The Monetary Policy Committee (MPC) met on the 23rd and 24th March 2020, amidst heightened uncertainty in the global macroeconomic environment arising from major disruptions associated with the outbreak of the Coronavirus Disease (COVID-19) and the oil price war between Saudi Arabia and Russia.

As you may know, the MPC (a committee within the CBN) is responsible for formulating monetary and credit policies, attainment of price stability and support the economic policies of the Federal Government. The MPC also monitors internal and external economic conditions in formulating monetary policy directions.

In the light of current internal and external economic realities, please find below highlights of the latest monetary policy communique from the MPC and other policy insights that may affect your business in the days and months ahead as this crisis gathers momentum locally.

Background:

The committee noted the N3.5 trillion worth combined policy measures put in place as a stimulus to ameliorate the pains arising from the COVID-19 health and economic crisis. The measures include:

- Extension of the moratorium on CBN intervention facilities effective 1st of March, 2020. A significant move by the Bank to ease pressure on loan repayments.

- Reduction of interest rate on all CBN intervention facilities from 9% to 5% over the next one year.

- Creation of a N50 billion targeted credit facility for households and SMEs that have been particularly hit by COVID-19 pandemic.

- N100 billion intervention in healthcare loans to pharmaceutical companies, healthcare practitioners intending to build new hospitals and health facilities or expand existing ones to first-class health centres

- Regulatory forbearance to Banks to restructure terms of facilities in affected sectors

- Strengthening the LDR policy, which is encouraging significant extra lending from Banks.

- Activation of the N1.5 trillion InfraCo Project for building critical infrastructure

- N1 trillion in loans to boost local manufacturing, production across critical sectors and import substitution

The committee also noted the following:

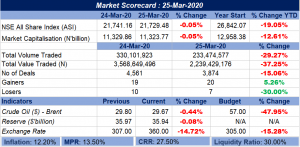

- Uptick in inflation from 12.13% to 12.20% for the 6th consecutive month, driven by shocks to food prices as well as persistent infrastructural challenges.

- Growth in aggregate credit by N2.35 trillion since the inception of the LDR policy, reflecting the potency of the LDR policy

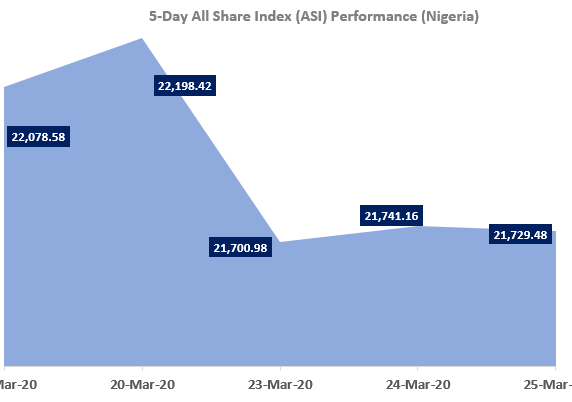

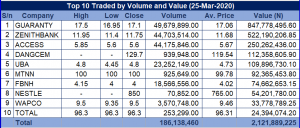

- Dismal performance of the equities market as the All-Share Index and market capitalization dipped by 19% and 12.57% respectively between 31st December 2019 and 24th March 2020.

- Continued resilience of the banking system due to the decline in NPLs while expressing confidence in the regulatory regime.

Outlook

- Increased deterioration in the financial market condition.

- Disruption to the global supply chain as a result of the COVID-19 pandemic.

- Decline in oil prices and non-oil receipts which will lead to a further decline in reserves.

- Subdued growth in 2020.

The Committee noted that these can be mitigated by:

- The effective response of the monetary and fiscal authorities.

- Recalibration of the 2020 budget.

- Sustained CBN interventions in selected sectors.

- Deliberate policies to diversify the economy.

Committee’s considerations

- COVID-19 pandemic resulting in further health and economic crisis.

