The Central Bank of Nigeria (CBN) said it will resume sales of forex to bureau de change (BDC) operators as Nigeria sets to lift restrictions on international flights.

The apex bank made the announcement via a circular signed by the director, Trade and Exchange Department, O.S Nnaji, which was shared with operators of BDC and the general public. The CBN said the exchange of currencies will happen on Mondays and Wednesdays.

“As part of efforts to enhance accessibility to foreign exchange particularly to travelers following the announcement of the limited resumption of international flights by the Honourable Minister of Aviation commencing with Abuja and Lagos, the CBN hereby wishes to inform the general public that gradual sales of foreign exchange to licensed BDC operators will commence with effect from August 31, 2020.

“Consequently, purchase of foreign exchange shall be on Mondays and Wednesdays in the first instance. The BDCs are to ensure that their accounts with the banks are duly funded with the equivalent Naira proceeds on Fridays and Tuesdays accordingly.

“Meanwhile, Authorized Dealers (banks) shall continue to sell foreign currencies for travel related invisible transactions to customers and non-customers over the counter upon presentation of relevant travel documents (passport, air ticket & visa),” the circular said.

It added that All Authorized Dealers and BDC Operators are hereby advised to ensure strict compliance with the provisions of extant regulations on the disbursement of foreign exchange cash to travellers as any case of infraction will be appropriately sanctioned.

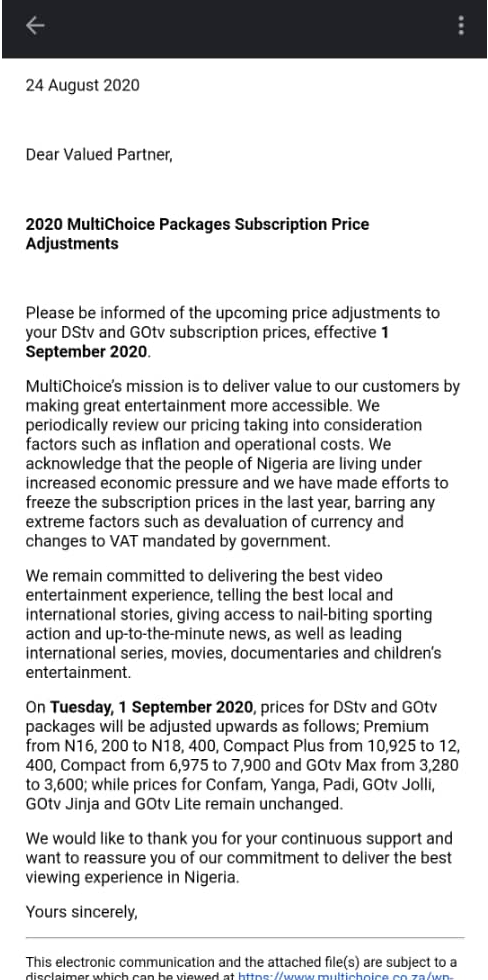

As part of efforts to contain the economic strains and forex crisis emanating from COVID-19 pandemic, the Central Bank also ordered BDCs to sell dollar at N386.

“Please, be advised that the application exchange rate for the disbursement of proceeds of IMTOs for the period, Monday, August 31, to Friday, September 4, is as follows:

“IMTOs to banks N382/1USD; banks to CBN N383/USD; CBN to BDCs N384/1USD; BDCs to end users N386/$1; volume of sale for each market is USD 10,000 per BDC,” the circular added.

The central bank has been pushing monetary policies aimed at stopping Nigeria from falling into recession, and curtailing the impact of COVID-19 pandemic as the N2.3 trillion Economic Stimulus Plan appears meager to the challenges.

Nigeria’s Bureau of Statistics (NBS) reported that the GDP shrank 6.10% year-on-year in Q2 2020; setting the country up for recession if the economy records further decline. The report indicated a drop of 8.22% points compared to Q1 2020 which was 1.87% and Q2 2019, which was (2.12%).

The decline is as a result of the ravages of COVID-19 pandemic on the oil market, which is Nigeria’s GDP highest earner. NBS reported that the oil sector recorded 6.63% contraction, year-on-year in Q2 2020, a decrease of -13.80% points relative to the rate recorded in the corresponding quarter of 2019.

Consequently, the oil sector contributed a meager 8.93% to the total GDP of in the second quarter of 2020, five percent lower than what was recorded in same quarter the previous year.

The non-oil sector also shrank -6.05% in real terms in the reference period, marking its first decline in real non-oil GDP growth since Q3 2017. The report said the non-oil sector grew at -70.70% points lower compared to the rate recorded during the same quarter of 2019, and -7.60% points compared to the first quarter of 2020.

The rate of the decline indicates that Nigeria is on the verge of plunging into its worst recession in 4 decades. The International Monetary Fund (IMF) said in its June outlook that the Nigerian economy would witness a deeper contraction of 5.4%, two percent higher than the 3.4% it projected in April.

Increasing rate of job loss smiting the Nigerian labor market indicates the impact of the shrinking economy. The NBS labor statistics reported that unemployment rose 27.1% at the end of Q2 2020. The decline in unemployment was enhanced by the exodus of some companies from Nigeria. Naira devaluation exposed multinational companies operating in Nigeria to harsh realities, forcing them to leave Nigeria for countries with stable foreign exchange.

The IMF has urged Nigeria to maintain a unified forex to make its business environment attractive. In July, the apex bank devalued naira to N380/$1, in a bid to curtail the multiple exchange rates that have characterized Nigeria’s money market. But the BDCs were still selling at rates around N470/$1 due to dollar scarcity.

Like this:

Like Loading...