Covid-19 is really bad. It has distorted all elements of commerce. Andela, the remote work placement company, has fired 135 workers as it works to manage the challenges arising from the virus. The CEO of the company wrote: “Like any venture backed startup, our ability to attract future investment is determined by the ratio of how quickly we grow in comparison to how much we spend to achieve that growth.” The company has raised about $181 million from investors and is certainly well loaded. Yet, its business model may be under stress, not necessarily from competition, but from an industry evolution.

Africa-focused tech talent accelerator Andela has let go 135 employees, CEO Jeremy Johnson confirmed to TechCrunch.

Senior staff at the company — with offices in New York and four African countries — will also take salary cuts of 10% to 30%.

The compensation and staff reductions are a result of the economic impact of the COVID-19 crisis and bring Andela’s headcount down to 1,199 employees. None of Andela’s engineers were included in the layoffs.

Backed by $181 million in VC from investors that include the Chan Zuckerberg Initiative, the startup’s client-base is comprised of more than 200 global companies that pay for the African developers Andela selects to work on projects.

Like I noted in the Harvard Business Review, Africa cannot rise on the strength of pure outsourcing as the U.S. and Western Europe will use AI, robotics and improved software systems to bring disintermediation. Sure, software developers are not within that domain at the moment. Yet, there are many software development works which AI will incrementally help elite companies to do, making it unnecessary to hire many junior software developers. Those elite companies are Andela’s core customers, and they are the ones investing massively in reducing human elements via semi- and full-automation.

The trajectory is simple: only the most experienced and talented software developers would be needed, while the junior and inexperienced ones will be disintermediated with intelligent systems. Yes, the Andela industry is shifting rapidly, and only elite software developers, the top 20% bucket in the world, can help it. It has to discover them in order to thrive. The inexperienced developers do not cost these companies that much, and most may not want outsourcing them at scale. For them, the key pain points are the ultra-expensive experts. They would like to get those capabilities at cheaper rates.

In September last year, Andela cut 420 staff. In Q1 2020, it also reduced workers. The recent one is evidently understandable with the virus derailing economies and markets. Yet, Andela challenge may not be a virus: it has to check the business model to see if other forms of tech are competing with the workers it has available to place in companies. Largely, Andela is not cutting staff due to competition (ignore the new 135 due to Covid-19). Rather, its competition is industry shift as AI advances! We are seeing the same in the microprocessor design industry. It has to revamp its playbook and account for this shift to get to its mission. That is important as you cannot let go about 600 direct staff in 9 months, and still claim that you can change the African continent!

Comment on LinkedIn Feed

Comment #: I’m not sure how this is the ‘problem’ with or for Andela. More so, I do not see ‘improved AI, Robotics and improved software systems’ changing the metrics. These intelligent systems have everyday parts that need to be put together. Even with data science skills gravitating towards increasingly towards drag and drop, engineers still need to be hands on.

Having been through 2 Andela tests and poached by several (way too much for my liking) tech recruiters, I see Andela’s challenge as failing to read well especially US international relations one hand and the fatigue of remote development on the other hand.

Remote work has been revolutionary but it comes with high cost of time, delay due to distance (even with virtual meets, it is a significant burden) and the fact that a lot of ‘resolutions’ arise every now and then.

The number of emails for developers and data analytics/science roles I get has increased in the past months. One thing is constant: they are looking for local talents. They realize that the immigration wahala bar has been raised especially during the present administration.

My Response: Of course we see it differently. Remote work is expanding. Most U.S. companies use remote workers in India as recently they cannot come to U.S. easily. But those used are top 5-20% to reduce cost. U.S. companies are not looking to cut the costs of those earning $90k but those earning $400k. Simply, Andela has to find a $150k equivalent to replace those earning $400k on skills. That is why it has no value for many junior engineers as U.S. firms are not concerned about them. Many community colleges in U.S. after 2 years can give you $60k engineers. Apple spent $50M to mass produce them in selected community colleges few years ago. Then AI is doing some of those jobs. The issue is the elite coders who command north of $400k.

Comment #2: Prof Ndubuisi Ekekwe is there a way the software development industry in Africa at large and Nigeria by extension can develop an internal solution that is Africa based? Yes, these companies get outsourced job from the West but there are also a lot of competitions. India for example is a big one but they are also developing themselves internally and the Fortune 500’s are now opening stores locally. Though, I believe power, security, broadband, and, trust are some of the major challenges but how can we harness the human resource strength to drive growth in Africa?

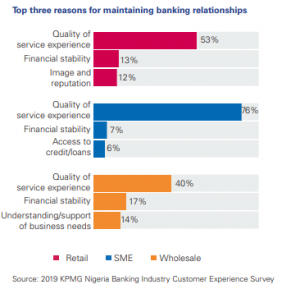

My Response: Our problem is not foreign companies. Our challenge is that we do not have BUYERS. If you build it, you will find few buyers. Sure, we parade 200m people as in Nigeria but you have a national budget execution of $20 billion and your largest bank’s market cap less than $1.5B. If Andela sees buyers of its solutions in NG, it will sell to them. South Africa is the only viable at national budget of $127 billion with great institutions. If the demand improves, Africa-focus will happen.