IMF Approves Nigeria’s Emergency $3.4 billion Financial Assistance

The Executive Board of the International Monetary Fund (IMF) approved Nigeria’s request for emergency financial assistance of SDR 2,454.5 million (US$ 3.4 billion, 100% of quota) under the Rapid Financing Instrument (RFI) to meet the urgent balance of payment needs stemming from the outbreak of the COVID-19 pandemic.

Our comments:

- Currently, Nigeria’s dollar supply (inflows) can no longer meet its dollar demand (outflows), thus creating a balance of payment need that is currently estimated at $17 billion.

- The Financial Assistance is a loan issued as an Emergency Support under the IMF’s Rapid Financing Instrument facility.

- This funding support is expected to relieve the Government of the pressure created by the crash in oil price. The support will provide assurance around the payment of salaries, palliatives and other preparations to combat coronavirus.

- The fund will also provide the much-needed dollar supply to the CBN who is expected to provide naira to the Government for the execution of projects.

- The dollar supply to CBN is expected to flow into the FX market to meet the current demands across different FX windows.

- In the short run, this is expected to stabilise the Naira.

- Also, as we have noted in the past weeks, the availability of dollars may trigger the exit of foreign portfolio investors from the equity and fixed income markets.

Domestic borrowing: Senate approves FG’s N850bn request

The Senate has approved the Federal Government’s request for conversion of N850bn new external borrowing in the 2020 budget to domestic borrowing. A statement released by the Debt Management Office on Tuesday said the House of Representatives was also expected to approve the request. The DMO is to issue FGN Securities in the domestic market to raise the N850bn once the request is approved by the House. Read more

Germany grants Nigeria N8.9bn debt relief

The Republic of Germany said it has granted Nigeria debt relief amounting to N8.9 billion (€22.4 million) on account of the coronavirus pandemic. Also, the German government said it has successfully campaigned in the G20 group of countries and the Paris Club group of creditor countries in favour of a debt moratorium for countries heavily affected by the economic impact of COVID-19. Read more

Stock Market Update and Corporate Disclosures:

The All-Share-Index is currently up by 0.28% with bluechips dominating the gainers’ list. MTN is currently up by 1.14%, WAPCO up by 1.34%, Zenith and UBA are up by 0.67% and 1.69% respectively.

Click on the link https://bit.ly/2XrvIf9 to open a stockbroking/share purchase account and trade within 24 hours

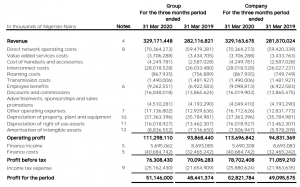

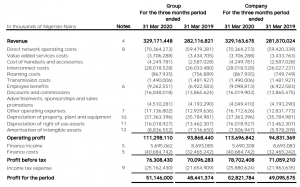

MTN: financial highlights for the three months ended 31 March 2020

- Mobile subscribers increased by 4.2 million to 68.5 million

- Active data users increased by 1.7 million to 26.8 million

- Service revenue increased by 16.7% to N5 billion

- EBITDA grew by 15.3% to N5 billion

- EBITDA margin is now at 52.7%

- PBT increased by 8.9% to N3 billion, with a margin of 23.18%

See highlights in the image below and details here. Without boring you with the usual financial details, MTN provides insights on its financials in a separate publication. This publication is recommended if you have any interest in MTN.

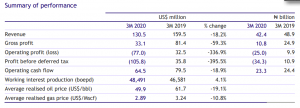

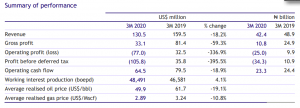

Seplat: Unaudited results for the three months ended 31 March 2020

Against the twin crises of significantly reduced oil demand and the price war, Seplat continues to demonstrate its resilience because of its ongoing philosophy of prudent financial management, the careful mitigation of risk and a keen focus on managing factors of the business that are within our control.

