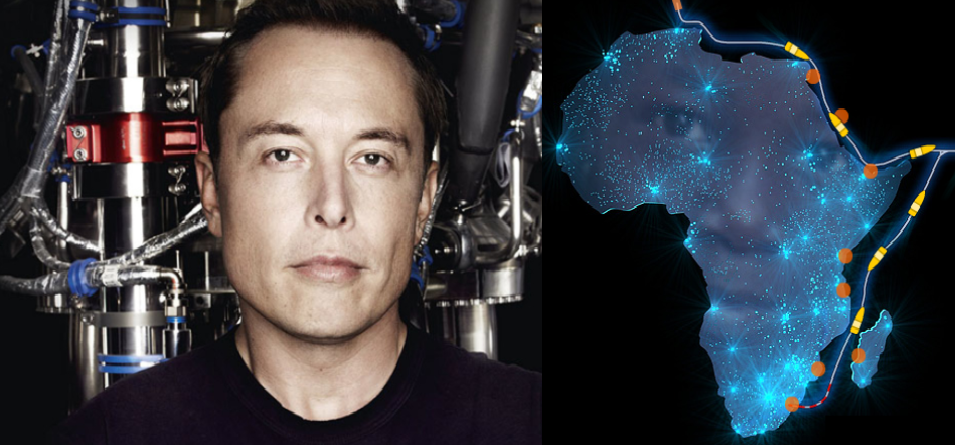

MTN Group today announced that the current group CFO of MTN Group, Ralph Mupita, has been appointed as the new group president and CEO with effect from 1 September 2020. Ralph has served as the MTN Group CFO since April 2017 and has played a critical role in the development and execution of the group’s strategy, capital allocation processes, and financial performance as well as in the resolution of a number of complex regulatory matters.

MTN Group chairman Mr Mcebisi Jonas said Mupita was chosen for the role because he has the ability to fill the group president and CEO position.

“After a rigorous and extensive search process, we are pleased to have appointed someone of Ralph’s calibre, experience and ability to fill the group president and CEO position.

“Ralph’s experience as the group CFO, strong knowledge of our businesses and markets, as well as successful background in financial services, M&A and emerging markets, place him in an excellent position to lead the growth and sustainability of the business going forward,” he said.

Ralph is a graduate of the University of Cape Town with a degree in Engineering and an MBA. Prior to joining MTN Group, Ralph was the CEO of Old Mutual Emerging Markets for five years, a business that provided financial services to individuals and corporates across 19 countries in Africa, Latin America and Asia, managing over R1 trillion of customer assets under management at the time.

Commenting on his appointment, Mupita said it has given him the opportunity to drive growth and unlock value for shareholders using the digital space of African continent.

“Leading a business with MTN Group’s history, scale and socio-economic impact is a privilege and honour, and I look forward to working with the group board and executive committee in driving growth and unlocking value for shareholders and broader stakeholders.

“MTN Group is well positioned to take advantage of the digital acceleration shifts and opportunities across our markets, and we are well placed to play an important and leading role in digital and financial inclusion of the African continent, working with our stakeholders and partners,” he said.

The current group president and CEO, Rob Shuter, will step down from his executive responsibilities on 31 August 2020 and will thereafter support Ralph as required until the end of his fixed-term contract early next year.

Shuter’s result statement shows that Mupita is stepping into big shoes. Under Shuter, the MTN Group delivered commercial momentum across its operations and yielded strong financial results.

The telecom giant added over 18 million customers to reach more than 251 million, with an increased data users that jumped from 17 million to over 95 million. In the fintech area of its business, Shuter pioneered a record 7 million to 35 million users’ growth.

MTN has, during his time, introduced many products such as the instant messaging platform Ayoba, which now live in 12 markets with two million monthly active users. And there’s MoMo, the payment platform launched in South Africa and Afghanistan. The product received super-agent license in Nigeria and registered more than 100,000 agents before the end of 2019.

The Group also delivered R14 billion of asset realizations within the first 12 months of its programme, and MTN Nigeria got listed on the Nigeria’s Stock Exchange. Shuter’s leadership addressed many business concerns affecting MTN, including the AGF tax matter in Nigeria, relationship with stakeholders and employee sustainable engagement which made it the best company in 2019.

On the financial growth, the telco’s revenue increased by 9.8% to R141.8 billion, and Earnings Before Interest Tax Depreciation and Amortisation (EBITDA) expanded by 13.6% to R53.4 billion. The holding company leverage ratio improved to 2.2x, and the capex intensity was reduced from 19.3% to 17.5%, indicating greater efficiency in deploying assets.

The strong earnings performance drove the operating cash flow to 18% increase and pushed the ROE from 11.5% in 2018 to 14.3% in 2019 on an IAS17 basis.

The result was attributed to double-digit growth in service revenue by both MTN Nigeria and MTN Ghana, and was driven by improved 4G services.

“On the financial side, we delivered service revenue growth of 9.8% with an acceleration in the second half. Our EBTDA margin improved and reported headline earnings per share grew 62%. Our network rollout brought a further 69 million people into 4G coverage whilst reducing capex intensity. Improved cash flows during the year supported stable balance sheet ratios,” report statement from Shuter said.

With this trajectory, the stakes are so high for Mupita, even as environmental and monetary policies become more challenging in Africa.