the world.

Another person who has benefited immensely from the company’s growth is Kelly Steckelberg, Zoom’s chief financial officer since 2017. She has seen her fortune jump from $255 million, since she debuted on the Forbes Richest Self Made Women list on October 13, to more than $340 million.

While coronavirus induced uncertainties spell doom for Exxon and the rest of the oil industry, it paves the way for Zoom and the rest of the tech industry. Earlier in the year, Apple overtook Saudi Aramco as the most valuable company in the world.

The oil industry continues to struggle amid the coronavirus pandemic. Exxon Mobil announced it is laying off up to 15% of its global workforce over the next year, including around 1,900 employees in the U.S., mainly from its management offices in Houston. The oil giant posted its third consecutive quarterly loss for the first time on record Friday, according to The Wall Street Journal, as gasoline usage has dipped drastically due to pandemic-induced lockdowns and people limiting their travel.