Operational Highlights

- Low unit cost of production at US$7.7/boe, with cost-cutting initiatives now in force

- Working interest production within guidance at 48,491 boepd

- Liquids production of 33,368 bopd

- Gas production of 88 MMscfd

Financial Highlights:

-

Cash at bank US$336 million, net debt of US$458 million

-

Revenue of US$130 million, down 18.2% due to a stock build at the terminal (underlift) of $47m and lower oil prices

-

Non-current asset impairment provision of US$146 million in line with IAS 36 COVID-19 impact assessment

-

Impairment provision reverses a profit for Q1 2020 of US$39 million into a loss for the period of US$107 million

-

Impairment provision reduces non-current assets from US$2.34 billion to US$2.20 billion

-

Total capital expenditure of US$46 million

-

Cash flow from operations US$65 million

See highlights in the image below and details here

Headlines:

Nigeria Records 195 New Cases Of COVID-19, Total Infections Now 1,532

Nigeria on Tuesday recorded 195 new cases of the novel coronavirus, bringing the country’s total infections to 1,532. According to a tweet by the Nigeria Centre for Disease Control (NCDC), of the new infections, 80 were recorded in Lagos, 38 in Kano, while 15 were recorded in the Ogun State. In Bauchi State, 15 cases were recorded, 11 in Borno, 10 in Gombe, Nine in Sokoto, five in Edo and Jigawa, two in Zamfara and one each in Rivers, Enugu, Delta, FCT and Nasarawa. Read more

COVID-19: IMF approves $3.4bn emergency loan for Nigeria

The Executive Board of the International Monetary Fund on Tuesday approved $3.4bn in emergency financial assistance to the Federal Government in addressing the severe economic impact of the COVID-19 pandemic. The financial assistance, approved under the Rapid Financing Instrument, is also to enable Nigeria to address the sharp fall in oil prices. Read more

Nigeria may record N4.9tn decline in nominal GDP — Investigation

The outbreak of the coronavirus pandemic in Nigeria may result in a decline of N4.95tn in the nation’s nominal Gross Domestic Product in the present fiscal year, investigation has revealed. Nominal GDP measures the value of all finished goods and services produced by a country at their current market prices. The N4.95tn decline in nominal GDP is about 48.19 per cent of the Federal Government’s revised N10.27tn budget. Read more

Trump speaks with Buhari on phone, to send ventilators to Nigeria

US President, Donald Trump on Tuesday, had a telephone conversation with Nigerian President, Muhammadu Buhari over the coronavirus pandemic in the country. This was revealed by Lai Mohammed, minister of information, at the media briefing of the presidential task force on COVID-19. He said the US president promised to send across ventilators to Nigeria. Read more

Asia shares extend gains as economies slowly re-open, oil rallies

Asian shares rose for a third session on the trot on Wednesday as investors took heart from easing coronavirus lockdowns in some parts of the world while oil prices jumped on hopes demand will pick up. Read more

Fed seen making small changes to keep fed funds above zero

The Federal Reserve is widely expected on Wednesday to lift the interest rates that influence its fed funds target, a technical move that could keep interbank lending running smoothly and help prevent financial market disruption should the benchmark rate fall below zero. Read more

U.S. coronavirus deaths surpass Vietnam War toll as Florida readies reopening plan

The U.S. coronavirus death toll climbed above 58,000 on Tuesday, surpassing the loss of American life from the Vietnam War, as Florida’s governor met with President Donald Trump to discuss an easing of economic restraints. Florida Governor Ron DeSantis, among the latest to lock down his state against the pandemic, has been weighing whether to join other states in a relaxation of workplace restrictions and stay-at-home orders that have been credited with slowing the contagion but which have battered the economy. Read more

Indexes drop as investors rotate from growth to value stocks

Wall Street’s major indexes lost ground on Tuesday as investors moved out of market-leading growth stocks, though a rotation into cyclical value stocks could point to hopes of economic revival as states begin to relax restrictions enacted to halt the coronavirus pandemic. The Dow Jones Industrial Average (DJI) fell 32.23 points, or 0.13%, to 24,101.55, the S&P 500 (SPX) lost 15.09 points, or 0.52%, to 2,863.39 and the Nasdaq Composite (IXIC) dropped 122.43 points, or 1.4%, to 8,607.73. Read more

Like this:

Like Loading...