This is how to tell if a business model will work or not. He never knew he would become one of the famous entrepreneurs in his time. He was just passionate and smart in business.

He happened to visit the United States of America one day, they introduced him to a browser called the mosaic browser. He happily used the browser to surf some information about products that are online.

Well, he searched for drinks brands in the United States and he found many online. He was excited about that development. The next thing was that he searched for the same product in his country, China. Surprisingly, there was no information about products from China online.

This was the experience that gave birth to Alibaba Group. This was the experience that birthed the star Jack Ma, the pioneer of the e-commerce industry in China and Asia.

In the book, 3S Rules‘ ‘ it was stated that if we have Singapore, South Korea, Hong Kong, Taiwan, etc as Asian Tigers, then China will be the Asian lion, because China is the king of Asian continent.

This is the story of how Business models are developed and designed. In this piece, I shall be analyzing the fundamentals of a business model. What are the key elements of a business model? When you observe a business opportunity, what do you do?

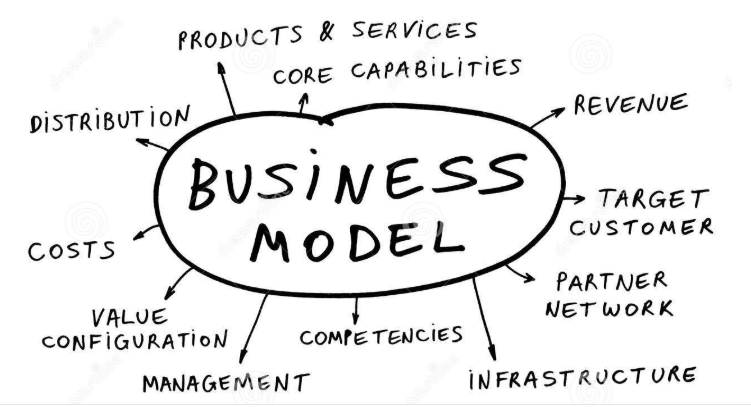

Key Fundamentals of A Business Model.

The business model is simply the designs of how your business idea will solve the intended problems and how it will make money.

Here is what an article from Harvard Business Review says about the business model. According to Joan Magretta, a business model, she says, has two parts: “Part one includes all the activities associated with making something and Part two includes all the activities associated with selling something.

So here are the fundamentals to consider in designing business models that will be sustainable.

- Market Friction/Problem

The first step in developing a business model is the problem or the opportunity that you have observed in the market. Business is simply solving a problem by way of offering products to those that have such problems.

What is the opportunity you identified? What is the problem you identified in the market? What are the lapses in the existing market you identified? What are the trends that you want to explore?

This is very crucial as it forms the base of your business modelling. Without it, then forget it…you don’t have a basis for business modelling.

This is in line with the jack ma story above. He identified a market gap and an opportunity in the China market. then, this is the next thing to do.

- Business Ideas.

This is expected of every entrepreneur or business owner. When you see a market opportunity, what comes to mind is a business idea to maximize such opportunity. Business ideas are imaginations you have in your mind about the possible solution to the problem you identified in the market.

Jack ma had the business idea to provide an online platform where business people could sell. But business ideas have one common feature which is they are always raw and formless. That is why business modeling is key. Then, the next thing to consider is this;

- Value Proposition.

As an entrepreneur, you should have known that people don’t buy Panadol but they buy health. People don’t buy flight tickets, they buy luxury in flying.

People don’t buy don’t buy food but they buy satisfaction or refreshment. In a nutshell, people buy solutions or antidotes to their problems and not the product itself.

But, product is the means to that solution.

At this stage you should have a clear value that the market target will obtain from this your business idea. One of the value propositions of e-commerce is to make it convenient for people to shop.

That is why in this time of lock down, you can shop at home and it will be delivered conveniently. So, state the value proposition of the business idea you have.Do you have a new business you want to launch? Do you have a new product you want to launch? Do you have an idea due to the current trends?

Do you want to innovate your already existing business? If yes, this series of articles on business models is what you need for a successful innovation. Part2, part3 and part4 of this series are on the way.