- Decline in oil price and supply glut in the nearest future.

- Emergence of exchange rate pressure.

- Downward revision of the 2020 budget by N1.5trillion and oil price benchmark to $30/barrel.

Committee’s decisions

At the end of deliberations, the Committee was faced with three options – whether to tighten, hold or loosen.

Tightening will result in reduced inflation rate and support reserve accretion however, it will reduce money supply, credit creation, increase cost of credit and have an adverse effect on growth which has already been weakened by the pandemic.

On loosening, the committee felt that this decision will boost money supply but will not necessarily increase credit creation. It will have an adverse effect on inflation and also lead to exchange rate pressures as money supply rises.

In view of the aforementioned, the Committee decided by a unanimous vote to:

- Retain the policy rate at 13.50%

- Retain the asymmetric corridor of +200/-500 basis points around the MPR

- Retain the CRR at 27.5%

- Retain the Liquidity Ratio at 30%

This decision will offer pathways to appraise the effects of the CRR and LDR policy while also allowing the pandemic to wear off before determining the next course of action.

Other News Headlines:

COVID-19: Massive economic crises loom, says CBN

The Monetary Policy Committee of the Central Bank of Nigeria on Tuesday said the outbreak of the coronavirus pandemic would lead to massive economic crisis capable of throwing many countries into recession. The committee said the COVID-19 pandemic would not only result in health crises, but also massive economic crises that would force even leading industrialised countries into recession. Read more

COVID-19: Staying safe with cash-less banking

For years, Nigeria’s push towards a cashless economy was greeted with mixed feelings, but eight years after the Central Bank of Nigeria (CBN) rolled out the scheme, many people have come to realise that the gains outweigh the pains. With the ongoing COVID-19 pandemic, digital payment remains one of the ways to stay safe, with banks encouraging their customers to go cash-less. Read more

FG threatens businesses involved in arbitrary price hike

The Federal Competition and Consumer Protection Commission on Tuesday threatened to prosecute businesses involved in unfair competition practices through unnecessary increase in prices of their products. The commission said the warning became imperative following unnecessary price hike by sellers of basic health products as a result of the natural apprehension by consumers due to the spread of the coronavirus pandemic. Read more

COVID-19: Reps propose duty waivers, new tax regime

In a record time, the House of Representatives has passed the Emergency Economic Stimulus Bill, 2020, which, among other things, aims at providing temporary relief to companies and individuals from the economic consequences of the COVID-19 pandemic. The bill especially seeks to maintain the general financial wellbeing of Nigerians pending the eradication of the pandemic and return to economic stability. Read more

Stocks – Europe Continues Higher Amid Fresh U.S. Stimulus Hopes

European stock markets are set to open positively Wednesday, continuing Tuesday’s sharp ride higher, on the expectation that U.S. policymakers will finally deliver a massive rescue package to bolster the country’s beleaguered economy. Read more

Asia rides Wall Street surge as investors place hopes on U.S. stimulus

Asian shares extended their rally on Wednesday in the wake of Wall Street’s massive rebound as the U.S. Congress appeared closer to passing a $2 trillion stimulus package to mitigate the economic blow from the coronavirus pandemic. On Tuesday, MSCI’s gauge of stocks across the globe (

MIWD00000PUS) rallied 8.39%, the largest single-day gain since the wild swings seen during the height of the global financial crisis in October 2008. It rose another 0.8% in Asia on Wednesday. Read more

Oil Prices Jump on Surprise Crude Draw

The American Petroleum Institute (API) estimated on Tuesday a crude oil inventory draw of 1.247 million barrels for the week ending March 21, capturing the period before over half of all Americans went into lockdown mode this week—a development that will surely curb the appetite for oil. Oil prices were trading up on Tuesday afternoon prior to the API’s data release on new hopes that a stimulus package would be passed and that the oil price war will come to an end with the US intervening.

Read moreLike this:

Like Loading...